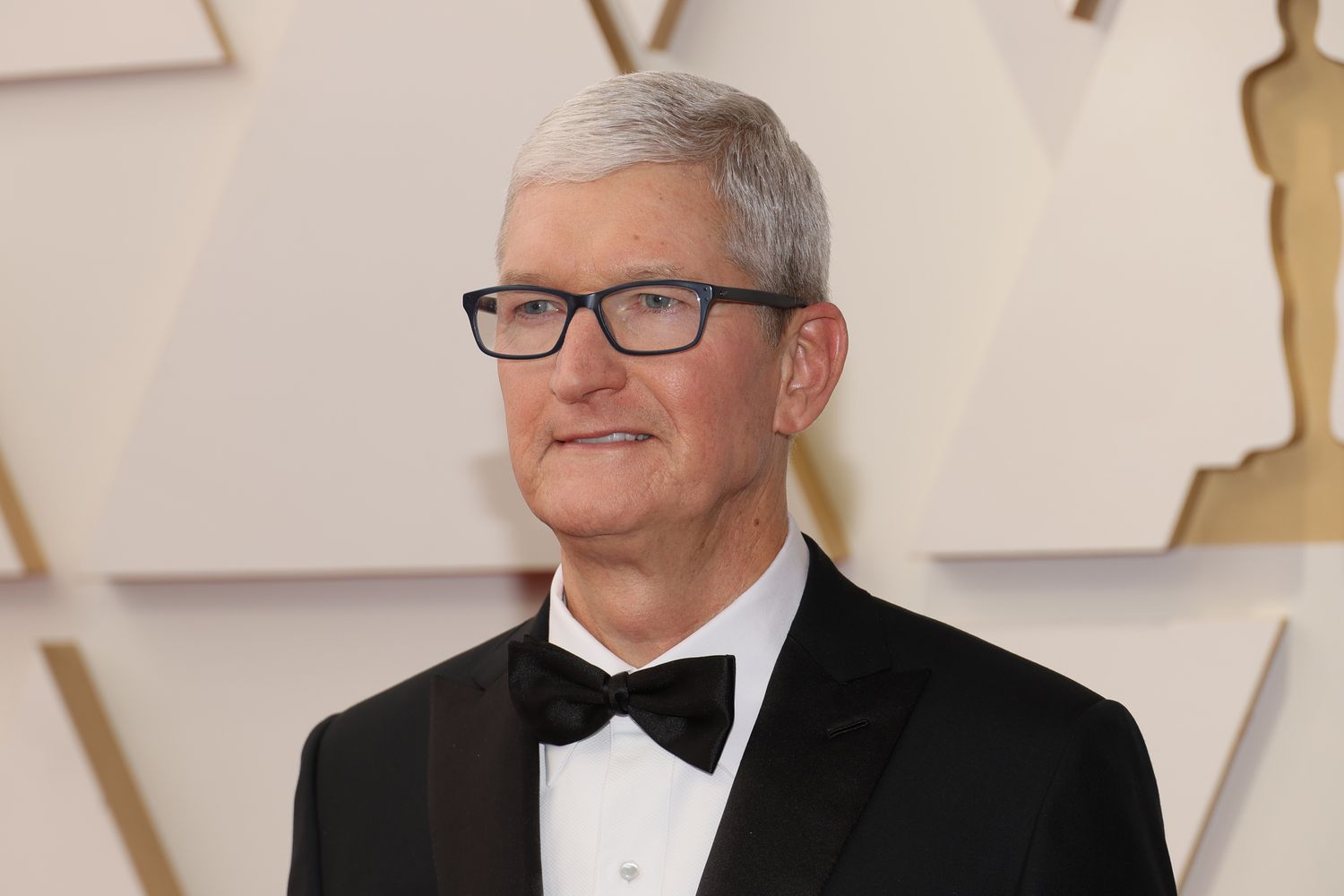

In the high-stakes world of corporate finance, the question of executive compensation is a topic that often stirs debate and scrutiny. Recently, the spotlight turned to Apple Inc., a titan in the tech industry, as it faced allegations of overcompensating its Chief Executive, Tim Cook, and other top executives.

This legal challenge, however, has been decisively quelled by a federal judge’s ruling, marking a significant moment for Apple and its leadership.

The Allegations: Missteps in Executive Bonuses?

The crux of the controversy centered around performance-based restricted stock units (RSUs) granted to Tim Cook and four other executives in 2021 and 2022. The lawsuit claimed that Apple intended to award $77.5 million worth of RSUs each year but instead overcompensated by granting $92.7 million and $94 million, respectively, due to miscalculations in the fair values of these RSUs.

This discrepancy, the plaintiff argued, led to shareholders being misled during the “say-on-pay” votes on executive compensation.

Judicial Clarity: Apple’s Compensation Strategy Upheld

The ruling by Judge Jennifer Rochon of the US District Court in Manhattan has put to rest the allegations of overpayment. Judge Rochon highlighted that Apple had meticulously outlined its payment methodologies in its 2023 proxy statement, adhering to the strict guidelines set by securities laws and the US Securities and Exchange Commission.

The judge found no evidence of misconduct by Apple’s board of directors in awarding the pay packages and noted that the plaintiff, associated with the International Brotherhood of Teamsters, prematurely filed the lawsuit without giving the board adequate time to address the concerns raised.

Norway's sovereign wealth fund to vote down Apple executive pay https://t.co/sTEcR2U15s pic.twitter.com/8gcoMr4Zqs

— VizualizeYourDream (@VizualizeDream) March 1, 2022

Executive Pay in the Spotlight

Apple’s approach to executive compensation is multifaceted, combining a base salary with performance-based bonuses, stock awards, and other negotiated perks. According to Apple’s filings, Tim Cook’s compensation in 2021 and 2022 was predominantly through stock awards, totaling about $99 million.

However, in a move reflecting a potential adjustment to the outcry over executive pay scales, Cook’s compensation saw a reduction to $63.2 million in 2023. Meanwhile, the other four top executives at Apple consistently received over $26 million each over the past three years.

Reflections on Corporate Governance and Accountability

The dismissal of the lawsuit against Apple’s executive compensation practices sheds light on the intricate balance between rewarding leadership and ensuring shareholder trust and satisfaction. It underscores the importance of transparency and adherence to regulatory standards in the governance of corporate entities.

For Apple, a company at the forefront of innovation and market leadership, this ruling reaffirms the legitimacy of its compensation strategy, even as it navigates the complexities of executive pay in the public eye.

In the broader corporate landscape, this case serves as a reminder of the critical role that oversight mechanisms play in maintaining the delicate equilibrium between rewarding top-tier leadership and safeguarding shareholder interests.

As companies continue to evolve in a rapidly changing global market, the principles of transparency, accountability, and fair valuation remain paramount in the discourse on executive compensation.