Netflix’s recent first-quarter earnings report delivered a surprising uptick in global subscriber numbers, sparking discussions about the sustainability of its growth amid strategic changes and market dynamics.

As the streaming giant transitions from a purely subscription-driven model to a multifaceted business with advertising and tiered memberships, industry watchers are weighing the implications of Netflix’s evolving business strategy and its potential impact on the streaming and Over-The-Top (OTT) industry landscape.

A Closer Look at Netflix’s Q1 Performance

In a notable shift from previous quarters, Netflix added 9.33 million members globally, significantly surpassing the modest 1.75 million subscribers added in the first quarter of 2023.

This marked improvement, however, did not reach the heights of the 13.1 million subscribers added in the fourth quarter. In the U.S. and Canada (UCAN), the company saw an addition of 2.5 million members—a stark contrast to the same quarter last year when only 100,000 new users were reported.

Ross Benes, a senior analyst at eMarketer, highlighted the unexpected strength in subscriber additions, attributing it to the company’s crackdown on password sharing.

“It added more subscribers than many analysts, myself included, expected,” Benes remarked, suggesting that password sharing was even more prevalent than previously thought, as evidenced by Netflix’s success in converting freeloader viewers into paying users.

Netflix all eyes on subscriber growth

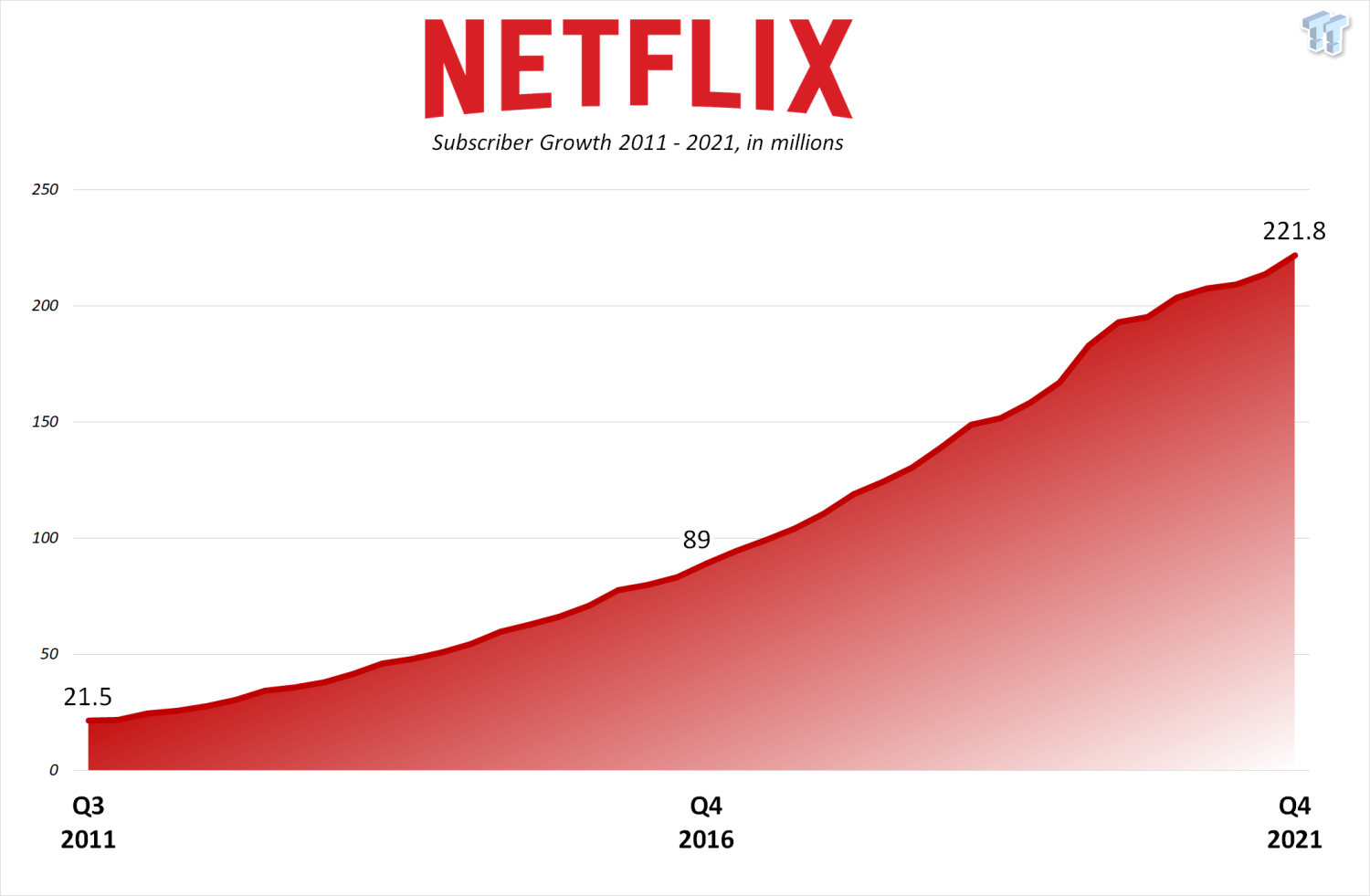

Netflix has added 22 million subscribers since they implemented its password-sharing crackdown since May last year.

Expectations are high for this quarter. They expect to add 5M subscribers, three times more than it's additions YoY. pic.twitter.com/sNt0cvrMyk

— Bad Trader (@BadTraderApp) April 18, 2024

Strategic Shifts and Future Outlook

Despite the strong start to the year, Netflix has announced a significant change in its reporting strategy, planning to discontinue the quarterly membership growth updates starting next year.

“As we’ve noted in previous letters, we’re focused on revenue and operating margin as our primary financial metrics—and engagement (i.e., time spent) as our best proxy for customer satisfaction,” the streaming company explained in its Q1 shareholder letter.

This shift reflects the company’s broader transformation from a focus on sheer subscriber numbers to a more diversified business model emphasizing revenue generation and customer engagement.

The company is also innovating with new revenue streams like advertising and added features for extra members, and modifying its pricing structure to accommodate various tiers and geographical markets. These changes underscore a strategic pivot from