In a bold move to address the escalating homelessness crisis, Chicago’s city officials are considering a significant real estate transfer tax increase on properties valued at over $1 million. The proposal, known as the Bring Chicago Home plan, aims to generate funds to build permanent supportive housing units for the city’s homeless population, which was reported to exceed 6,100 individuals in a January 2023 count.

The Impact on Chicago’s Real Estate Market

The proposed tax hike would see the current rate of 0.75% rise sharply to 2.65%, a move that has stirred a mix of support and apprehension within the Windy City.

While the increase promises to funnel approximately $163 million annually into homelessness alleviation programs—including assistance for children, veterans, and women recovering from domestic violence—it also raises concerns about the additional burden on an already struggling real estate sector.

Amy Masters, a spokesperson for the Chicago Association of Realtors, voiced significant concerns during a city housing committee hearing, stating, “Market studies suggest that Chicago’s office buildings have lost 50% of their value, and we estimate that almost half of Chicago’s office buildings are in some state of financial distress.”

CHICAGO CONSIDERS CONTROVERSIAL TAX HIKE ON PROPERTY SALES OVER $1M TO FUND HOMELESS HOUSING

Chicago City Council considering putting real estate transaction tax hike on ballot as referendum.

The proposal, known as the Bring Chicago Home plan, was discussed at length during a… pic.twitter.com/WHn0jJWsWP

— FXHedge (@Fxhedgers) September 14, 2023

Political and Public Reactions

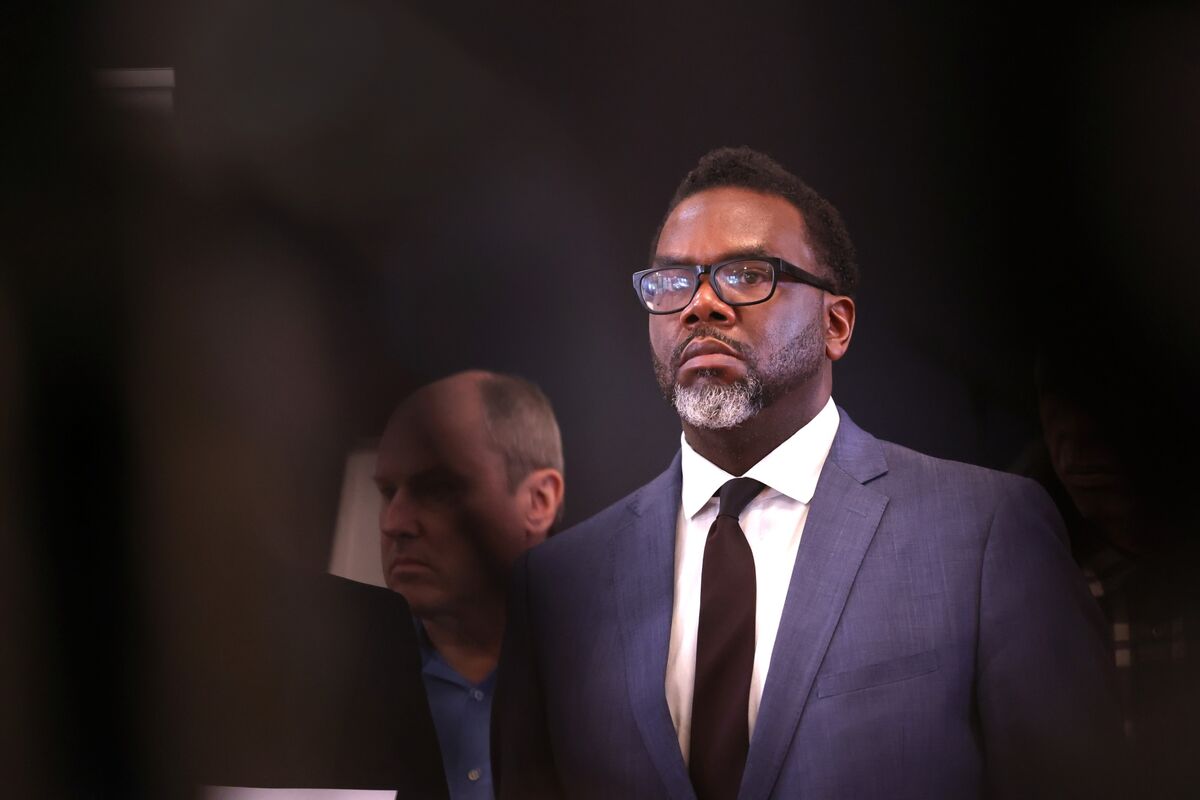

The tax proposal has received backing from the city’s newly elected mayor, Brandon Johnson, who expressed his commitment via social media: “My administration is committed to Bring Chicago Home, and to building consensus around providing affordable housing to combat homelessness in our city.”

This support reflects a broader trend in liberal cities adopting similar fiscal measures, with Los Angeles recently implementing a “mansion tax” of its own.

However, the proposal did not advance to a vote during the latest city council meeting, serving more as a symbolic reintroduction to the public and political spheres. The lack of progress echoes past challenges, notably when former Mayor Lori Lightfoot shelved the proposal due to inadequate council attendance.

Broader Implications and Business Community’s Stance

The prospect of increasing property transfer taxes has also prompted reactions from the business community, highlighting a tense intersection between urban development and social welfare initiatives.

Ken Griffin, a notable business leader, relocated his hedge fund from Chicago to Miami in 2022, citing concerns that may well be exacerbated by such tax increases.

The debate over the “mansion tax” is set against a backdrop of broader economic issues facing Chicago, including high crime rates that add to the city’s challenges. FOX Business’ Lydia Hu reports from the ground, capturing the shock and concern of local business leaders grappling with the city’s crime wave alongside fiscal changes.

What Lies Ahead

As discussions unfold, the City’s Council must decide whether to advance this tax proposal to the 2024 ballot as a referendum. The outcome will significantly influence the city’s approach to tackling homelessness and may set a precedent for how American cities fund social services through real estate taxation.

Chicago stands at a crossroads, with its decision likely to resonate well beyond its borders, shaping policy discussions in other metropolitan areas facing similar dilemmas between economic vitality and social responsibility.