In a move that caught the eye of fintech enthusiasts and Apple users alike, Cupertino has made a slight adjustment to the Apple Card Savings, marking the program’s first interest rate decrease since its inception. This development, discovered in the company’s backend, sees the interest rate trimming down by 0.1 percent—a seemingly small figure that nonetheless signals a significant shift in Apple’s strategy.

The Context of the Cutback

Aaron Perris, a contributor for MacRumors, unearthed this update, noting that the interest rate for Apple Card Savings has slipped from 4.5 percent APY to 4.4 percent. This adjustment follows a series of rate hikes throughout 2023, culminating in December’s peak.

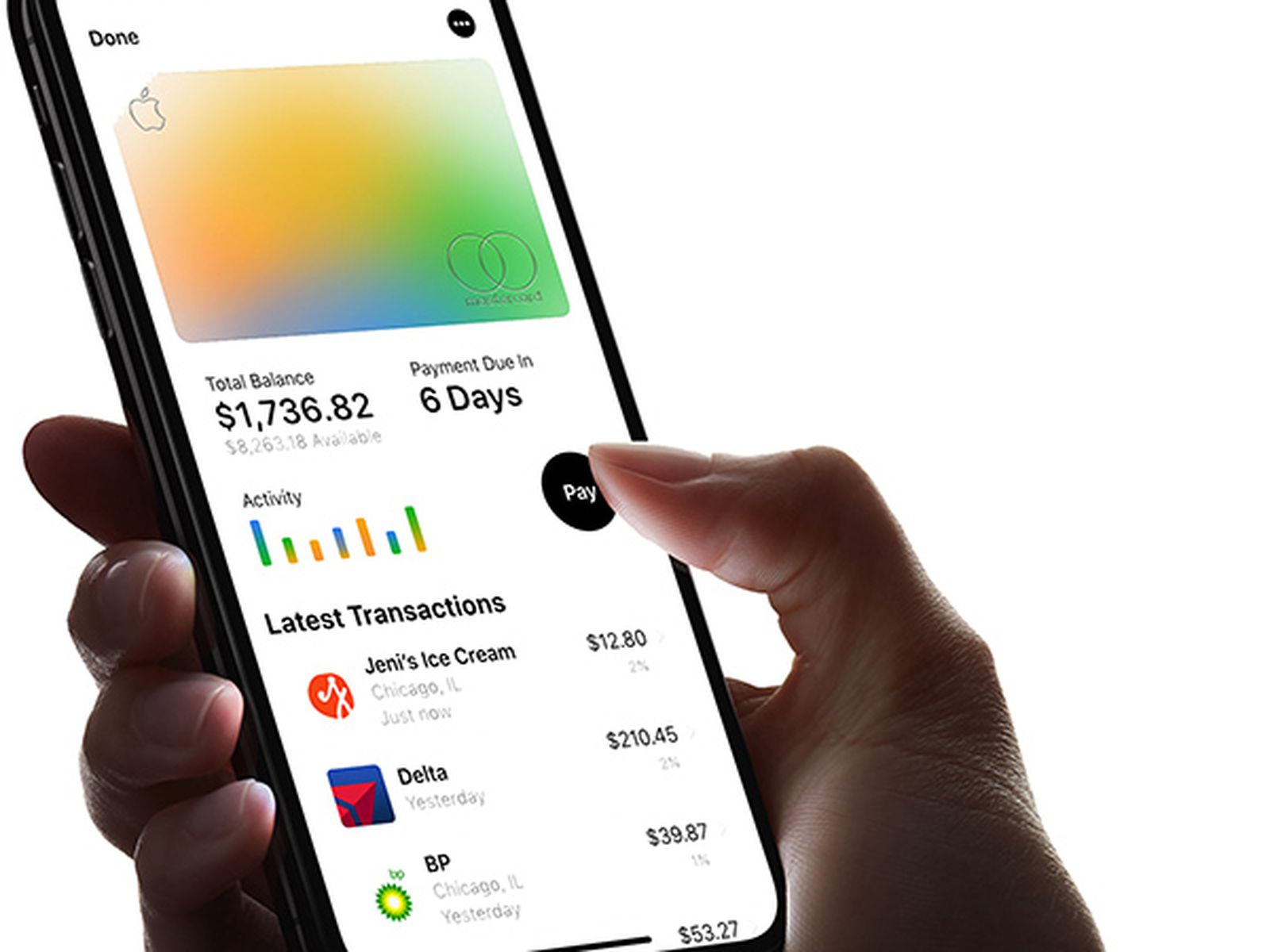

Such a reversal is not just noteworthy for being the first of its kind; it also highlights Cupertino’s dynamic approach to managing its high-yield savings account program. This program, recognized for its absence of minimum deposit requirements, fees, and balance mandates, continues to offer these user-friendly terms, albeit at a slightly reduced earning potential.

