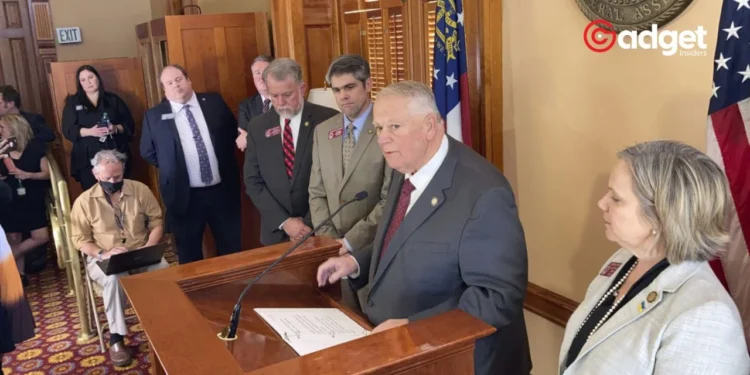

In a major fiscal development, Georgia Governor Brian Kemp has ushered in a new era of reduced taxation for the state’s 11 million residents, promising an economic boost through substantial income tax cuts. This strategic move aligns with Georgia’s goal to enhance its reputation as a business-friendly locale while ensuring more dollars stay in the pockets of its citizens.

Tax Cuts: A Boon for Georgians and Businesses Alike

Starting in 2025, both individual and corporate income tax rates will see a decrement from the current 5.75 percent to 5.39 percent. This adjustment is expected to relieve Georgians of approximately $1.1 billion in taxes annually, with projections estimating a $3 billion reduction over the next decade. Governor Kemp emphasized that this initiative is a direct result of “conservative budgeting and our pro-growth, business-friendly environment.”

Furthermore, the alignment of individual and corporate tax rates underscores Georgia’s commitment to fostering an equitable economic environment. By standardizing these rates, the state aims to attract more businesses and promote higher job creation, ultimately benefiting hardworking Georgians.

Gov. Brian Kemp signed what is being touted as the largest income tax cut in Georgia’s history today.

The bill will gradually drop the state’s income tax rate from 5.75% to 4.99% by 2029 and could eventually save Georgia residents more than $1 billion a year. pic.twitter.com/E1etjXxUcJ

— Everything Georgia (@GAFollowers) April 26, 2022

Legislative Innovations in Tax Regulation

In addition to the headline-grabbing income tax cuts, Governor Kemp has also signed legislation introducing other noteworthy tax adjustments. One significant proposal, pending approval by Georgia voters, would allow local governments to implement a “statewide homestead valuation freeze.” This initiative would cap property value appreciation to the inflation rate, thereby stabilizing property taxes and aiding homeowners in budget management.

Moreover, the state plans to enhance fiscal support for its residents through adjustments in income tax dependent exemptions. The exemption will increase by 33 percent, allowing residents to deduct $4,000 per dependent, up from the current $3,000. This change will provide considerable financial relief to families, making everyday living more affordable.

Georgia Leads in Preservation and Revitalization Efforts

Georgia is also setting a precedent with its renewed focus on cultural and rural preservation. The extension of tax credits for the rehabilitation of historic homes and structures until December 31, 2029, alongside those for rural zone revitalization until December 31, 2032, reflects a balanced approach to development. These initiatives not only encourage the preservation of Georgia’s heritage but also stimulate economic activity in rural areas, often overlooked in broader fiscal policies.

Conclusion: A Forward-Thinking Fiscal Policy

Governor Kemp’s comprehensive tax reform package represents a significant shift towards creating a more prosperous economic future for Georgia. By reducing tax burdens, encouraging local government autonomy in fiscal matters, and promoting cultural preservation, these measures are set to enhance the financial well-being of Georgians while fostering a robust, business-friendly environment. As these policies unfold, they promise to transform Georgia’s economic landscape, making it a model of fiscal responsibility and growth.