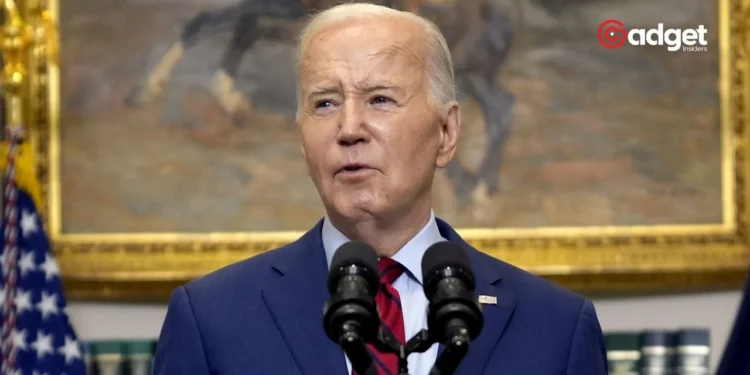

In a surprising turn of events, a federal judge in Texas has issued a temporary injunction against a progressive initiative from the Biden administration aimed at reducing credit card late fees to a mere $8. This decision, emerging from the Northern District of Texas, represents a significant setback for consumer advocates and a victory for major banks and credit card companies.

The Implications of Judge Pittman’s Ruling

Judge Mark Pittman’s decision to halt the implementation of the new late fee cap has sent ripples through the financial and political landscapes. The ruling not only delays the proposed changes that were set to start next week but also underscores the intense legal battles surrounding regulatory adjustments in the banking sector.

Originally, these regulations, introduced by the Consumer Financial Protection Bureau (CFPB), were designed to lower the average credit card late fee from $32, potentially saving American families billions in what the White House terms “junk fees.” Annually, banks accumulate approximately $14 billion from these fees, marking a significant revenue stream that the new rule aimed to cut.

Reaction from the White House and Advocacy Groups

The response to the injunction was swift and pointed. White House spokesperson Jeremy Edwards expressed disappointment, stating, “We are disappointed that a court sided with House Republicans, big banks, and special interests to hit pause on a critical measure to save American families billions in junk fees.”

On the advocacy front, Liz Zelnick from Accountable.US did not mince words, criticizing the U.S. Chamber of Commerce for championing corporate profits over consumer relief. “In their latest in a stack of lawsuits designed to pad record corporate profits at the expense of everyone else, the U.S. Chamber got its way for now — ensuring families get price-gouged a little longer with credit card late fees as high as $41,” she remarked.

this world is a giant matrix that operates on codes (your entire life is literally based around NUMBERS BTW..from credit card number, social security number, dates, time, how much money you get paid, etc)

