In a surprising turn of events, Comcast Corporation has once again surpassed Wall Street’s expectations with its latest quarterly earnings, proving its robust financial health even as the company navigates through a phase of losing broadband customers. Despite a challenging environment marked by intense competition and a shifting media landscape, Comcast has not only maintained but also slightly increased its revenue streams.

Broadband and Business Dynamics

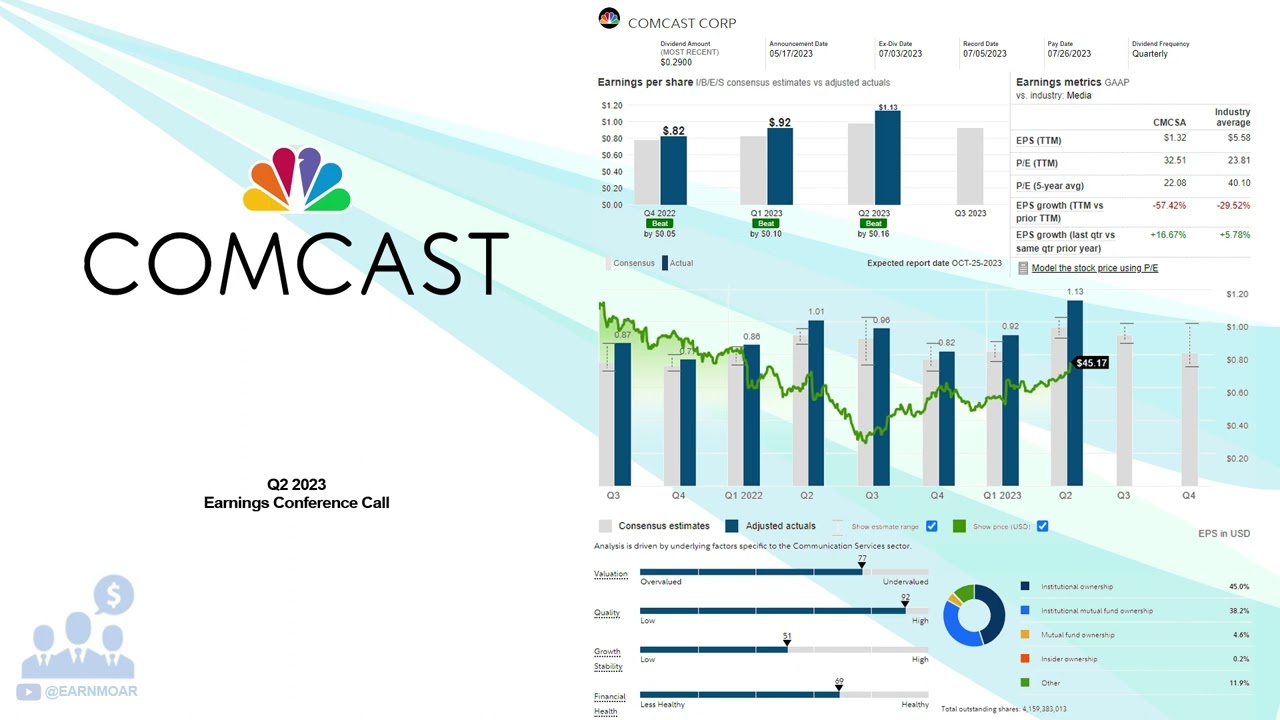

For the first quarter, Comcast reported earnings of $1.04 per share on an adjusted basis, comfortably beating the analysts’ expectations of 99 cents per share. Total revenue climbed to $30.06 billion, outpacing the forecast of $29.81 billion, reflecting a 1.2% increase compared to the same period last year. Notably, the rise was supported significantly by increased rates in the domestic broadband sector, although the segment did see a net loss of 65,000 customers during the quarter.

Despite these losses, Comcast’s adjusted EBITDA slightly declined by 0.6% to approximately $9.4 billion, indicating controlled operational costs amidst revenue adjustments. This performance underscores Comcast’s ability to manage profitability even as it faces subscriber churn in a highly competitive market.

Comcast beat first-quarter earnings expectations on Thursday as broadband drove revenue even as the company and its peers have seen customer growth slow.

Earnings per share: $1.04 adjusted vs. 99 cents expected

Revenue: $30.06 billion vs. $29.81 billion expected

Key points:… pic.twitter.com/ZClhpTj1Jr

— Mr. Seymour Duck 🦆 (@MrSeymourDuck) April 25, 2024

The Competitive Edge in Broadband

Telecom Giant’s broadband sector is at a pivotal point. The market dynamics are influenced by a slowdown in housing markets due to soaring interest rates and fierce competition from wireless providers like T-Mobile and Verizon. Addressing these challenges, Mike Cavanagh, president of Comcast, commented during the earnings call that the market remains “extremely competitive,” especially for cost-conscious customers.

In response to these market conditions, Comcast has innovatively launched ‘NOW’—a prepaid and month-to-month internet and phone plan aimed at offering low-cost, fixed wireless options. This initiative complements Comcast’s existing Internet Essentials program, which caters to low-income customers, showcasing the company’s strategy to diversify offerings and capture different market segments.

Diversification and Streaming Success

On the media front, Comcast continues to leverage its NBCUniversal segment, which encompasses a thriving film studio and the burgeoning streaming platform, Peacock. Universal Pictures has been producing hits like “Oppenheimer” and “The Holdovers,” which have significantly contributed to the segment’s revenue. The release of “Oppenheimer” on Peacock marked it as the most-watched movie in the streaming service’s history, proving the strategic success of exclusive releases.

Peacock itself has seen substantial growth, with the platform adding three million paid subscribers in the quarter, bringing its total to 34 million. The platform’s success is further bolstered by exclusive broadcasting rights, like the NFL Wild Card game, which have helped retain and attract new subscribers.

Financial Outlook and Future Projections

Despite these successes, Peacock faced an adjusted EBITDA loss of $639 million, although this was an improvement over the previous year. Company remains optimistic about narrowing these losses, particularly with upcoming events like the Olympics in Paris, which are expected to drive significant growth in viewership and advertising revenues.

Comcast’s Resilience Amid Challenges

Comcast’s latest earnings narrative is one of resilience and strategic adaptation. While the company faces ongoing challenges in its broadband and cable sectors, its ability to innovate in offerings and capitalize on its media and streaming segments suggests a robust pathway forward. As the market continues to evolve, Company agility in adjusting to consumer needs and market demands will be crucial to its sustained growth and market leadership.