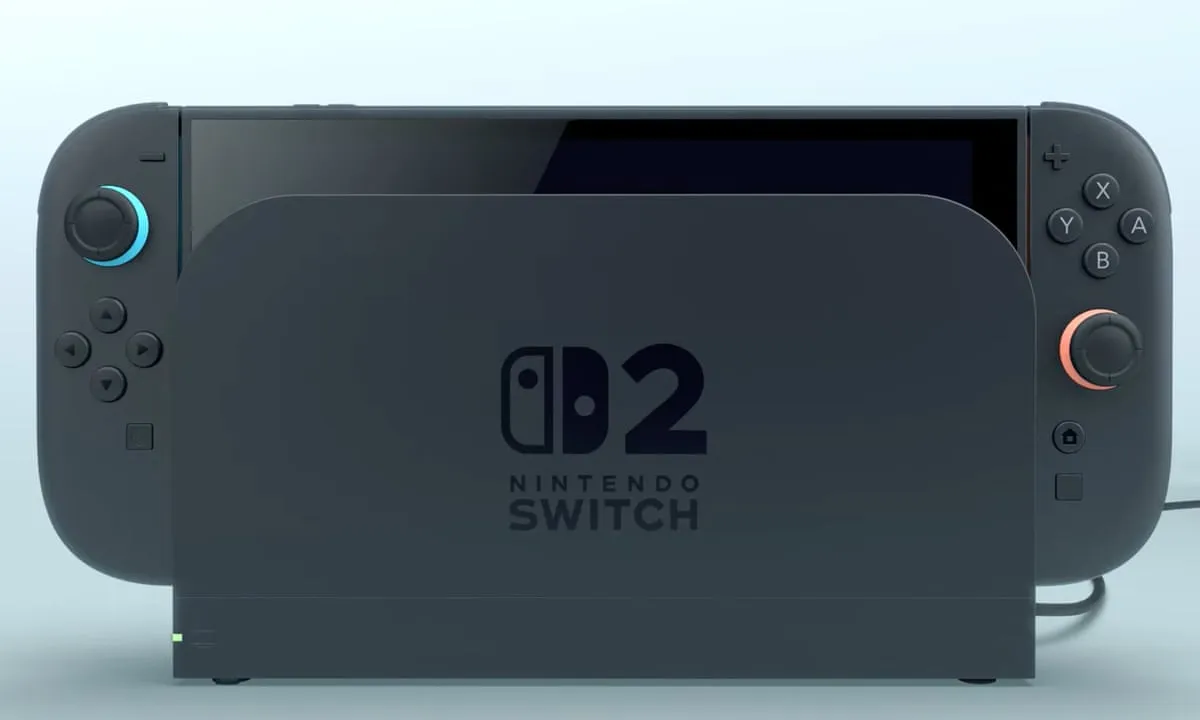

As Nintendo gears up for the highly anticipated release of its Switch 2 console on June 5, 2025, a sudden shift in US trade policy offers a critical advantage. The 90-day pause on some of the most aggressive US tariffs in a century, initiated by former President Trump’s administration, comes at a pivotal moment for the gaming giant. This unexpected break in the tariff escalation gives Nintendo a chance to bolster its shipments, stabilize pricing, and streamline its production process ahead of the much-awaited console’s launch.

For Nintendo, a company that derives over a third of its sales from the US market, this reprieve provides a moment of relief. The pause specifically impacts tariffs on electronics, including gaming consoles like the Switch 2, allowing the company to maintain pricing and avoid major delays. Without this tariff break, Nintendo’s operations would have faced significant pressure. The 46% tariff previously imposed on units assembled in Vietnam would have severely impacted the retail price of the Switch 2. Instead, the tariff has been reduced to a 10% universal rate, creating a valuable window for Nintendo to prepare for the console’s rollout.

Shifting Production and Market Strategy

Nintendo’s reliance on Vietnam as a key production hub for the Switch 2 has been well-documented, with approximately a third of the new consoles set to be assembled there. Without the tariff reprieve, those units would have been subject to the higher levy, making it difficult for Nintendo to keep its pricing competitive in the US market. However, with the tariffs on most countries paused, the company is able to allocate more resources to US-bound shipments, aiming to fill as many orders as possible within the next three months.

The tariff situation had forced Nintendo to delay pre-orders in the US, offering the company a bit of extra time to navigate the economic and logistical hurdles that could otherwise disrupt its launch. Nintendo’s initial approach to releasing the Switch 2 has been cautious, with its global strategy focusing on ensuring that the consoles reach loyal gamers before they fall into the hands of scalpers. For example, the company has targeted regions like the UK for early orders, prioritizing those with active Switch Online memberships and established gaming histories.

Bernstein analyst Robin Zhu weighed in on the financial impact, stating, “If the tariffs stay at 10%, Nintendo probably keeps pricing at $450 and just takes the hit on margin. At 46% Vietnam tariffs, I expected them to raise by $50 to $100.” This means that the pause in tariffs not only offers relief in terms of shipping logistics but also prevents a significant price increase that could have hurt the console’s chances of success in an already competitive market.

The Role of the Switch 2 in Nintendo’s Long-Term Strategy

Beyond the immediate financial implications, the Switch 2 holds substantial strategic value for Nintendo, marking a critical moment in its long-term plans. While the company has expanded its reach through various channels like film, merchandise, and theme parks, the success of its gaming platform remains the cornerstone of its business. As Nintendo diversifies into new areas, the Switch 2 is set to be the centerpiece, carrying beloved franchises like “Mario Kart” and “The Legend of Zelda” into the next generation of gaming.

Shares in the Kyoto-based company surged 10% after the announcement of the tariff break, underscoring the importance of a smooth launch for the Switch 2. The console is expected to lead the charge for Nintendo’s efforts to tap into its vast library of intellectual properties, with the Switch 2 serving as the key gateway for new content and experiences. The pressure is immense, as Nintendo has no “Plan B” if the Switch 2 doesn’t meet expectations. Analyst Hideki Yasuda of Toyo Securities pointed out that, despite the lowered tariff, the Switch 2’s bill of materials remains around $400, meaning that Nintendo could still sell the consoles at a loss in the US and absorb the costs if necessary.

An Uncertain Future for Nintendo’s Competitors

While Nintendo may have gained a temporary reprieve, its competitors face their own challenges. The Trump-era tariff war continues to affect the broader electronics industry, with companies like Sony Group Corp. feeling the strain. Sony’s PlayStation 5, which has struggled with supply chain issues of its own, faces a similar dilemma, as much of its production is based in China. With US tariffs on Chinese imports soaring to 125%, it’s expected that Sony will soon be forced to raise prices for its consoles in the US market, further intensifying the competition.

As Nintendo moves forward with its launch plans, it will continue to keep a close eye on the evolving trade landscape. The next few months could be crucial in determining whether the Switch 2 can live up to the high expectations set by Nintendo and its fanbase. While the company is well-positioned to capitalize on this 90-day tariff pause, the real test will come when the consoles hit the shelves.

The gaming world is watching closely to see if Nintendo can once again disrupt the industry with its innovative technology and beloved gaming franchises. As it stands, the Switch 2 is more than just a console; it represents the future of Nintendo’s ambitious global vision.