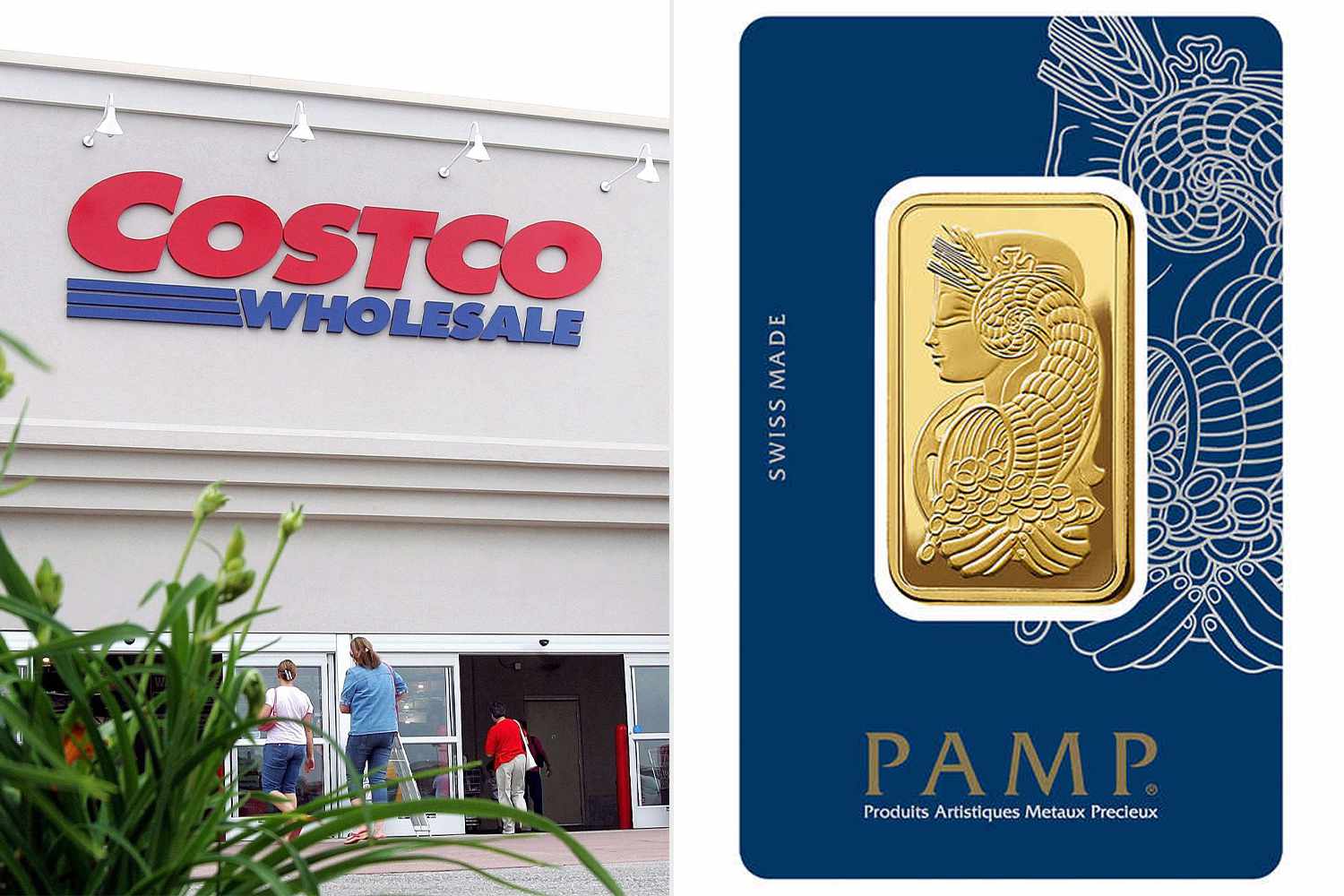

For years, Costco has been more than just a bulk goods paradise; it has ventured into selling precious metals, turning the act of buying gold into a seemingly lucrative opportunity. On the surface, purchasing gold bars from Costco appears to be a straightforward affair with the warehouse giant selling millions of dollars worth of gold monthly.

As tempting as it sounds, customers are quickly realizing that the journey from acquisition to resale is not as glittery as the initial buy.

The Allure of Instant Gold

Each time Costco replenishes its stock of gold bars, they are sold out within hours, signaling a high demand for the shiny assets. The phenomenon is fueled by the minimal markup over the spot price of gold, making these bars an attractive purchase.

This rapid sell-out not only highlights the allure but also paints a picture of a high-stakes investment easily within reach of the average Costco member. However, the allure of owning gold quickly fades as buyers step into the resale market.

Costco shoppers are finding it's harder to sell gold than to buy it https://t.co/qr1cL4yJPV

— Insider (@thisisinsider) April 23, 2024

The Realities of Reselling Gold

Unlike many products at Costco where returns and refunds are the norm, gold bars fall under a different policy. There are no returns, refunds, or price adjustments allowed once a gold bar is purchased.

This policy shifts the burden of resale entirely onto the buyer, introducing them to the less-discussed complexities of trading in the gold market.

Learning the Hard Way

As reported by the Wall Street Journal, some Costco members have had to learn about these complexities the hard way. New York-based appraiser Lark Mason explains the transaction as not akin to trading stocks.

“There’s a friction between what you pay and what you get,” Mason elaborates, indicating the unexpected challenges that arise when attempting to liquidate such investments.

Take for instance, Adam Xi, a Costco shopper who initially bought a gold bar to earn credit card points. His endeavor to resell the bar resulted in a slight loss, fetching him $1,960 on a $2,000 investment.

Another customer experienced a lengthy wait of nine years before making a profit of $850. These examples underscore the unpredictable nature of gold as an investment, particularly when handled through unconventional retail avenues like Costco.

Tax Implications and Other Considerations

The decision to invest in gold bars also brings its set of fiscal responsibilities. The Internal Revenue Service (IRS) classifies these as collectibles, subjecting any profits from gold held over a year to a 28% tax. This tax bracket can significantly diminish the attractiveness of gold as a long-term investment.

Furthermore, the tangible nature of gold bars adds layers of complexity including storage, security, and insurance costs, not to mention the logistical hassle of finding a buyer.

Each of these factors needs to be meticulously considered before plunging into what might seem like a straightforward buy-and-sell scenario.

Is Trading Gold at Costco Worth It?

While the idea of buying gold from Costco might conjure images of savvy investment moves, the reality is fraught with challenges that can turn this glittering opportunity into a cumbersome burden.

As gold continues to symbolize wealth and stability, its practical implications in modern investment portfolios remain debatable, especially when bought from a retail giant known for household goods rather than financial wisdom.

For potential investors, the key lies in understanding the full spectrum of owning and trading gold—not just the initial purchase but the entire lifecycle of this ancient asset.

Before stepping into the world of precious metals, thorough research and consideration of all financial implications are crucial. After all, in the world of investments, glitter is not always gold.