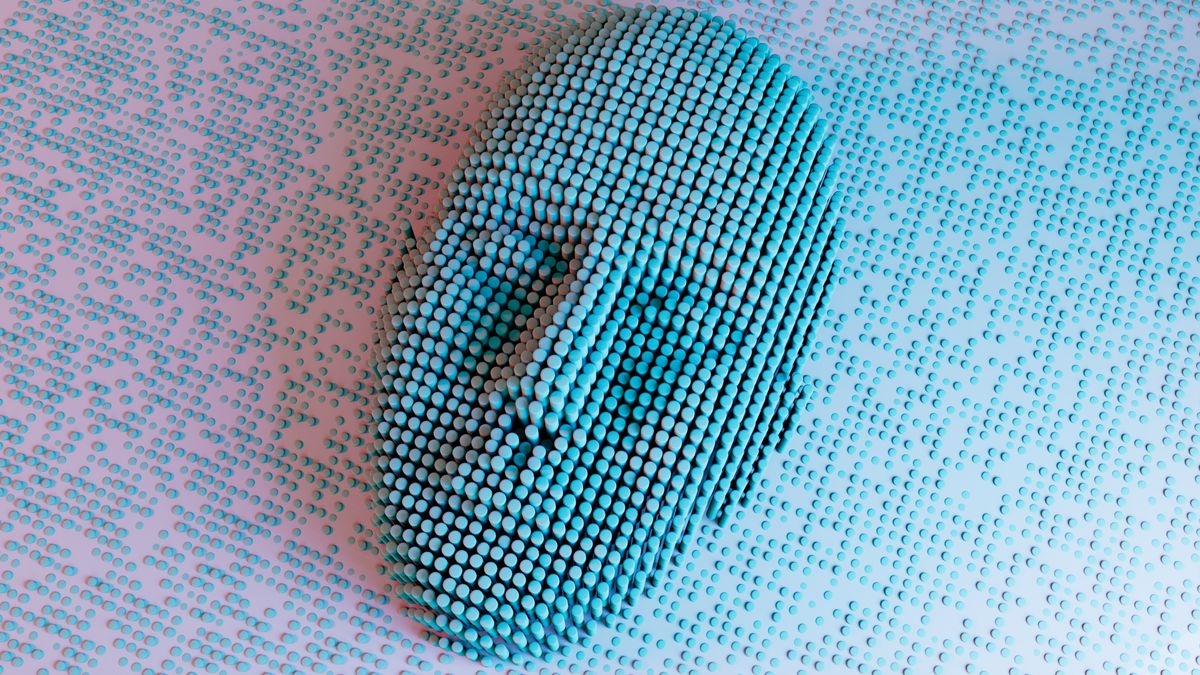

Scammers use a Deepfake Video of a CEO to Swipe out $26 million in a flash. In an era where technological advancements are celebrated for their innovation and impact on society, the darker underpinnings of these developments often go unnoticed until a major incident shines a spotlight on the potential for misuse.

A recent case, as reported by Dexerto’s Liam Ho, underscores the alarming capabilities of deepfake AI technology in perpetrating financial fraud on a scale previously unimaginable. This incident, involving a staggering $26 million theft from a multinational corporation by scammers impersonating the company’s Chief Financial Officer (CFO) via a deepfake video call, is a stark reminder of the dual-edged nature of technology.

The Ingenious Scam that Shocked the Corporate World

The scam unfolded with the precision of a well-rehearsed play, leveraging the sophisticated capabilities of deepfake technology. The fraudsters, with malicious intent, impersonated the CFO and other colleagues of a major multinational company, convincing an unwitting financial worker to participate in what was presented as a confidential company meeting.

During this virtual assembly, the worker was duped into transferring the equivalent of $26 million into five local bank accounts through 15 separate transactions.

The deepfake technology used in this scam was not rudimentary by any means. The scammers had pre-downloaded videos and employed artificial intelligence to overlay fake voices onto the video feed during the conference, creating a convincing illusion of real-time interaction with company executives.

A Wake-Up Call for Corporate Security Measures

This incident serves as a critical wake-up call for corporations worldwide, emphasizing the urgent need for advanced security measures to combat the rising tide of AI-assisted fraud. The ease with which the scammers executed this fraud, stealing millions through a fabricated video call, demonstrates the pressing challenge of distinguishing between real and artificially generated content.

Moreover, the case raises important questions about the ethical implications of deepfake technology. While the potential for positive applications exists, the misuse of such technology for criminal activities casts a long shadow over its benefits. It underscores the necessity for a balanced approach to technological innovation, where the development of cutting-edge tools is accompanied by robust ethical guidelines and security measures.

The scammers reportedly used deepfake AI technology to impersonate the company’s CFO. Impersonating the CFO and other colleagues, the scammer invited a financial worker to a company meeting.

— Dexerto (@Dexerto) February 6, 2024

Beyond Financial Fraud: The Cultural Impact of Deepfakes

The implications of deepfake technology extend beyond the realm of financial fraud, touching upon cultural and societal norms. The recent deepfakes made of pop star Taylor Swift exemplify the potential for deepfakes to infringe on individual privacy and integrity, manipulating public perceptions and spreading misinformation. This incident not only highlights the financial risks associated with deepfake technology but also its broader impact on society.

Navigating the Future with Caution

The $26 million scam is a potent reminder of the dark potential of technological advancements. As we marvel at the possibilities opened by AI and deepfake technology, it’s crucial to remain vigilant against their misuse. The incident calls for a concerted effort from technology developers, legal frameworks, and corporate governance to ensure that the benefits of innovation are not overshadowed by the risks. As we move forward into an increasingly digital future, the balance between innovation and ethical responsibility remains paramount.