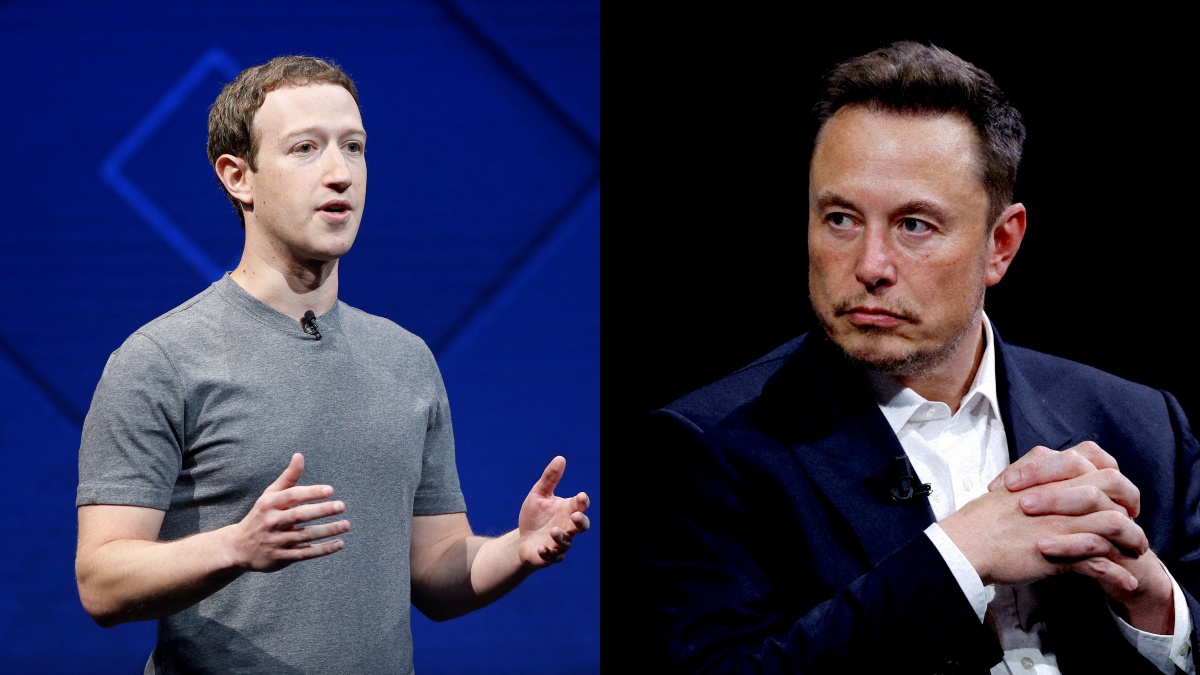

In a dramatic shift in the billionaire rankings, Meta’s CEO Mark Zuckerberg has recently overtaken Tesla’s Elon Musk, securing his spot as the world’s third-richest person. This significant financial crossover highlights the volatile nature of tech stocks and the impact of corporate strategies on personal fortunes.

Zuckerberg’s Financial Ascent Amidst Meta’s Success

Mark Zuckerberg’s wealth has seen an extraordinary increase, growing by over $47 billion in 2024 alone. As of this Wednesday, his net worth reached a staggering $175 billion, as per Bloomberg’s Billionaire Index. This surge is largely attributed to Meta’s robust performance in the market, particularly after announcing solid earnings in the fourth quarter and initiating its first-ever quarterly dividend.

Meta’s stock has appreciated notably, rising by nearly 3% on Thursday and showing an impressive 47% increase year-to-date, with shares trading around $509. Financial analysts are bullish about Meta’s prospects, with UBS recently raising their 12-month price target for Meta stock to $610 per share, up from $530.

Elon Musk surpasses Facebook's Mark Zuckerberg to become the world's third-richest person after his net worth increased by over $15 billion in extended trading. pic.twitter.com/JZ1j98yiHn

— Quick Bits (@quick_bitss) November 17, 2020

Musk’s Decline Linked to Tesla’s Struggles

On the other side of this wealth spectrum, Elon Musk has experienced a significant downturn. His net worth has plummeted by more than $55 billion, leaving him with $174 billion. Tesla’s shares have suffered a sharp 39% drop in 2024, making it one of the S&P 500’s worst performers. The company’s market capitalization now stands at roughly $475 billion, a stark decline influenced by extensive layoffs, executive resignations, and a lackluster performance in first-quarter sales.

Tesla’s strategic pivot away from its long-promised affordable electric car to focus on developing a self-driving robotaxi has also impacted investor sentiment and market performance.

The Broader Billionaire Landscape

The fluctuating fortunes of Zuckerberg and Musk are reflective of broader shifts in the billionaire hierarchy. Amazon founder Jeff Bezos and LVMH CEO Bernard Arnault have both surpassed Musk in recent months. Meanwhile, other tech giants like Microsoft’s Bill Gates and Steve Ballmer, as well as former Google CEO Larry Page, continue to maintain their top spots in the wealth rankings.

Impact of Company Ownership and Market Performance

Both Zuckerberg and Musk’s wealth is tightly coupled with the fortunes of their respective companies. Zuckerberg holds approximately 13% of Meta, which has been performing well this year. Conversely, Musk, who controls about 20.5% of Tesla stock, has felt the brunt of Tesla’s declining stock value. Besides Tesla, Musk continues to lead several other ventures, including SpaceX and Neuralink, which also factor into his overall financial picture.

Conclusion

The ongoing rivalry and fluctuating fortunes between Mark Zuckerberg and Elon Musk not only highlight their personal competition but also underscore the volatile dynamics of tech industries and their leaders’ fortunes. As these tech titans continue to innovate and steer their companies through the ups and downs of market forces, the global financial community remains keenly attuned to their every move, watching how these billionaires navigate the challenges and opportunities that lie ahead.