sooner you realize that + open your eyes the sooner we can start having…

— Madame Black Swan 🕷🦢 (@DrIndyEinstein) May 12, 2024

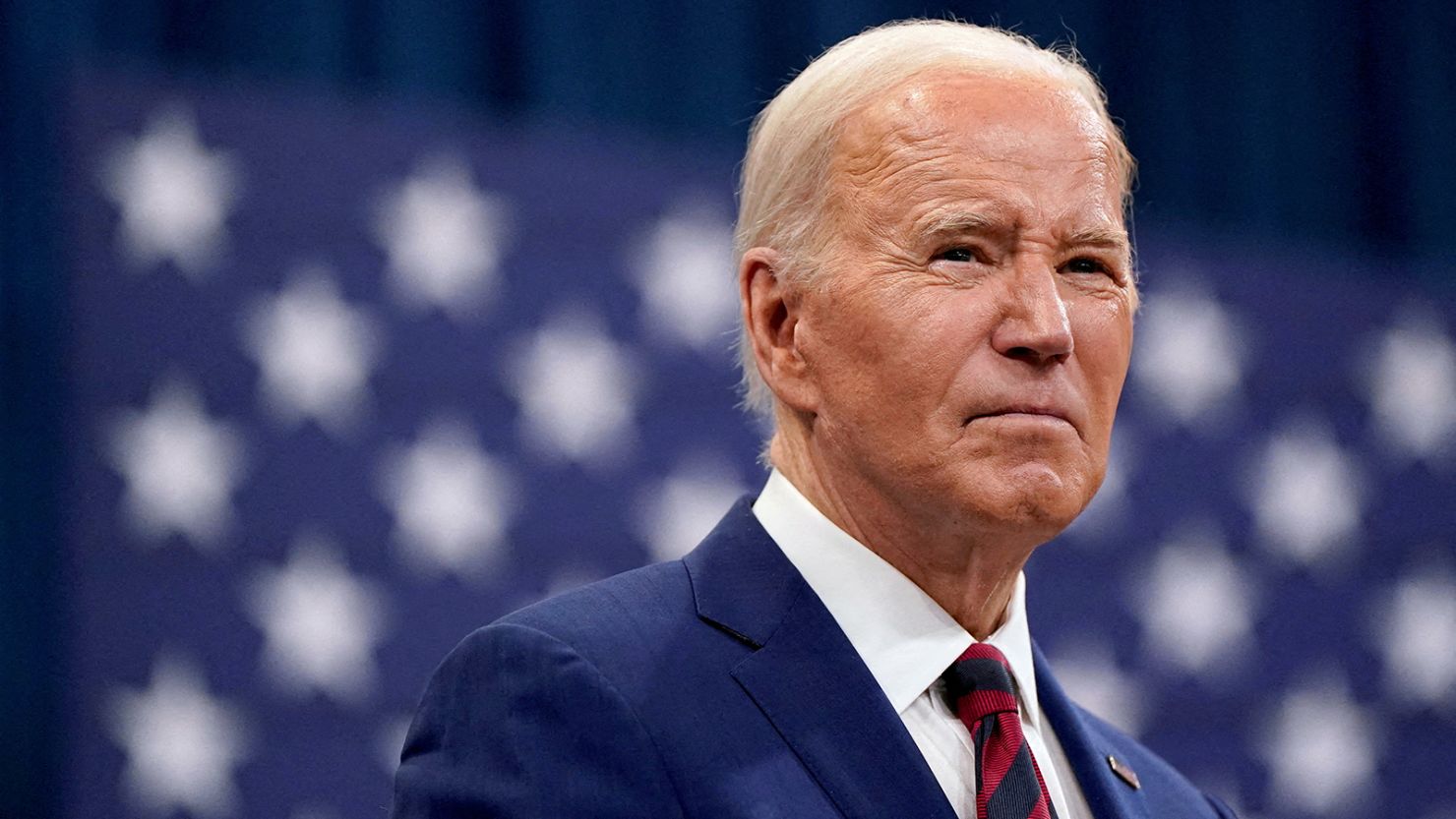

A Legal and Political Chess Game

This legal setback occurs amid a broader push by President Joe Biden, as part of his reelection campaign, to clamp down on various banking fees that he argues take advantage of ordinary Americans. According to the administration, “Every month that the credit card late fee rule is blocked will cost Americans over $800 million,” a statistic that paints a grim picture of the financial burden on consumers.

The legal strife also highlights the practice of “judicial forum shopping,” a tactic where litigants select a court believed to be more favorable to their case. Critics argue that this case exemplifies such strategies, especially given the earlier attempt to move the lawsuit out of Texas, a motion initially approved by Judge Pittman but later overturned by an appeals court.

Judge’s Ruling on Credit Card Fees: High Stakes and Implications

As this legal drama unfolds, the stakes are high for both consumers, who seek relief from steep late fees, and for banks, whose business models could be significantly impacted by the proposed cap. With billions of dollars and the financial well-being of many American families hanging in the balance, all eyes will be on the ensuing legal maneuvers and their implications for the future of consumer finance regulation.

In the meantime, the temporary halt serves as a reminder of the powerful interplay between legislation, the judiciary, and the market forces that shape our daily financial realities.