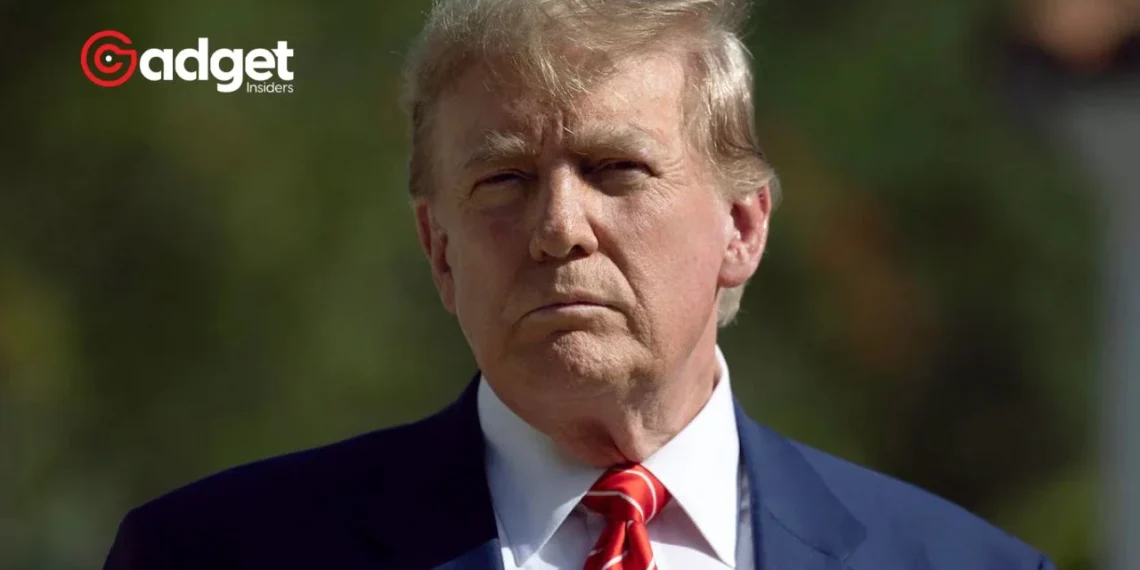

In a striking display of market dynamics and political allegiance, shares of Donald Trump’s social media company saw a significant uptick, climbing approximately 16% on their inaugural day of trading on the Nasdaq. This surge amplified the valuation of Donald Trump Media & Technology Group Corp.

It signaled a vibrant endorsement from a broad spectrum of investors, from ardent supporters to speculative traders seeking to leverage the former president’s enduring influence.

Donald Trump: The Initial Triumph and the Skeptic’s Perspective

With a closing price that marked a 16.1% increase, ending the day at $57.99 per share, the company’s market capitalization burgeoned to an impressive $7.85 billion.

However, beneath the immediate gains lies a tapestry of challenges and skepticism. Critics and analysts alike point to the volatile nature of meme stocks and the unpredictable trajectory of social media platforms, emphasizing the potential for significant downturns.

Riding the Wave of Support and Anticipation

Donald Trump Media’s entry into the stock market was not just a financial event but a rallying cry for supporters and investors who see value beyond the numbers. Enthusiasts on Truth Social, the company’s flagship platform, shared their excitement and commitment to bolstering the stock, reflecting a blend of political support and financial optimism.

The platform, launched amidst the exclusion of Donald Trump from major social media outlets, represents not just an alternative space for free expression but a strategic investment in the future of digital communication.

A Future Fraught with Uncertainty

Despite the initial success, the path ahead for Donald Trump Media is uncertain. The company’s financial disclosures reveal a challenging road, marked by significant losses and a modest revenue stream.

Trump’s social media company rises 16% in first day trading gains, but the stock price could fall by 95%, says an IPO expert https://t.co/lWrA6oX0ha

— B. Sargent Noble (@schpsych8) March 28, 2024

Donald Trump Media’s strategy, focusing on long-term growth over short-term metrics, underscores a commitment to carving out a niche in a crowded market. Yet, this approach also reflects the inherent risks of building a platform heavily reliant on a singular political figure’s popularity and the volatile nature of stock market speculation.

In conclusion, the debut of Donald Trump Media on the Nasdaq is a testament to the complex interplay between politics, technology, and market dynamics.

As the company navigates the challenges ahead, the broader implications for the digital landscape and political discourse remain to be seen, making this venture one of the most intriguing developments in the intersection of technology and politics.