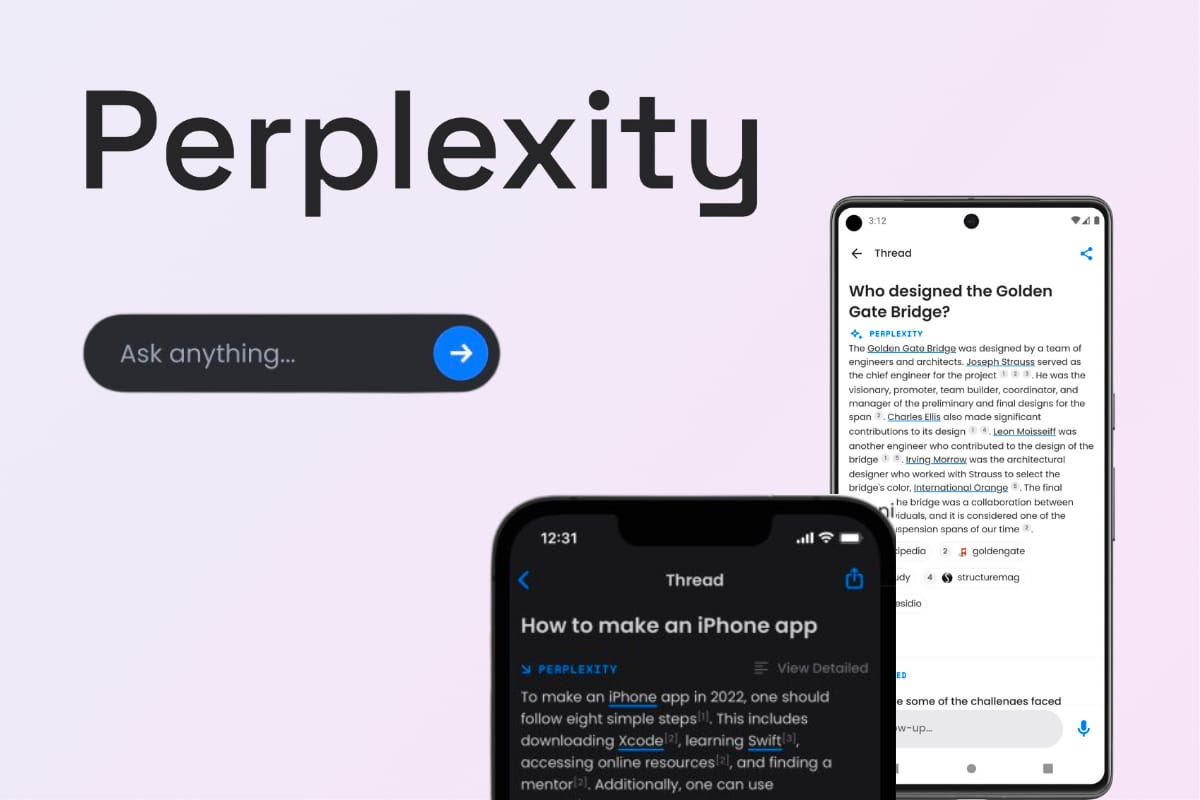

In the realm of financial services, the emergence of generative artificial intelligence (GenAI) has marked a new era of data-driven decision making. Perplexity AI, a frontrunner in the GenAI industry, is reshaping how financial enterprises approach market analysis, risk assessment, and investment strategies with its cutting-edge technologies.

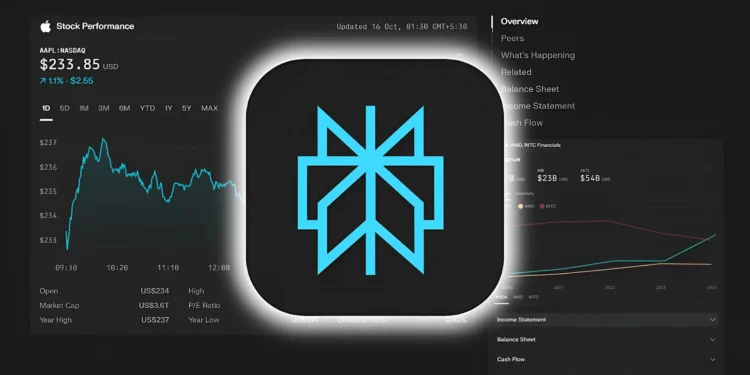

Introducing Perplexity for Finance

Perplexity AI recently unveiled ‘Perplexity for Finance’, a comprehensive suite that amalgamates real-time stock quotes, historical earnings, peer comparisons, and in-depth financial analyses into a user-friendly interface. “These decisions are worth several millions or even billions of dollars. So, it’s worth using a tool to give you more clarity,” remarked Aravind Srinivas, the founder of Perplexity AI. This feature promises to empower fintech firms and banks with tools that rival, and potentially surpass, established services like Bloomberg Terminal and Yahoo Finance.

Internal Knowledge Search: A Gateway to Enhanced Due Diligence

Another innovative service offered by Perplexity AI is the ‘Internal Knowledge Search.’ This feature allows users to scour through organizational files and web data simultaneously, providing a robust mechanism for conducting due diligence. According to Srinivas, “We want Perplexity to be the central knowledge base and research platform for everybody.” This functionality is particularly valuable for financial services firms, enabling more thorough research and analysis which are critical in high-stakes financial environments.

Competing with Giants: The Strategic Edge of Perplexity AI

Despite the presence of heavyweights like Google and upcoming tools from OpenAI, Perplexity AI holds its own due to several strategic advantages. “Every single query on Perplexity, on average, has 10 to 11 words, compared to about two to three words on Google, so users have much higher intent with each query,” explained Srinivas. This specificity translates into more precise and actionable answers for users.

A Diverse Ecosystem of Data Integrations

The forthcoming integration with third-party data providers such as Crunchbase and FactSet for its Enterprise Pro customers is set to further enhance the capabilities of Perplexity AI. Srinivas announced plans to expand these integrations beyond finance to sectors like legal and health, indicating the versatile potential of Perplexity’s platform.

User Endorsements and Industry Recognition

The enthusiasm for Perplexity AI’s offerings isn’t limited to corporate announcements. Users on platforms like X have been vocal about the transformative potential of these tools. One user posted, “With this kind of data integration, Perplexity can become the default go-to place for capital market research and perhaps disrupt online sites/forums.” This sentiment is echoed by industry experts like Michael J. Miraflor, who likened Perplexity’s tool to “Bloomberg Terminal Lite for normies.”

The Broader Impact on Financial Analysis

As GenAI continues to evolve, its impact on financial services becomes increasingly profound. Institutions like JPMorgan have also begun deploying in-house GenAI tools, enhancing productivity and decision-making capabilities within their operations. The introduction of such technologies is set to redefine the roles of traditional financial analysts, with AI handling complex data synthesis and analysis tasks more efficiently.

Perplexity AI’s innovative approach to integrating advanced AI capabilities with financial services is enhancing analytical precision and setting a new standard for the industry. As more financial institutions recognize the benefits of GenAI, the landscape of economic analysis and consultation is poised for a significant transformation, making Perplexity AI a key player in the future of finance.