Credit card fraud has long been a major pain point for both consumers and banks. The frustration of having a transaction declined because you forgot to notify your bank of your travel plans is something many of us have experienced.

However, recent advancements in technology have begun to turn the tide against fraudsters, leading to a significant improvement in the way banks handle security measures.

A Personal Encounter with Enhanced Security

A recent incident involving a fraudulent attempt to purchase a large order from Wingstop using my debit card highlighted the strides that banks have made in fraud detection.

Citibank, my card issuer, was able to decline the transaction instantly and alert me, allowing me to quickly take action by shutting down my card and ordering a new one. This rapid response was a stark contrast to my previous experiences and a testament to the improved capabilities of modern fraud detection systems.

During a trip to Buenos Aires in April, I was pleasantly surprised when none of my transactions were flagged as fraudulent, despite my concerns. JPMorgan Chase astutely handled a $200 charge for Botox without a hitch, showcasing an impressive understanding of my spending patterns, even though the purchase was not made with the same card used to book my flight.

QTXAI is the next gen artificial intelligence mining project with its unique AI features for fraud detection,

$0

QAI Coin, latest whitepaper

Total Supply : 50,000,000QAI

✅Join now!https://t.co/BOJi9XXvwE

Invite Code : Onizuka#QTXAI #QAI $QAI #QTXAICOIN @QTXAIofficial pic.twitter.com/XOGTVd7cAj— อู๊ดคับ – OudKub (@Oud_Kub) May 13, 2024

Behind the Scenes of Fraud Detection

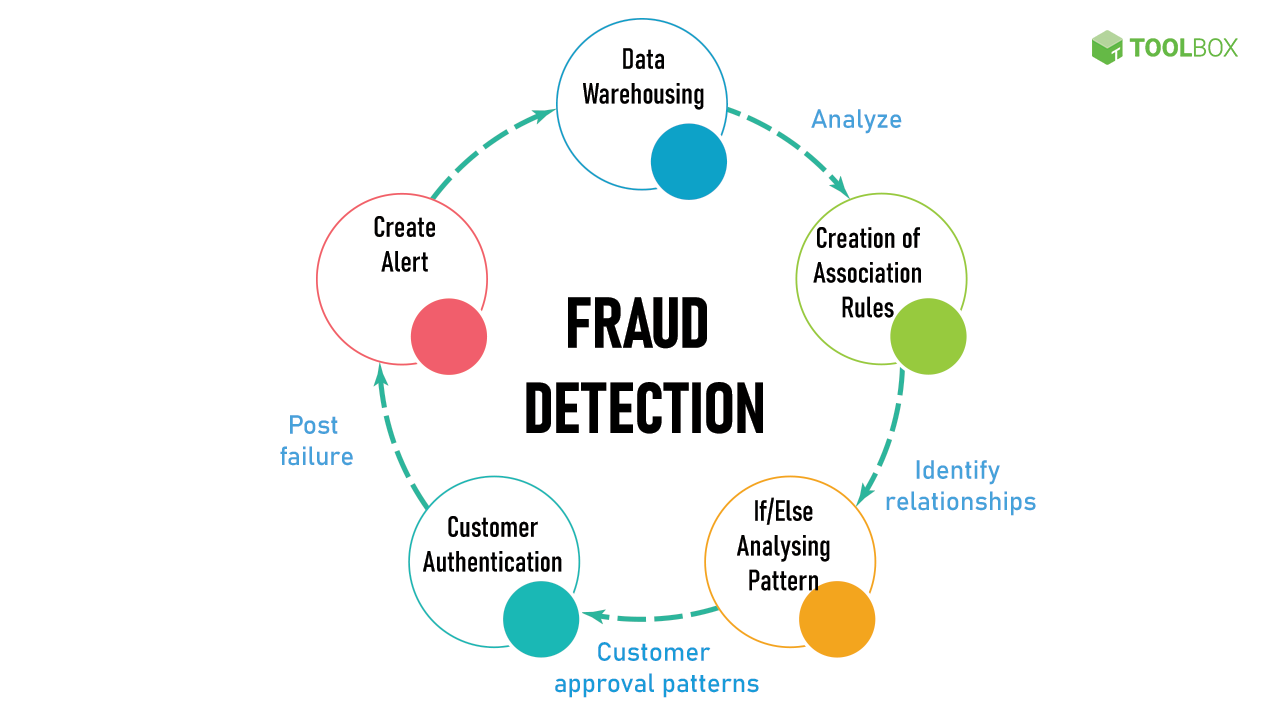

Curious about how these sophisticated systems work, I delved into the technology that underpins modern fraud prevention. Credit card companies and banks are increasingly utilizing machine learning, a subset of artificial intelligence that has been in development for years.

This technology enables them to analyze vast amounts of data to identify patterns and predict fraudulent transactions effectively.

Tina Eide, an executive vice president of global fraud risk at American Express, shed some light on the process. According to Eide, these systems are not just looking at individual transactions but are analyzing overall behavior patterns to identify anomalies.

This approach has allowed American Express to evaluate transactions worth over a trillion dollars each year, with increasing accuracy.

The Role of Data in Fraud Detection

Mike Lemberger, Visa’s regional risk officer for North America, emphasized the explosion in data points that each consumer generates through their credit card usage. From online shopping to digital wallet applications, these data points provide a rich tapestry of information that Visa uses to enhance its fraud detection algorithms.

The collaboration between banks and credit card companies is crucial in this regard. By sharing and analyzing data, they can create more accurate models to predict and prevent fraudulent activities. This partnership extends beyond individual companies to encompass the entire financial ecosystem, ensuring a unified front against fraud.

The Human Element in a Digital World

Despite the reliance on advanced algorithms, there is still a significant human element involved in fraud detection. Experts like Yann-Aël Le Borgne and Gianluca Bontempi from the Université Libre de Bruxelles point out that while machines can analyze countless features, the final interpretation often requires human insight.

This balance between machine efficiency and human judgment is crucial for maintaining the effectiveness of fraud prevention systems.

The Future of Credit Card Security

As technology continues to evolve, so too does the sophistication of fraud detection systems. Banks and credit card companies are not only working to improve the security of financial transactions but are also ensuring that these advancements do not compromise customer convenience or privacy.

While the threat of fraud is ever-present, the advancements in technology offer a promising outlook for the security of financial transactions. As we move forward, the collaboration between data scientists, technology, and the banking industry will be pivotal in shaping the future of fraud prevention.

The journey towards perfecting credit card security is ongoing, but the progress made thus far gives us many reasons to remain optimistic. Banks may not always be the subject of consumer praise, but in the realm of fraud prevention, they certainly deserve a resounding “Yay, banks!”