As the electric vehicle (EV) market accelerates, Tesla finds itself at a crossroads, courtesy of the Inflation Reduction Act (IRA) of 2023. This pivotal legislation, a beacon for the Biden administration’s clean energy ambitions, aims to reshape America’s automotive future. But what does this mean for the company, the standard-bearer of the EV revolution, as we move into 2024?

The IRA’s Electric Shock to the EV Industry

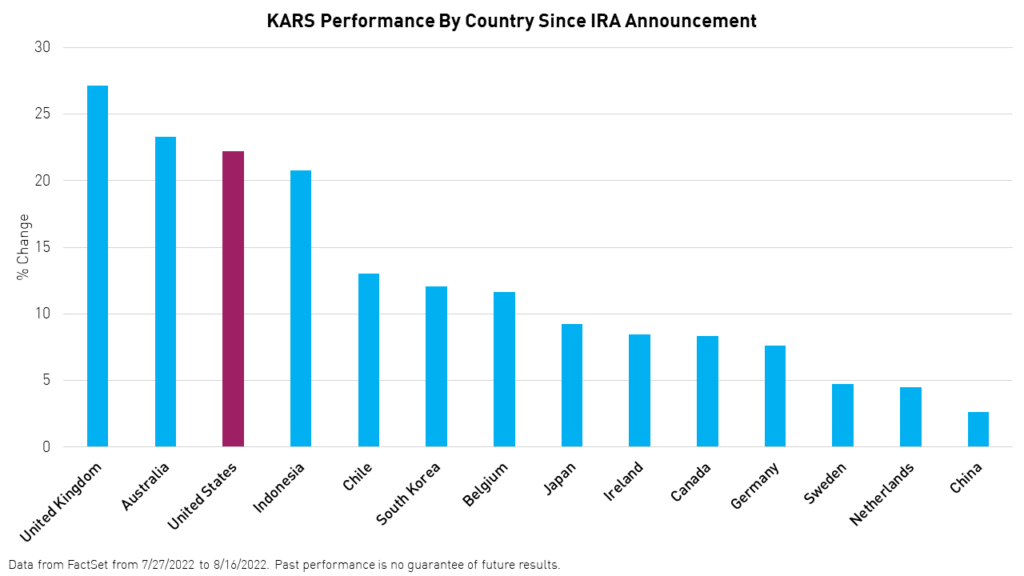

The IRA’s introduction has been nothing short of a seismic shift for the EV sector, introducing stringent criteria for tax credit eligibility. Vehicles now need to source a significant portion of their critical minerals and battery components from domestic or allied sources.

This policy aims to wean the U.S. off foreign dependencies, particularly Chinese, and foster a resilient domestic EV ecosystem.

Tesla’s Tug-of-War with Tax Credits

Tesla’s journey through this transformed landscape is complex. While models like the Model 3 Performance and Model Y navigate these changes with grace, maintaining full credit eligibility, others in Tesla’s lineup stagger under the new rules.

The end of 2023 marked a turning point for the Model 3 Rear-Wheel Drive and Long Range variants, stripping them of their credit, a scenario that could ripple through its market positioning and sales dynamics.

Unpacking the IRA: The Devil in the Details

Critical Minerals and Manufacturing Milestones

The IRA stipulates that EVs must increasingly rely on the U.S. and its allies for critical mineral sourcing and North American manufacturing of battery components. This gradual tightening of requirements poses a dual challenge: aligning supply chains with geopolitical alliances and boosting local manufacturing capacities.

Financial Fences: Income and Price Caps

The act also introduces caps on buyer income and vehicle prices, aiming to target tax credits toward middle-class consumers and more affordable EVs. These measures add layers of complexity for potential buyers, directly impacting the company’s market strategy.

The Dealership Dilemma: Immediate Tax Credit Transfers

From 2024, the IRA allows for the immediate transfer of tax credits at dealerships, a move that could alter the purchasing process. This adjustment means dealers could lower vehicle prices on the spot, a boon for consumers but a new frontier for Tesla’s direct-sales model.

Tesla’s Model-by-Model Marathon in 2024

Hi everybody. Based on my calculation, Tesla's global order backlog was 87K on 31 Jan, down from 107K on 15 Jan.

31 Dec: 74K

15 Jan: 107K

31 Jan: 87K

15 Feb: See https://t.co/09CVduZDtL I will post it here after 2 weeks. Today's Patreon update also focuses on inventory in Europe pic.twitter.com/tYwTBtkoBr— Troy Teslike (@TroyTeslike) February 16, 2023

The Mixed Bag: Model S and Model X

The luxury linchpins of Tesla’s lineup, the Model S and Model X, face diverging paths under the IRA. The Model S, priced beyond the hatchback/sedan cap, finds itself sidelined from tax credits. Contrastingly, the Model X Dual Motor, by its pricing, enjoys the full $7,500 credit, showcasing the nuanced impact of the IRA across Tesla’s range.

The Model 3 and Model Y: A Split Scenario

The Model 3’s sportier Performance variant retains its credit eligibility, standing in stark relief against its Standard Range and Long Range siblings, which fall from grace. Meanwhile, the Model Y continues to stride confidently into 2024, with both Performance and All-Wheel Drive versions holding onto the full credit, underscoring the varied effects of the IRA within a single brand.

Enter the Cybertruck: An Uncertain Contender

Tesla’s much-anticipated Cybertruck enters the fray with cautious optimism. Early indicators suggest its base and all-wheel-drive versions could enjoy the full tax credit, thanks to strategic pricing. However, the evolving regulatory landscape and Tesla’s production timelines could shift these initial assessments.

The Road Ahead: Challenges and Adaptations

Adapting to the IRA’s Mandates

Tesla’s roadmap through this regulatory thicket involves strategic adaptations. Meeting the IRA’s sourcing and manufacturing requirements necessitates a recalibration of Tesla’s supply chain and a potential ramp-up in domestic production capabilities.

The Competitive Edge: Tesla vs. The World

As the IRA reshapes the competitive landscape, Tesla must navigate increased competition, both from the surge of used EV tax credits and the broader eligibility of new models from other manufacturers. This scenario demands a nuanced approach from Tesla, balancing price adjustments, feature enhancements, and market positioning to maintain its leadership.

Regulatory Agility: Tesla’s Ace Card

In the fast-evolving world of EV policy, Tesla’s ability to adapt and innovate remains its greatest strength. Staying ahead of regulatory changes, optimizing its technology, and leveraging its brand’s allure will be key to navigating the post-IRA era.

As we venture into 2024, Tesla’s journey under the IRA embodies the broader challenges and opportunities facing the EV industry. The act, while a catalyst for change, presents a labyrinth of requirements and restrictions. Tesla’s response to these challenges will not only shape its future but also signal the direction of the electric revolution.

In this electrified dance of policy and innovation, Tesla’s moves will be closely watched by enthusiasts and competitors alike, marking a pivotal chapter in the quest for a cleaner, more sustainable automotive landscape.