In a recent earnings call, Zhao Haijun, co-CEO of Semiconductor Manufacturing International Corporation (SMIC), China’s chip-making behemoth, articulated a pressing concern: the global semiconductor market may be heading towards an oversupply.

This announcement comes at a time when the industry is facing a fierce price war over less advanced chips within the Chinese market, escalating tensions and competitiveness.

Intensified Competition and Financial Strain

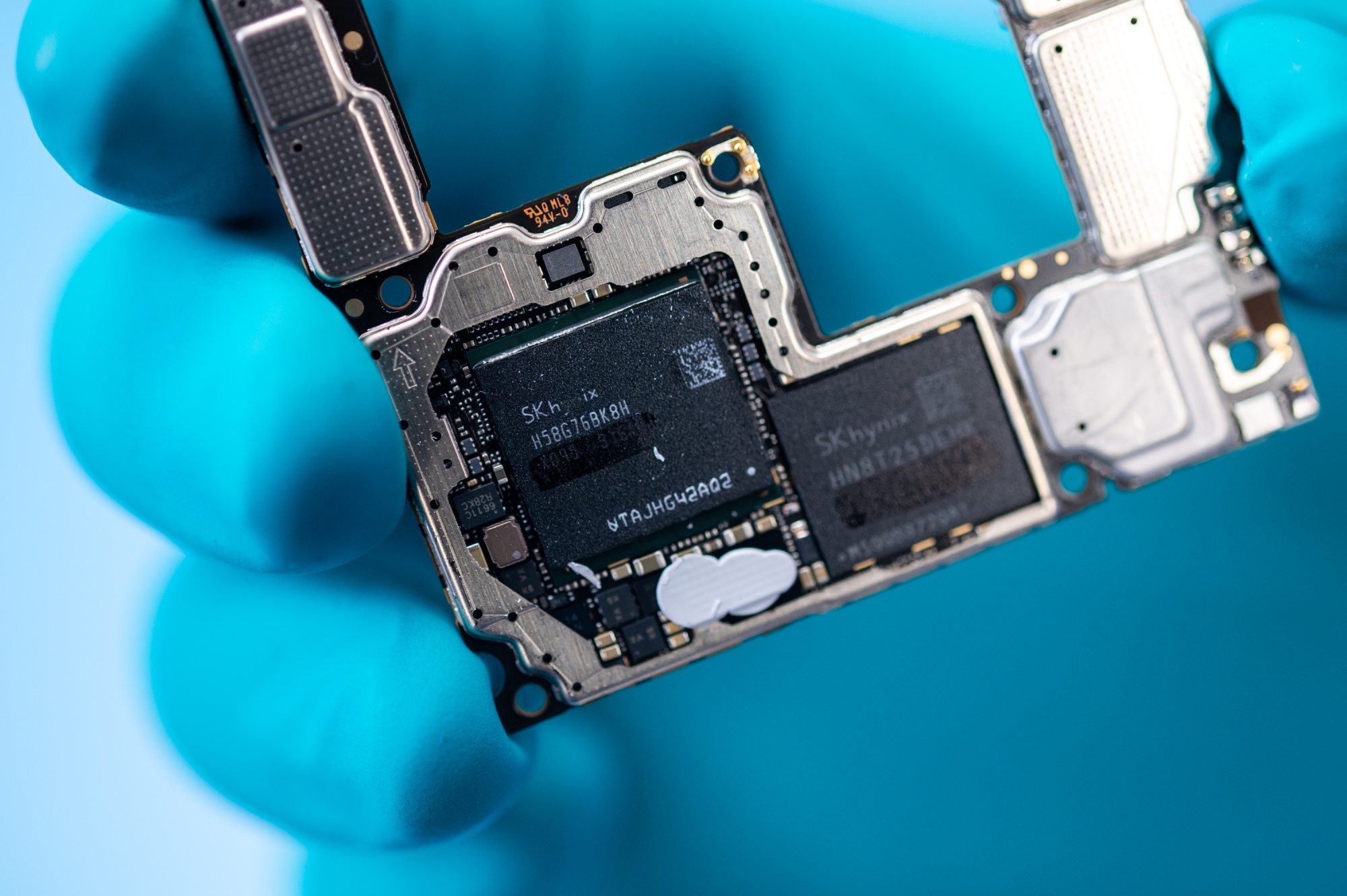

As one of the leading chip manufacturers in China, SMIC has observed a worrisome trend in the semiconductor industry. Despite a significant 19.7% year-on-year increase in revenue, reaching $1.75 billion, SMIC’s profit margins have dramatically declined.

The first quarter of the year saw a stark decrease in profits by 68.9%, plummeting to just $71.7 million, while the gross margin dropped to a historic low of 13.7%. This financial downturn is attributed to the aggressive production increases by Chinese chipmakers, aimed at supporting domestic tech giants like Huawei amid stringent U.S. export controls.

This push has inadvertently saturated the market, sparking intense price wars among competitors. Zhao Haijun highlighted the severe impact of this trend, noting that “orders worth tens of millions suddenly went to competitors,” underscoring the volatility and fierce rivalry in the sector.

SMIC issues caution amid intensifying chip oversupply fears globally. Profit dips sharply as competition heats up, with analysts warning of market saturation repercussions.https://t.co/coVkbeKEpi

— Tech Times (@TechTimes_News) May 10, 2024

Global Chip Production Surge and Market Challenges

The semiconductor industry is bracing for further challenges as numerous new chip manufacturing plants are set to commence operations in the coming months. This expansion could exacerbate the already precarious market conditions, with a surge in production potentially outstripping demand.

Data from SEMI predicts the initiation of 42 global chip projects in 2024 alone, with 18 of these based in China. This rapid increase in less advanced chip capacity, primarily driven by U.S. restrictions on advanced semiconductor equipment, is a strategic move by China to fortify its technological infrastructure.

However, the resultant market oversupply could lead to underutilization of new capacities and prolonged financial duress.

SMIC’s Strategic Response and Industry Outlook

Facing these daunting challenges, SMIC is doubling down on capacity construction and ramping up its research and development efforts. The company’s strategy aims to not only enhance its competitiveness but also secure a larger market share amid the turbulence.

However, achieving profitability under these circumstances remains a formidable challenge.

Looking forward, SMIC remains cautious. Although there is a tentative recovery in global demand, particularly from the Chinese smartphone sector, the overall industry outlook is tempered by the potential of new production capabilities overwhelming the market

Zhao emphasized the necessity for the industry to have sufficient time to integrate and utilize this new capacity effectively.

Navigating a Volatile Future

The semiconductor industry stands at a critical juncture. As SMIC and other industry players navigate these turbulent waters, the global market must brace for the implications of a potential chip oversupply.

Industry analysts and executives are closely monitoring these developments, aware that the decisions made today will shape the semiconductor landscape for years to come.