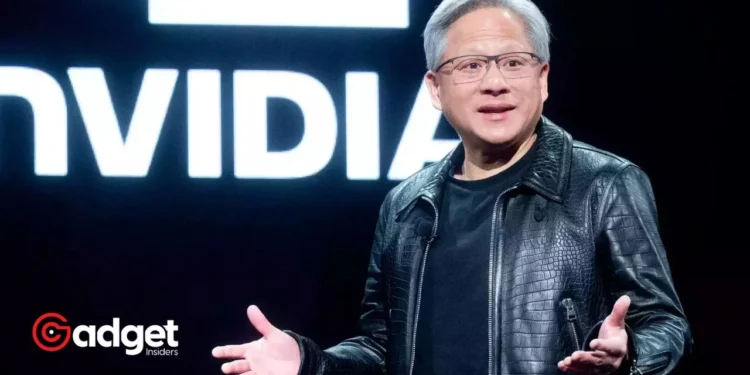

In a remarkable comparison that’s turning heads in the financial world, Nvidia, the powerhouse behind the cutting-edge graphics chips fueling today’s artificial intelligence revolution, is on track to potentially mirror the historic rise of Cisco during the dot-com era. This comparison, drawn by esteemed Wharton finance professor Jeremy Siegel, suggests that Nvidia could ascend to an unprecedented market valuation of $6 trillion, a feat that would not only dwarf its current tech giants but also redefine market leadership in the digital age.

The Path to $6 Trillion: Nvidia’s Unprecedented Journey

At the heart of Nvidia’s explosive growth is a product portfolio that’s become indispensable. From gaming to AI, the brand’s graphics processing units (GPUs) are at the forefront of technological innovation.

This demand has translated into a staggering 500% increase in stock value since the outset of 2023, with a remarkable 90% leap occurring in just the past 10 weeks. With a current valuation of $2.3 trillion, the GPU giant has already surpassed tech behemoths Amazon and Alphabet, trailing only behind Microsoft and Apple.

Jeremy Siegel’s insight into Nvidia’s trajectory draws a parallel to Cisco’s ascent during the dot-com bubble, where Cisco’s valuation skyrocketed, briefly making it the world’s most valuable company.

If the GPU giant were to follow this path, its value could see a 2-3 fold increase, positioning it as the first company to breach the $6 trillion market cap. This comparison isn’t just about numbers; it’s a testament to the transformative power of technology and the markets’ capacity to recognize and reward innovation.

A Bubble or Sustainable Growth?

The meteoric rise of Nvidia raises inevitable questions about market bubbles and the sustainability of such growth rates. Siegel himself poses the question, likening the current tech boom to the dot-com era, yet with a crucial distinction.

Today’s growth stocks, including the GPU giant, boast more reasonable valuations and are backed by significantly more substantial, profitable business models than their dot-com predecessors.

Cathie Wood of Ark Invest also draws parallels between Nvidia and Cisco, noting, however, the harsh lessons learned post-dot-com bubble. This perspective brings a sobering balance to the excitement, reminding investors of the importance of sustainable growth and value-based investing.

Nvidia’s Role in the AI Revolution

Nvidia’s ascendancy is not just a story of stock valuations but also a narrative about the central role of technology in driving the next wave of industrial and societal transformations. The company’s GPUs are the backbone of AI developments, supporting ventures from automotive to social media.

The company’s recent financial performance, with a 265% increase in year-on-year revenue, underscores the critical nature of its technology in our increasingly digital world.

Moreover, the broader stock market rally and speculative projections about interest rate cuts by the Federal Reserve have buoyed investor confidence, contributing to Nvidia’s impressive performance.

Nvidia could be worth $6 trillion if it follows Cisco's dot-com trajectory, says Jeremy Siegel pic.twitter.com/EKHoaeM2qn

— News Scouter, Ph.D. (@akawak1) March 13, 2024

Looking Ahead: Nvidia’s Place in Tech History

As Nvidia continues its upward trajectory, comparisons to Cisco’s dot-com era success serve as both a beacon of potential and a cautionary tale.

The key to the brand’s future will not just be in maintaining its technological edge but also in navigating the volatile waters of market speculation and investor expectations.

In the grand tapestry of tech industry lore, Nvidia’s current journey is a captivating chapter, marked by groundbreaking innovation, market dominance, and the ever-present specter of historical precedents.

Whether the GPU brand will reach the $6 trillion mark or find a different path remains to be seen, but its impact on technology and the financial markets is undeniably profound.

In this evolving narrative, Nvidia’s story is more than just a financial spectacle; it’s a reflection of the transformative power of technology and the boundless possibilities it heralds for the future.