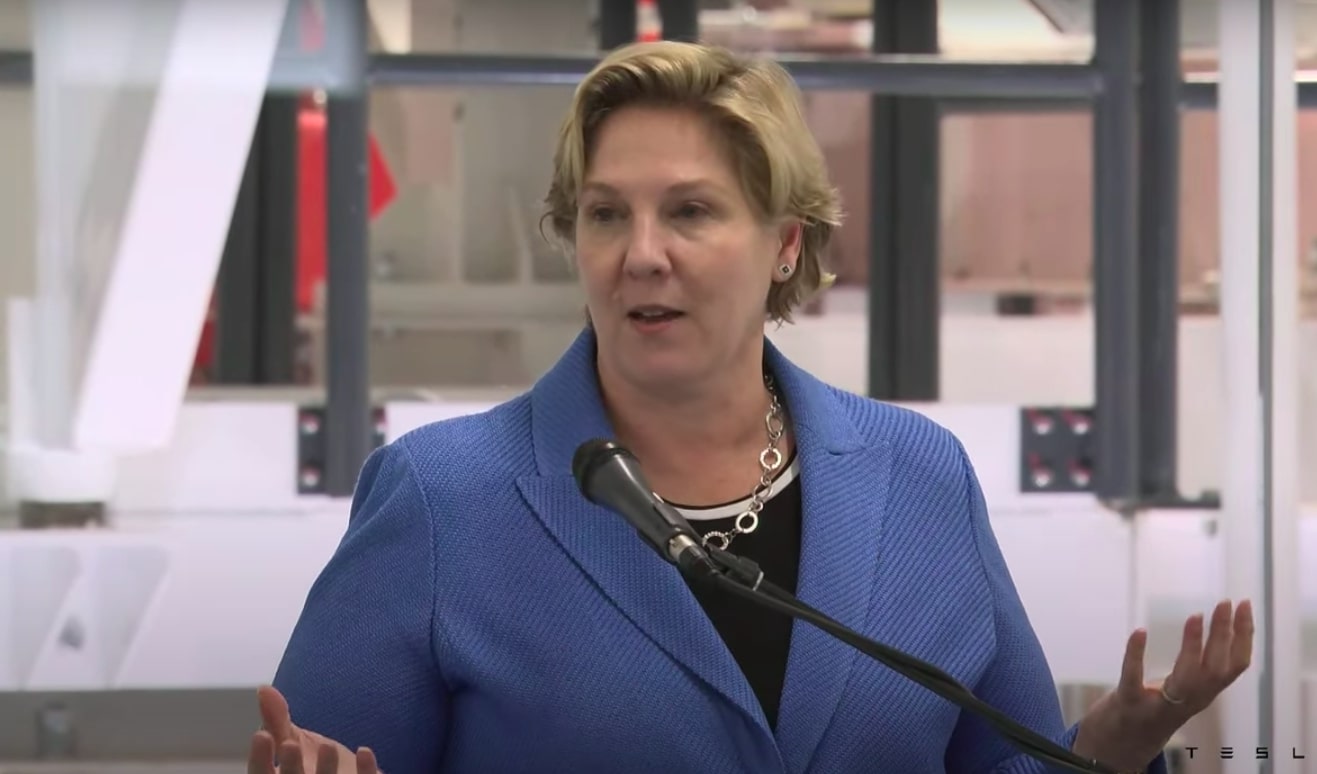

In a strategic move by Tesla Chairwoman Robyn Denholm, the electric vehicle powerhouse witnessed the sale of $17.3 million worth of its shares, as revealed by a recent filing. This transaction marks a cumulative sale of more than $50 million by Denholm in 2024 alone.

Denholm, who ascended to Tesla’s leadership as chairman after a tenure as an independent director starting in 2014, utilized a 10b5-1 trading program initiated last October to execute these sales.

Strategic Sales Amidst Organizational Challenges

Despite her significant sales, Denholm retains a major portion of her Tesla holdings, amounting to approximately 1.66 million shares as of last year’s end. Her actions align with those of other company executives, such as former Senior Vice President Drew Baglino, who divested shares worth around $181.5 million following his April resignation.

