In an era marked by soaring inflation and a pressing housing market crisis, California’s financial woes extend into another critical domain—auto loans. Recent findings from the California Policy Lab reveal a startling snapshot: approximately 8 million Californians are currently submerged in auto loan debt, averaging a staggering $24,900 per individual.

California: The Epicenter of Auto Debt

A 2023 report by WalletHub paints a concerning picture for the Golden State, pinpointing several Californian cities where auto loan debts are not just prevalent but rapidly increasing. Leading this list within the state are Fremont and Chula Vista, ranking third and fourth respectively nationwide.

Additional California cities like Anaheim and Bakersfield also feature prominently, landing in the top 20 of this dubious honor roll.

Cities like Winston-Salem, Scottsdale, and Miami top the nationwide list, but the spotlight remains on California, where economic pressures mount against a backdrop of high living costs.

Fremont’s Financial Burden

In Fremont, the burden of auto debt is palpable. WalletHub’s data indicates that the average resident grapples with a monthly auto loan payment of $559, carrying an average balance of $22,733—the fifth highest in the nation.

This financial strain is exacerbated by California’s notorious housing costs and general high cost of living, which deplete the cash reserves of many, leaving less available for substantial down payments.

The Deceptive Nature of Debt

Alex Beene, a financial literacy instructor, argues that while the numbers are high, they might not spell doom for everyone. “In cities like Scottsdale and Fremont, where income levels are generally above the national average, most residents can manage their debt without significant strain,” Beene explains.

However, he warns that other cities, particularly those in the southeastern U.S., might not be as fortunate. There, lower income levels combined with rising credit card debt could forecast a troubling economic future.

A Closer Look at Auto Debt Implications

Michael Ryan, a finance expert, suggests that the implications of rising auto debt are profound, particularly for those in regions with lower economic growth. “Car values might be increasing, but taking on hefty loans for depreciating assets can trap consumers in a cycle of debt that hampers their ability to invest in their future,” he cautions.

Ryan highlights that while some may handle the debt, the overall trend could lead to increased delinquencies and defaults, potentially destabilizing the broader economic landscape.

Looking Forward: Steering Clear of the Debt Quagmire

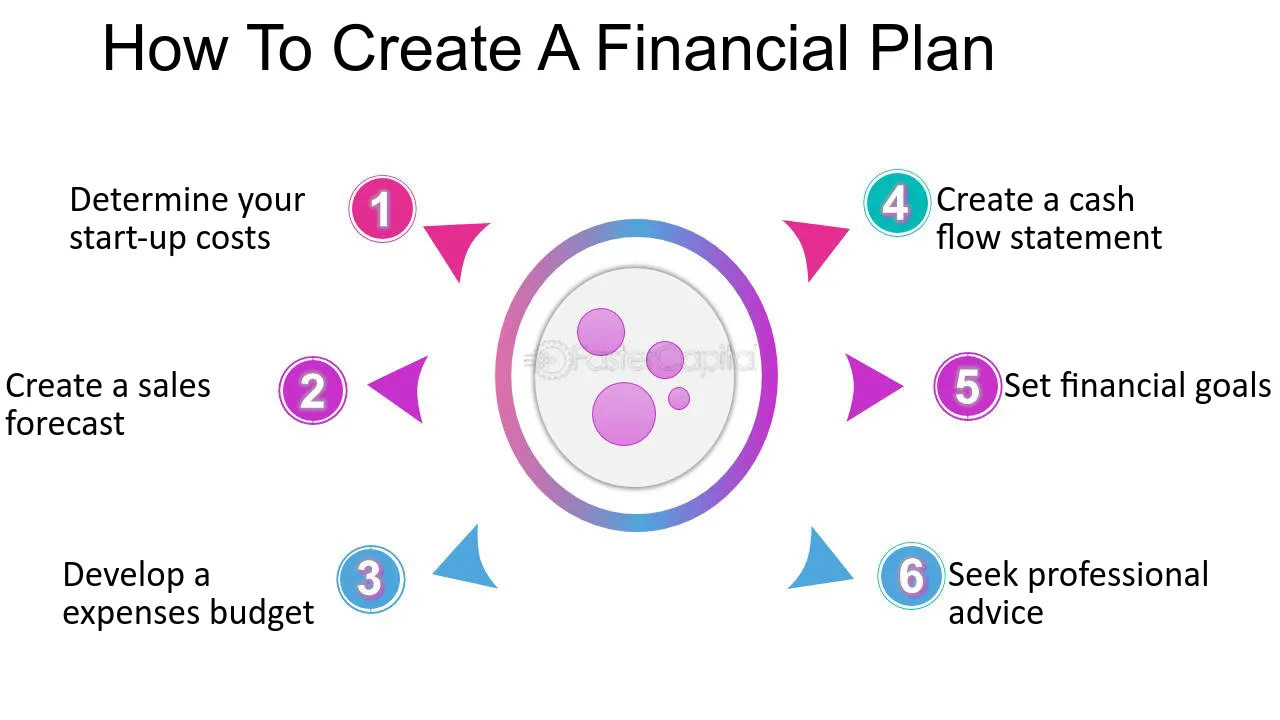

For Californians caught in the whirlwind of auto debt, the path forward involves careful financial planning. Strategies like making extra payments, setting up automatic payments, and refinancing loan terms can help mitigate the impact. However, as auto debt continues to climb, the broader implications for the state’s economic stability remain a looming question.

In the face of these challenges, understanding the nuances of auto loan debt and adopting proactive financial strategies is crucial for Californians striving to navigate the turbulent economic waters of today’s market.