In a landmark ruling that has sent shockwaves through the cryptocurrency world, Binance, the global cryptocurrency exchange behemoth, has agreed to pay a staggering $4.3 billion in penalties to the United States Department of Justice. This settlement marks the largest criminal penalty in U.S. history, signaling a pivotal moment in the regulation and oversight of the crypto industry.

A Groundbreaking Plea Deal

At the heart of this unprecedented legal development is Binance’s acceptance of responsibility for a series of significant violations, including breaches of sanctions and lapses in anti-money laundering protocols.

The company’s plea deal, approved by Judge Richard Jones of the US District Court for the Western District of Washington, underscores a commitment to rectify past missteps and forge a path toward regulatory compliance.

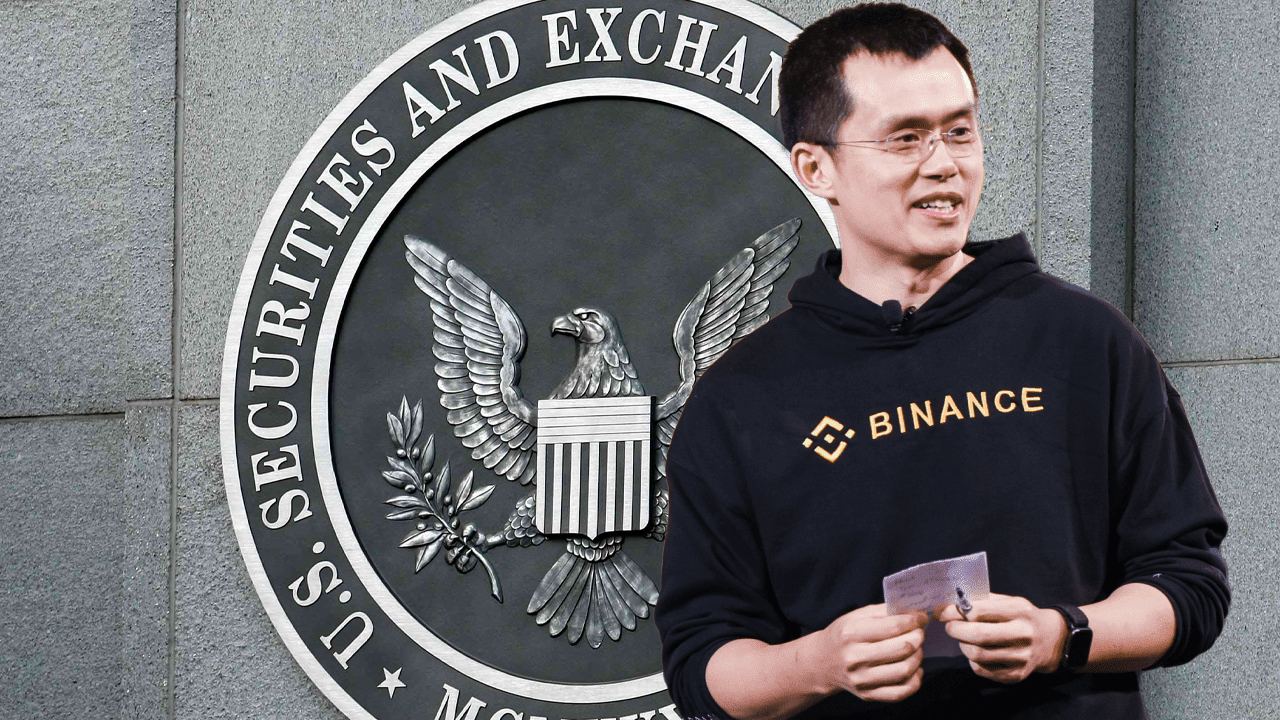

Former CEO Changpeng Zhao, better known as “CZ,” has also admitted his part in these violations, highlighting a period of introspection and accountability for one of crypto’s most influential figures.

With CZ’s movements now restricted within the U.S. borders until his sentencing in April, the saga underscores the gravity of Binance’s situation and the broader implications for leadership accountability within the crypto sphere.

The Path Forward: Oversight and Compliance

In addition to the monumental financial penalty, the crypto’s future operations will come under the scrutiny of an independent monitoring firm for the next five years. While the specific firm has yet to be named, reports suggest that Sullivan & Cromwell are in the running to take on this critical oversight role.

This move is a clear signal of the U.S. judiciary’s intent to ensure that the cryptocurrency adheres to stringent compliance standards moving forward.

Josh Eaton, the company’s deputy general counsel, voiced the company’s stance in court, stating, “Binance accepts full responsibility for its past and for the reasons we’re sitting here today.” This acknowledgment is a cornerstone of the plea deal and represents a pivotal step in Binance’s journey toward operational and ethical rectitude.

1⃣Breaking News on Binance and US Legal Settlement🚨#CryptoNews: #Binance, the world's largest cryptocurrency exchange, faces a major legal shift in the US. Changpeng Zhao, Binance's CEO, has stepped down amidst a $4.3 billion settlement with US authorities. #XBorg Thread👇 pic.twitter.com/AFK4ld4ibp

— Arakine | ❌Borg – $XBG -$GNET (@Arakine) November 22, 2023

A New Chapter for Binance and Crypto

The settlement comes at a time when the crypto industry is under intense scrutiny, especially in the aftermath of the FTX collapse. Binance’s commitment to enhancing its know-your-customer (KYC) and anti-money laundering (AML) frameworks is a testament to the evolving landscape of crypto regulation and the increasing demands for transparency and accountability.

As Binance navigates through this challenging chapter, the implications of its plea deal extend far beyond the company’s immediate future. This historic settlement is a clarion call for the entire crypto industry to elevate its standards, ensuring that compliance, transparency, and accountability become the bedrock of this dynamic and rapidly evolving sector.

In sum, Binance’s $4.3 billion settlement is not just a resolution of past misdeeds but a harbinger of the future of cryptocurrency regulation. As the industry continues to mature, the saga of Binance serves as a potent reminder of the critical importance of adhering to legal and ethical standards, ensuring the long-term sustainability and integrity of the crypto ecosystem.