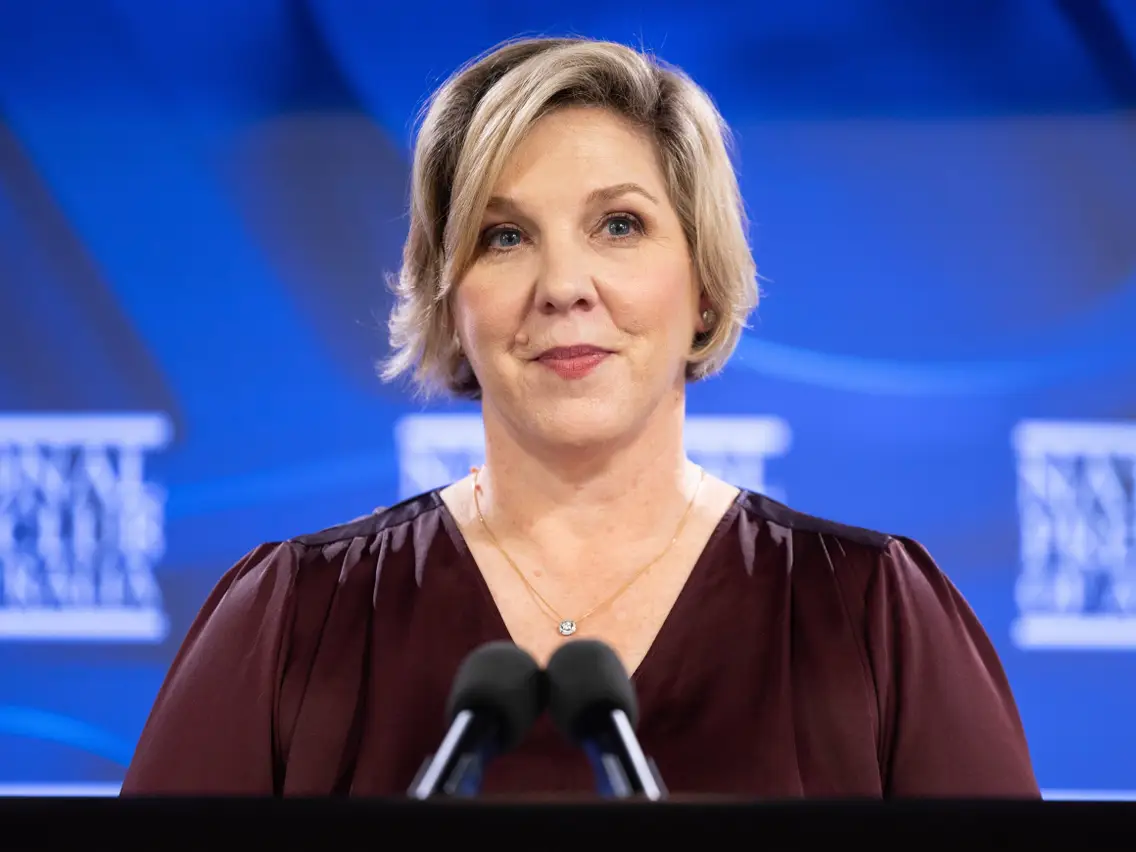

Kathleen Wilson-Thompson, a member of the company’s board of directors, also devised a trading strategy that is comparable to this one, intending to sell up to 280,000 shares by the beginning of 2025.

The EV company’s stock performance has notably declined, dropping 26% this year, which aligns with a broader narrative of increased competition and dampening demand for its vehicles. The company has also reported a decrease in first-quarter deliveries, further fueling market hesitations.

A Focus Shift to Autonomous Future

Amid these financial maneuvers and market challenges, The company’s CEO Elon Musk has been steering the company’s focus toward its autonomous driving technology.

During a recent earnings call, Musk emphasized the importance of this sector, suggesting that skeptics of the company’s potential for autonomy might reconsider their investments. He stated, “If somebody doesn’t believe Tesla’s going to solve autonomy, I think they should not be an investor in the company.”

The still Chairman of Tesla’s Board of Directors shows strong believe in the future of Tesla and in the capacity of Elon Musk to turn things around:

CNBC – Tesla Chairwoman Robyn Denholm has sold over $50 million worth of stock in 2024

Tesla Chairwoman Robyn Denholm sold $17.3…

— Andreas West (@A4XRBJ1) May 7, 2024

The Backdrop of Denholm’s Tenure

Robyn Denholm‘s journey with Tesla has been marked by notable milestones and challenges. She took over the chairmanship from Elon Musk in November 2018 following an SEC agreement that temporarily required Musk to step down.

This transition occurred in the aftermath of Musk’s controversial tweets about potentially privatizing Tesla at $420 per share, a statement that had stirred significant market volatility.

Her leadership tenure has also seen her embroiled in high-profile legal challenges, including the Tornetta vs. Musk lawsuit, which criticized the 2018 CEO pay plan as excessively influenced by Musk’s position. Despite these controversies, Denholm has been a crucial part of Tesla’s strategic committees, influencing major corporate decisions.

Tesla’s Restructuring and Future Outlook

As Tesla navigates through its current economic slump, with a visible increase in inventory and a decline in quarterly revenues and net income, Denholm and Musk are rallying shareholders to support various proxy proposals.

These include a contentious plan to reinstate Musk’s previously invalidated compensation package, which could significantly impact his holdings and the company’s financial strategy.

The company’s approach to downsizing, described by Musk as a “pruning exercise,” aims to refine its operational efficiency without compromising critical aspects of its business.

As Tesla continues to innovate and push for a dominant position in the electric vehicle and autonomous driving markets, the strategic decisions of its leaders, including those of Denholm, will be pivotal in shaping its trajectory through these tumultuous times.

In the realm of technology and automotive sectors, Tesla remains a key player to watch, as it balances innovation with the challenges of market dynamics and internal governance.