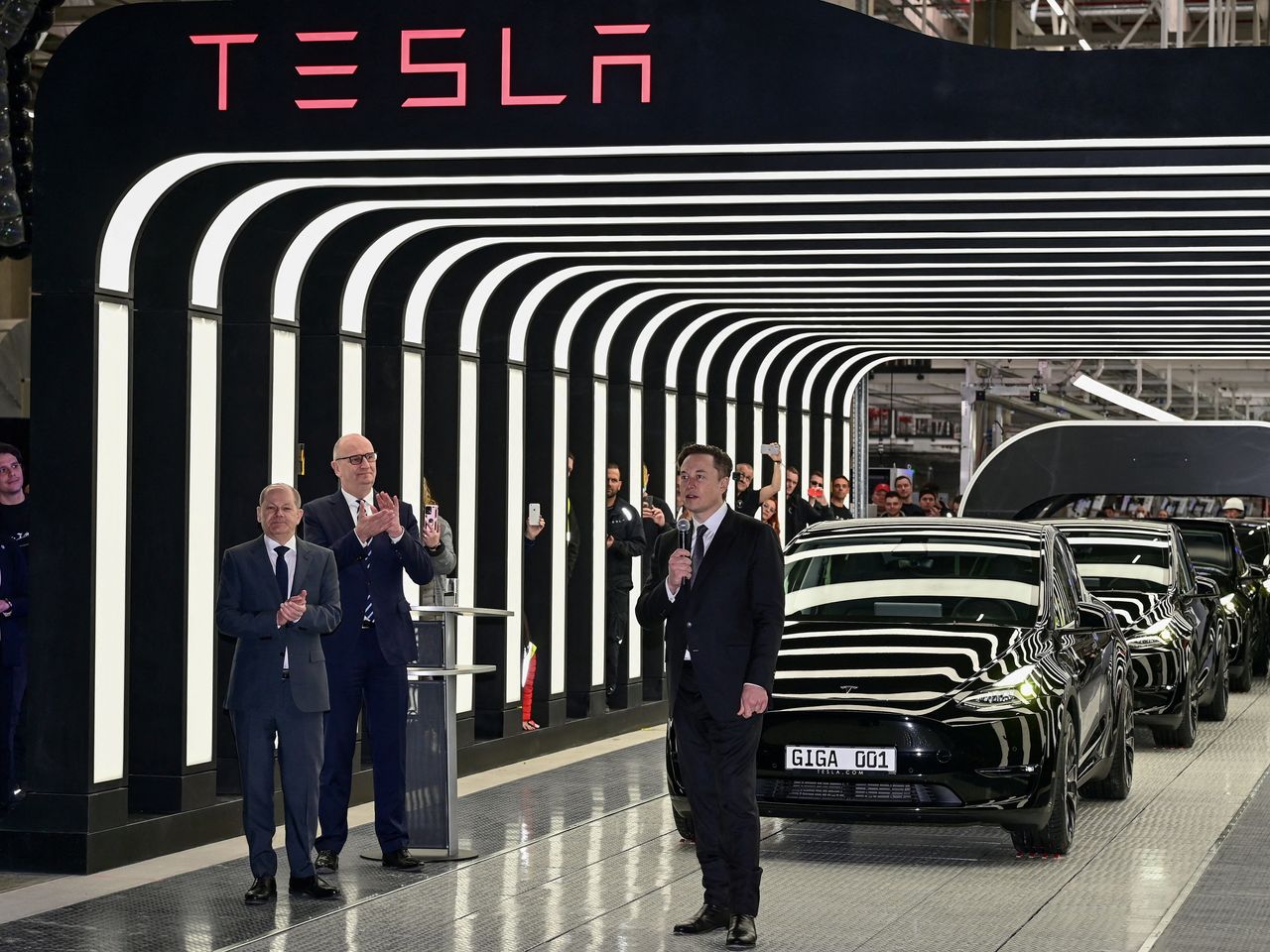

In a revealing study that sheds light on the economic practices of some of the United States’ most profitable companies, Tesla Inc., led by the globally renowned entrepreneur Elon Musk, stands out for its financial maneuvers over the last five years. As the electric vehicle market leader, Tesla’s financial strategies have sparked debates on fiscal responsibility and equity, revealing a complex portrait of corporate wealth in America.

Tesla’s Financial Juggernaut

Between 2018 and 2022, Tesla didn’t just make headlines for its groundbreaking electric vehicles or its ambitious space ventures under Musk’s SpaceX. It also raised eyebrows for its fiscal gymnastics—accumulating $4.4 billion in earnings while its top five executives received a staggering $2.5 billion in compensation.

This revelation becomes even more startling considering that during this period, Tesla paid no federal income taxes. Instead, the company received $1 million in refunds from the government.

Elon Musk, Tesla’s CEO and the face behind this financial enigma has been a subject of public fascination and scrutiny. With a net worth reported by Forbes to be $207.9 billion at the beginning of March 2024, Musk’s financial strategies have prompted discussions on the ethical dimensions of wealth accumulation and tax responsibility.

A Broader Trend of Tax Avoidance

Tesla’s case is not an isolated incident. The study, conducted by The Institute for Policy Studies and Americans for Tax Fairness, highlights a broader trend among major US companies.

It found that 35 corporations paid more to their top executives than they did in federal income taxes over the same five-year period. Collectively, these companies enjoyed $9.5 billion in executive payouts while receiving $1.8 billion in tax refunds.

Among these, 18 reported substantial profits without contributing to federal income taxes, with almost all receiving refunds.

The report names other significant players like T-Mobile, Netflix, and Ford Motor Company, each with its unique story of tax management and executive compensation. For instance, T-Mobile’s $17.9 billion earnings led to $675 million in executive payouts and $80 million in tax refunds, with the company heavily investing in lobbying for favorable tax conditions.

This is another example of why in house Republicans wanted so badly to block the funding to hire more IRS agents! Need to lower the deficit? Start collecting the YEARS of unpaid taxes that the countries wealthiest are not paying 🤬 https://t.co/pbPCU8iLRw

— Jody (@JodyFitzwater) March 14, 2024

The Debate on Fair Taxation

This situation fuels the ongoing debate about corporate taxation and the disparities in tax responsibilities between corporations and individuals. With companies like Tesla and Netflix navigating the tax code to minimize obligations—Netflix paid just 1.6% of its $15.1 billion earnings in taxes—the discussion centers on the fairness of the current tax system and the role of corporations in society.

Critics argue that the statutory rate of 21% for federal income tax when compared to these figures, highlights a significant imbalance. The findings urge a reevaluation of tax policies to ensure that companies with substantial profits contribute their fair share to the national coffers, supporting public services and infrastructure from which they also benefit.

Looking Ahead: Innovation vs. Fiscal Responsibility

Tesla’s story is emblematic of a modern economic paradox: how to balance the drive for innovation and growth with fiscal responsibility and equity. As society stands at the crossroads of technological advancement and social justice, the conversation around corporate taxes and executive compensation is more relevant than ever.

As we move forward, the challenge for policymakers, corporations, and the public will be to navigate these complex financial landscapes with an eye toward fairness, transparency, and accountability. The goal? To ensure that the engines of innovation also contribute to the building of a more equitable society.