In a significant regulatory action, the Consumer Financial Protection Bureau (CFPB) has slapped Chime with a hefty $4.55 million fine for failing to promptly refund customers upon account closure. This decision underscores the challenges within the fintech sector, particularly concerning consumer rights and corporate compliance.

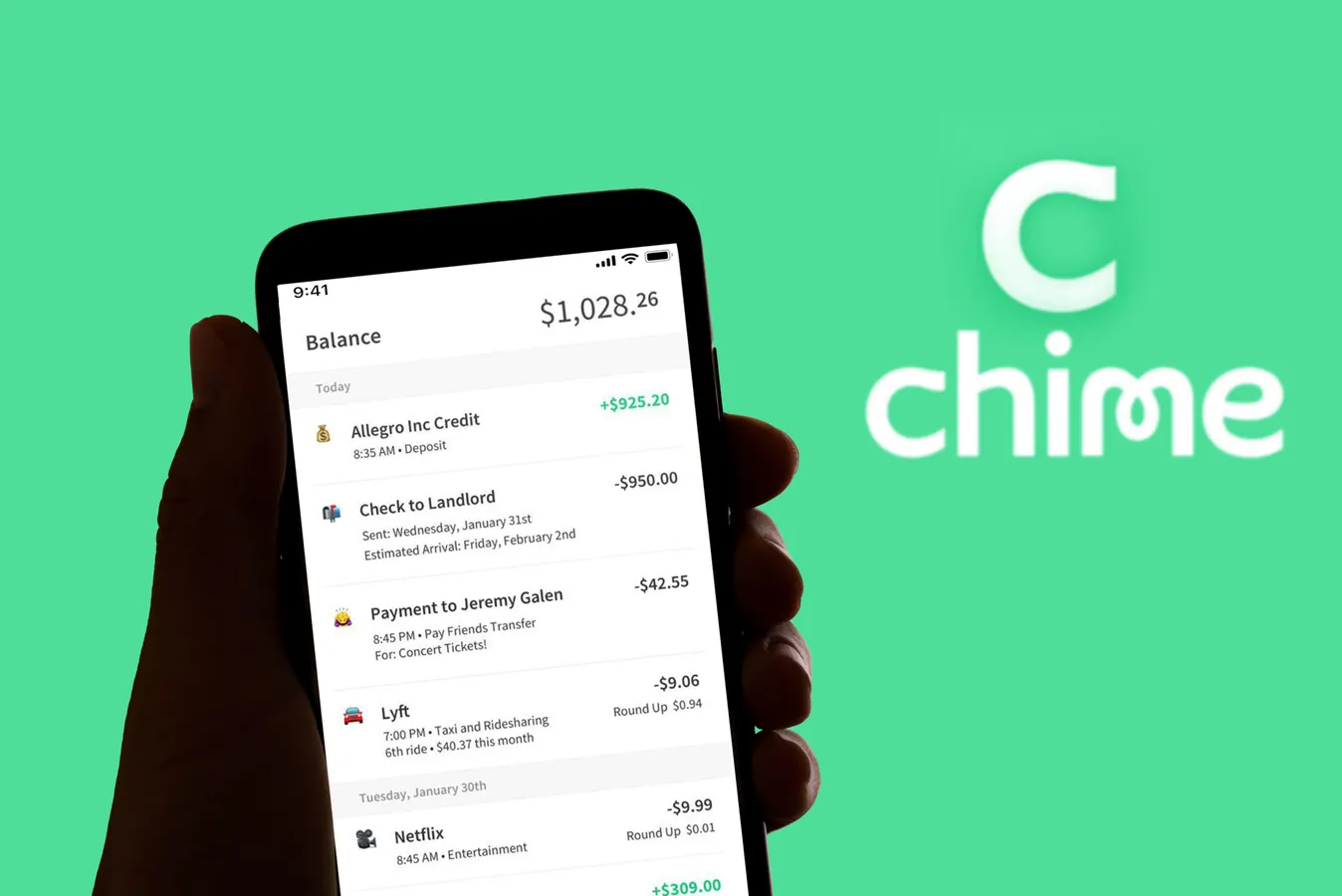

Chime, a leading online banking entity that collaborates with traditional banks to offer innovative financial services, found itself in hot water as thousands of its customers faced undue delays in receiving their account balances. Despite Chime’s policy promising a 14-day refund period, many customers reported waiting up to 90 days to access their funds, a misstep that did not go unnoticed by the CFPB.

“Chime’s customers had to wait weeks or months for access to their own money and were forced to use alternative funds to cover their essential expenses,” stated CFPB Director Rohit Chopra. This delay not only compromised customer trust but also highlighted potential vulnerabilities in fintech operations that prioritize rapid growth over user protection.

The Root of the Issue

The origins of these delays were traced back to what Chime referred to as a “configuration error” with one of their third-party vendors, an issue that persisted from 2020 to 2021. Chime has since addressed these technical setbacks and has agreed to adhere to the CFPB’s directives, emphasizing its commitment to improving the financial landscape for consumers.

“We share the Bureau’s goal to create a more competitive and accessible financial landscape that is good for everyday consumers,” the company commented following the settlement. This statement not only reflects a pledge to rectify past mistakes but also an intent to prevent future incidents.

Ensuring Future Compliance

In addition to the monetary fine, the CFPB has mandated that Chime update its refund processes as per the Consumer Financial Protection Act (CFPA) of 2010. Chime is now required to issue refunds within a more stringent timeframe and submit a detailed redress plan within 60 days to outline how affected consumers will be compensated.

For Chime customers, this means potential financial compensation if they were impacted by the delay. Those with minor account balances may receive a nominal compensation, while others could see a more significant reimbursement, ensuring that all affected parties are appropriately addressed.

#Chime Financial and #CFPB Reach Settlement on Delayed Balance Refunds#financialservices #fintech #banks #banking #payments #ecommerce #digitaltransformation #SeamlessDXB #Money2020EU #FintechLivehttps://t.co/GQ46GtOCeG pic.twitter.com/CZk6eEfDt8

— Saburai Consulting #FinTech #FinancialServices (@TonyMoroney3) May 10, 2024

Impact on Chime’s Business Model

Despite these challenges, Chime continues to be a significant player in the fintech industry, offering no-fee accounts and generating revenue through Visa card transactions. The company’s business model, built around simplifying banking for its users and removing traditional barriers like overdraft fees, remains attractive to consumers seeking user-friendly banking solutions. However, this regulatory hiccup serves as a crucial reminder for Chime and similar fintech firms that rapid innovation cannot come at the cost of customer service and legal compliance. As the industry continues to evolve, maintaining a balance between growth and user protection will be paramount.

Looking Ahead: Fintech and Consumer Protection

The CFPB’s action against Chime is part of a broader initiative to ensure that fintech companies adhere to the same regulatory standards as traditional banks. This case likely signals a growing scrutiny of fintech practices, potentially leading to more rigorous regulatory frameworks in the future.

For consumers, it’s a reminder of the importance of understanding the terms of service and the protections available when choosing a fintech company for their banking needs. As for the industry leader, the company’s willingness to rectify its mistakes and align with federal regulations may restore consumer confidence and set a precedent for accountability in the digital banking space. As fintech continues to redefine the financial landscape, the need for robust consumer protection mechanisms becomes increasingly evident. Through cases like this one, regulators are setting a clear standard: innovation must go hand in hand with integrity and accountability.