On January 29, following an unannounced update in Apple’s iOS 18.3, Bloomberg broke the news that Starlink’s beta testing would extend to certain iPhone users in the U.S. This development led to a significant downturn in the stocks of satellite communication companies. Shares of Globalstar plummeted nearly 18%, while AST SpaceMobile fell by 12%. Canada’s MDA also saw a drop of over 9% in its stock price.

Globalstar, in particular, has been a key player in this arena, thanks to a robust partnership with Apple that enables enhanced connectivity beyond traditional cellular reach. Unlike its counterparts, Globalstar uses its Mobile Satellite Services (MSS) spectrum licenses independently of cellular networks.

Adam Rhodes, a senior telecoms analyst at Octus, commented on the market’s reaction: “Today’s price action in Globalstar and satellite manufacturer MDA suggest a real investor fear that SpaceX could disintermediate the Apple-Globalstar partnership.” However, he also noted, “There is room for both services. We do not anticipate that Apple views the T-Mobile-Starlink service as a replacement for the Globalstar MSS network.”

Strategic Moves and Market Dynamics

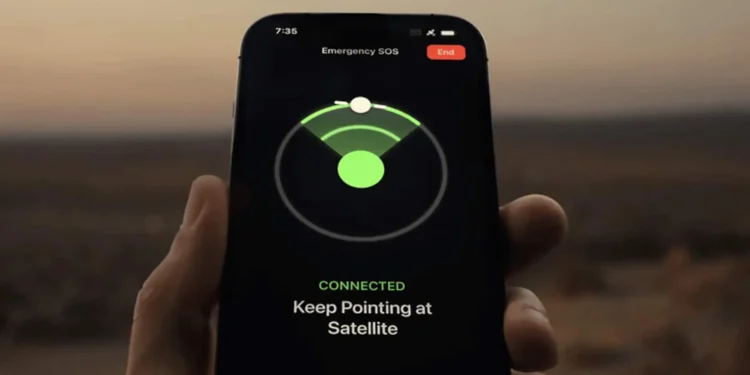

Starlink’s initial beta service offers basic connectivity options like SOS and texting, mirroring the existing features provided by Globalstar on iPhones. The expansion of this service and broader regulatory approvals are pending, but the potential for growth is immense.

Last year, Globalstar disclosed Apple’s commitment to inject $1.7 billion into a new satellite constellation, aiming to boost space-based communications for iPhones. This move underscores Apple’s strategy to diversify its connectivity options and secure a leading edge in satellite communications.

Mike Crawford, an analyst from B. Riley, emphasized Apple’s deep investment in Globalstar, which includes binding contracts extending into the next decade. These agreements not only guarantee recurring service revenues but also cover 95% of capital expenditures for new satellites.

“Apple will reap vast utility from this partnership,” Crawford said. “Regardless, Apple is contractually committed to recurring wholesale service revenues and significant capex reimbursements.”

Regulatory and Competitive Landscape

As SpaceX continues to deploy Starlink satellites equipped for direct-to-smartphone communications, the competitive landscape is evolving. Crawford pointed out that SpaceX needs to either modify its current satellite designs or obtain FCC approval for specific power adjustments to enhance service capabilities. In contrast, AST SpaceMobile’s existing satellites already meet the FCC’s regulatory standards, giving them an early advantage.

AST SpaceMobile recently gained Special Temporary Authorization from the FCC to conduct beta tests with AT&T, following the successful deployment of its BlueBird satellites. Vodafone also marked a milestone with its first-ever video call over satellite on January 29, using AST SpaceMobile technology in an area devoid of terrestrial mobile coverage.

The integration of Starlink into Apple’s ecosystem marks a significant step forward in direct-to-smartphone satellite communications but highlights an evolving market where no single player is likely to dominate. As these technologies develop, the potential for multiple successful platforms grows, offering consumers unprecedented connectivity options, no matter their location.

This strategic expansion into satellite communications not only diversifies Apple’s service offerings but also promises to reshape the landscape of mobile connectivity. As companies continue to innovate and regulatory frameworks evolve, the race for satellite connectivity supremacy is just beginning, and it’s clear that the sky is no longer the limit.