In a world where the automotive industry constantly grapples with innovation and sustainability, Elon Musk, the visionary behind Tesla, made a bold claim that stood out even by his standards. In 2019, Musk asserted that buying a Tesla was not just an investment in green technology but an appreciating asset. This statement was groundbreaking, considering the well-known fact that cars typically depreciate the moment they leave the dealership.

However, the unfolding reality has painted a different picture, challenging Musk’s optimistic forecast and stirring a mix of reactions across the market.

Tesla: The Promise That Turned Heads

Musk, known for his audacious predictions, claimed that his EV vehicles, equipped with cutting-edge self-driving features, would defy the traditional automotive economic model by appreciating post-purchase. “If you buy a Tesla today, I believe you are buying an appreciating asset, not a depreciating asset,”

Musk stated during a 2019 interview, suggesting that the brand’s autonomous driving capabilities would significantly enhance its value. This perspective was not only innovative but seemed plausible as the automobile company continued to push the envelope in automotive technology.

Reality Checks In

Despite Musk’s confident assertions, the market tells a different story. Contrary to the expected appreciation, Tesla’s flagship Model 3 has seen a notable decrease in value. Initially priced at $35,000 in early 2019, the Model 3’s price surged during the pandemic, a period of unusual market behaviors across the board.

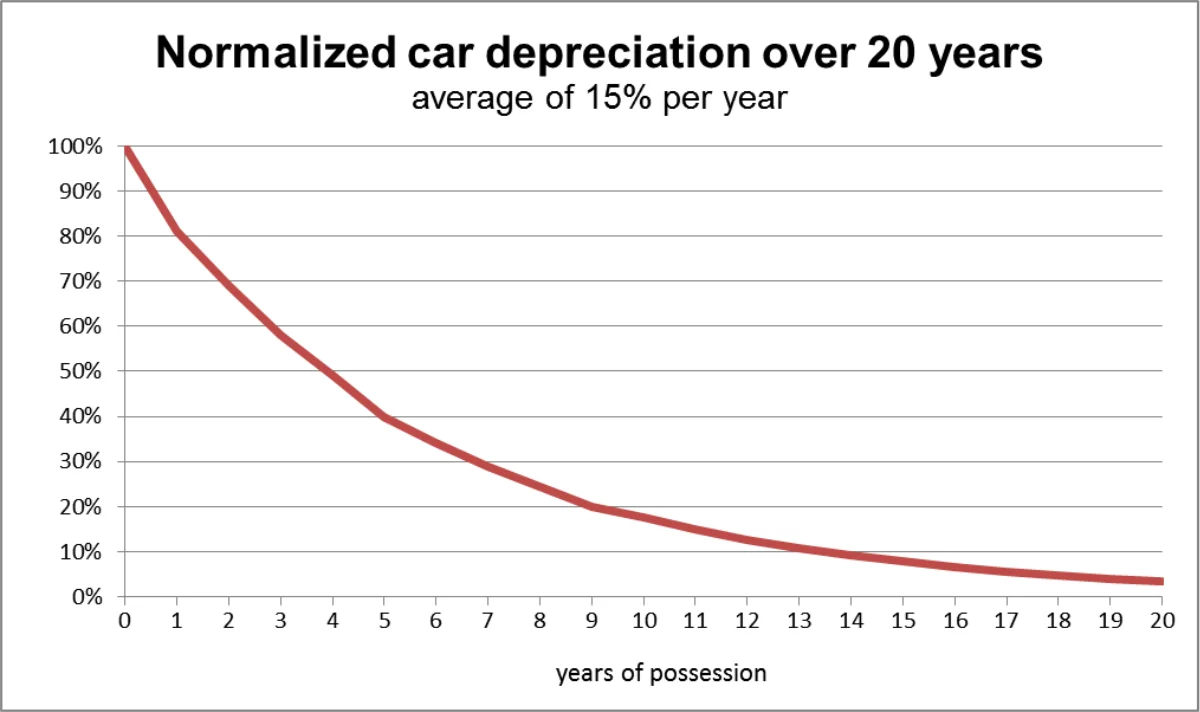

However, the current valuation for used models stands at around $29,000, reflecting a depreciation contrary to Musk’s predictions. This trend is not isolated to the EV giant but is a common occurrence in the automobile industry, where vehicles generally lose a significant portion of their value over time.

#ElonMusk showing what a "genius" businessman he is – #Tesla have the highest depreciation rate of any vehicle brand in the US!

🤣🤣🤣 pic.twitter.com/32kw3IIKX3— LordBruceStuart (@LordBruceStuart) March 4, 2024

The broader implications of Tesla’s pricing dynamics are evident in the company’s recent strategies. Towards the end of last year, the automobile company initiated price cuts nearing 25% to boost sales and stay ahead in the competitive electric vehicle (EV) market.

These adjustments, however, have not entirely turned the tide in the company’s favor. The brand’s dominance in the American EV market has diminished, from commanding 80% of sales in 2020 to about 56%.

A Silver Lining or A Fleeting Anomaly?

Amidst the general trend of depreciation, there’s a glimmer of the extraordinary within the Tesla lineup. The company’s Cybertruck, a vehicle that breaks the mold in design and functionality, reportedly saw a resale value soar to twice its original price. This anomaly highlights the unpredictable nature of consumer demand and the potential for specific models to defy broader market trends.

Nevertheless, even this silver lining is tinged with caution, as early adopters have reported issues like rust spots developing under less-than-ideal conditions, casting a shadow over the long-term viability and value of the company’s innovations.

Elson Musk’s Tesla: The Way Forward

The divergence between Elon Musk’s optimistic projections and Tesla’s market performance is a poignant reminder of the complexities surrounding innovative technologies and consumer markets. While the electric vehicle company continues to lead in electrification and autonomous driving technology, the economic realities of vehicle ownership and depreciation remain significant challenges.

As the EV market evolves, Tesla’s journey offers invaluable lessons on the balance between innovation, market expectations, and the immutable laws of economics.

https://www.youtube.com/watch?v=UgK8Ulz84ec