A Glimpse into the Partnership’s Strategy

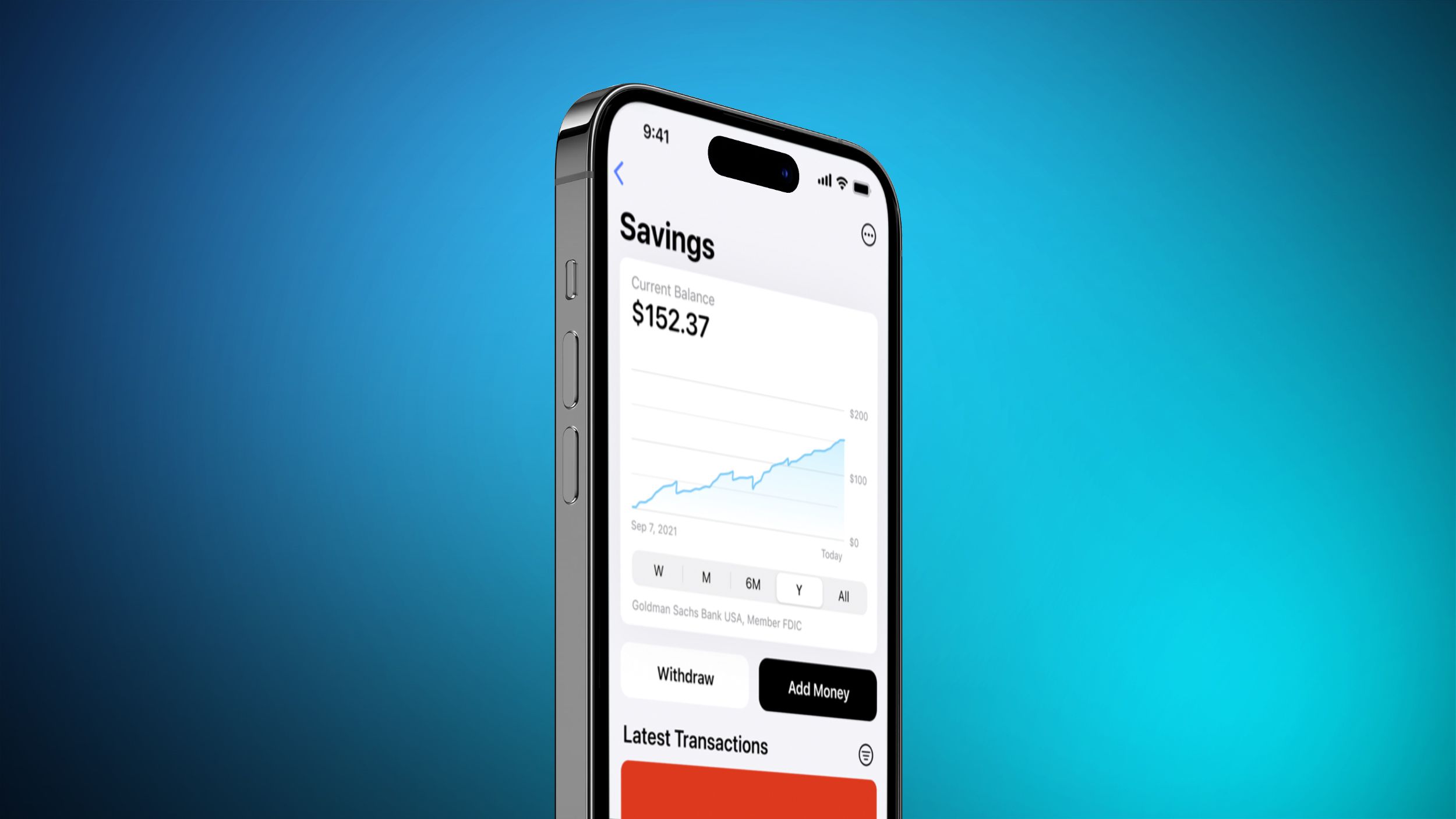

The inception of Apple Card Savings was a collaboration between Apple and Goldman Sachs, setting the fintech sphere abuzz. Launching with an APY of 4.15 percent, it presented robust competition to conventional banking options.

Over time, this rate saw a progressive increase, reflecting a commitment to providing an enticing yield to users. The recent adjustment, therefore, raises questions about the underlying strategy and market conditions prompting such a decision.

Beyond the Numbers: User Impact and Market Positioning

Despite the decrement, Apple Card Savings still positions itself as a formidable player in the digital banking arena. The service, exclusive to Apple Card users in the U.S., continues to allow earnings on daily cash balances and cashback, maintaining its appeal among tech-savvy savers.

This shift occurs amidst news of the potential conclusion of the partnership between Apple and Goldman Sachs, sparking speculation on the future direction of their fintech ventures.

Apple Card Savings: A Review of High-Yield Benefits

The journey of Apple Card Savings from its launch has been marked by notable milestones, including a rapid accumulation of $1 billion in deposits within just four days of availability.

Initially capping deposits at $250,000, the service has consistently aimed to outdo traditional banking experiences by offering higher interest rates and a streamlined digital banking experience. Even as it navigates through rate adjustments, the essence of providing a competitive edge in the savings domain remains unchanged.

This means less savings for user's money on the Apple service.https://t.co/GBc1WNa80b

— Tech Times (@TechTimes_News) April 2, 2024

Looking Ahead: The Path of Fintech Innovation

As Apple Card Savings undergoes its first interest rate decrease, the move invites discussions on the strategic calculus of Apple and its future in the financial technology sector.

With a history of adjusting rates in response to market dynamics and user engagement, Cupertino’s latest step might be reflective of broader economic trends or a recalibration of its financial services portfolio.

In sum, while the decrease in the Apple Card Savings interest rate marks a departure from previous trends, it also underscores Apple’s adaptability in the ever-evolving fintech landscape.

As users and industry watchers alike ponder the implications of this change, the focus remains on how such strategic decisions will shape the future of digital banking and customer experiences.