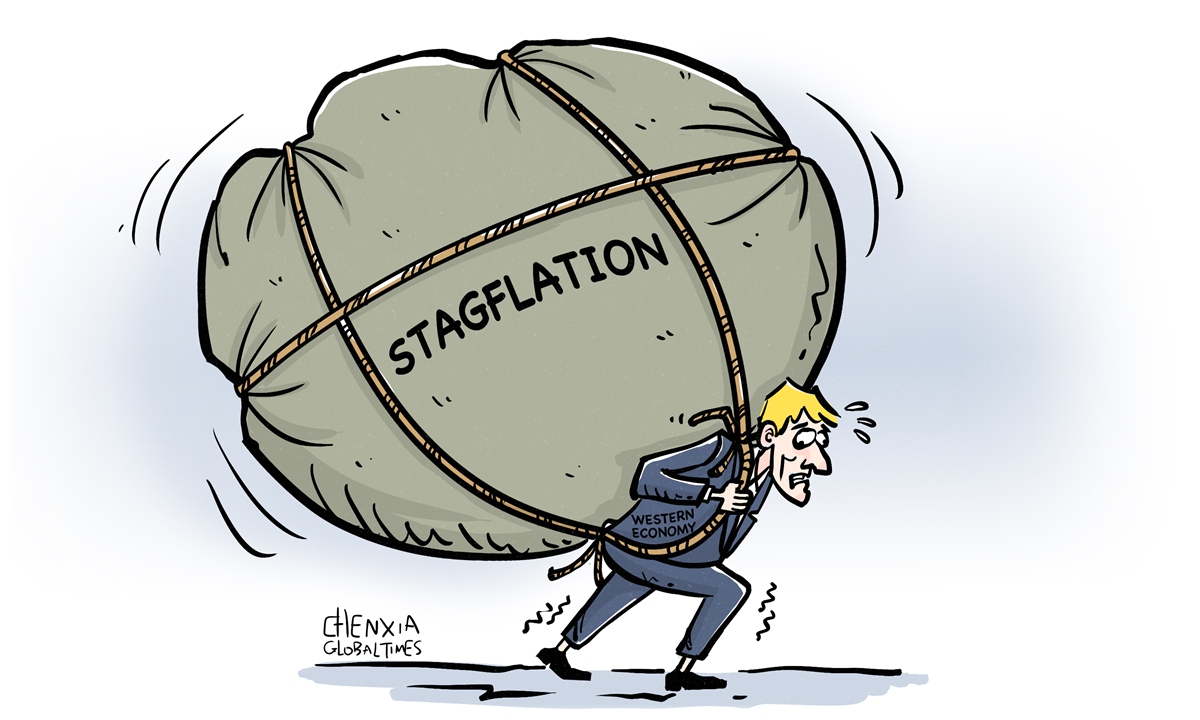

The U.S. economy is currently navigating through turbulent waters, with recent data suggesting a shift that could signal the onset of stagflation, a scenario reminiscent of the challenging economic times of the 1970s. This period is particularly marked by slow growth and rising inflation, a combination that poses unique challenges to policymakers.

The Shadows of the 1970s Loom Over Today’s Economy

Jerome Powell, Chairman of the U.S. Federal Reserve, has recently highlighted the conundrum faced by the economy following the first-quarter GDP report. With growth rates falling to 1.6%, significantly below the expected 2.5%, and consumer prices climbing higher than anticipated, the specter of stagflation is becoming more apparent.

This economic condition, characterized by stagnant activity coupled with inflationary pressure, is notoriously difficult to manage and can lead to long-term detrimental effects if not addressed swiftly.

Headline:

"The US economy is facing stagflation risk" pic.twitter.com/1PsfBlBZKR

— Benzinga (@Benzinga) April 26, 2024

David Donabedian, chief investment officer of CIBC Private Wealth US, described the recent economic reports as the “worst of both worlds,” highlighting the dual challenge of slower growth and higher inflation.

The inability to counter these issues with rate cuts, as noted in the reports, limits the Federal Reserve’s maneuverability, adding to the complexity of the current economic landscape.

A Closer Look at Historical Precedents

The 1970s served as a stark reminder of the potential consequences of uncontrolled inflation and economic stagnation. During that decade, geopolitical tensions and policy decisions led to soaring energy prices and rampant inflation, pushing the U.S. into economic turmoil.

It was a period that challenged existing macroeconomic theories and changed the role of the Federal Reserve within the economy.

The lessons from that era are particularly relevant today as the U.S. faces similar challenges. The Federal Reserve, under the leadership of Powell, finds itself in a precarious position, needing to balance inflation control with the need to support economic growth.

Market Reactions and Analyst Perspectives

The reaction from the stock market to the recent economic data has been sharply negative, reflecting investor concerns about the potential for continued economic weakness combined with inflation.

Moreover, prominent figures like Jamie Dimon, CEO of JPMorgan, have drawn parallels between today’s economic environment and the 1970s, emphasizing the impact of fiscal spending and various inflationary pressures, from green industrialization to global remilitarization.

Despite these challenges, some analysts remain optimistic. For instance, Pooja Sriram and her team at Barclays noted that final sales to domestic purchasers have increased, suggesting that underlying demand conditions in the economy remain strong.

This perspective offers a glimmer of hope that the current economic headwinds could be managed with careful policy adjustments.

Forward-Looking Statements and What Lies Ahead

Investors and policymakers alike are keenly awaiting the upcoming personal consumption expenditures report, which will provide further clarity on the inflation trajectory.

This report is crucial for shaping the Federal Reserve’s policy decisions in the coming months, particularly as the market adjusts its expectations around interest rate cuts.

As the U.S. economy stands at a critical juncture, the decisions made in the next few weeks will be pivotal in determining whether the U.S. can steer clear of a full-blown stagflation scenario or if it will succumb to the economic pressures that have historically led to severe recessions.

The echoes of the past serve as a cautionary tale, urging today’s leaders to tread carefully to avoid the missteps that have previously derailed the nation’s economic prosperity.