Philips, the renowned Dutch medical device maker, has recently announced a landmark $1.1 billion settlement in the United States, resolving lawsuits related to its DreamStation sleep apnea machines. This development comes as a significant turn in the company’s fortunes, particularly after a tumultuous period marked by recalls and legal challenges.

A Much-Anticipated Relief for Philips and Its Shareholders

The settlement, which Philips reached without admitting any fault or liability, has not only relieved the company of the ongoing uncertainty tied to litigation but also surpassed the expectations of shareholders and analysts. The news prompted a dramatic surge in Philips’ stock, which climbed over 33 percent on the Amsterdam stock exchange, signaling a robust vote of confidence from the market.

Analysts from Jefferies investment firm have described the settlement as “much milder than feared” and a decisive step towards ending litigation uncertainty. This sentiment reflects a broader market consensus that Philips is now poised to stabilize and refocus on its core business areas without the overhang of legal disputes.

Strategic Moves to Rebuild Trust and Ensure Patient Safety

In response to the crisis, the Company took decisive steps to halt new sales of the DreamStation machines in the U.S. and initiated a comprehensive recall. The company’s CEO, Roy Jakobs, emphasized Philips’ commitment to patient safety and quality, stating, “We have taken important steps in further resolving the consequences of the Respironics recall.”

Philips reported that the remediation of the sleep therapy devices is nearly complete, with tests showing that their use is not expected to cause appreciable harm to health. Jakobs expressed regret over the concern caused to patients but highlighted the settlement as a “significant milestone” providing clarity on the path forward.

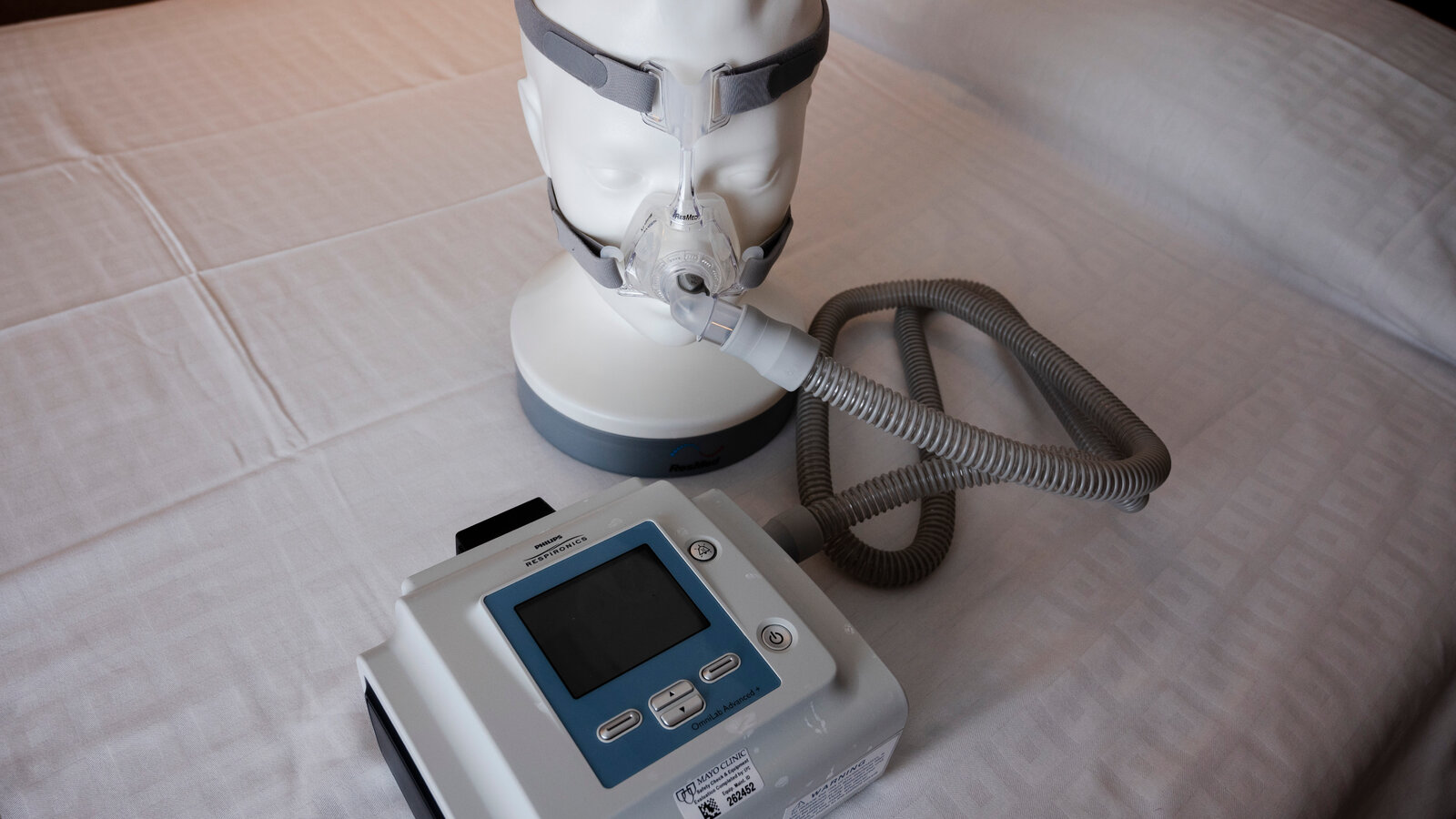

The settlement comes after a yearslong legal battle concerning 15 million recalled DreamStation CPAP and other respiration machines. https://t.co/E9yc7DZGF8

— CarlsbadCurrentArgus (@CCurrentArgus) April 30, 2024

Financial Repercussions and Future Outlook

Despite the positive reception to the settlement, Philips has faced financial hurdles, including substantial losses. The company posted a loss of 824 million euros in the first quarter of this year and had previously reported annual losses of 463 million euros for 2023. However, the settlement payments, expected to be made in 2025, will be funded through cash flow generation, demonstrating Philips’ strategic planning in financial management.

Additionally, the Company has secured an agreement with insurers, receiving 540 million euros to cover claims related to the Respironics recall. This financial backing further bolsters Philips’ position as it seeks to move past the litigation phase.

Conclusion: A New Chapter with Continued Vigilance

While today marks a pivotal point for Philips, with the most significant litigation cases put to rest, the journey ahead remains filled with cautious optimism. As Jakobs remarked, the settlement does not resolve everything, but it allows the company to focus on innovation and growth while continuing to manage any remaining legal risks. The company DreamStation settlement not only closes a challenging chapter for the company but also serves as a case study in managing corporate crises effectively. As company turns the page, its focus on rebuilding trust and ensuring the safety of its products will be crucial in shaping its future in the competitive medical device industry.