As the Biden administration lays out its 2025 budget proposal, the implications for investors across the United States are becoming increasingly clear—and for some, concerning. The proposal includes a significant adjustment to capital gains taxes, which could see the rates for some Americans climbing to over 50% when combined with state taxes.

This move, marking the highest top capital gains tax in over a century, has sparked a wave of analysis and speculation regarding its potential effects on both personal finances and broader economic trends.

The Proposal at a Glance: A Significant Shift in Tax Policy

The heart of the new tax proposal is an increase in the long-term capital gains and qualified dividends tax rate to 44.6%. This rate would primarily impact individuals with taxable incomes exceeding $1 million and investment income over $400,000.

According to Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, while this might sound alarming, the increase applies under specific conditions set by the administration. Beene suggests that the impact might not be as drastic as it appears at first glance.

However, in states like California, New Jersey, Oregon, Minnesota, and New York, where state taxes are added to federal rates, the total tax on capital gains could exceed 50%. This includes a staggering 59% in California and slightly lower, yet substantial, rates in other mentioned states.

This scenario is likely to affect decisions made by investors, potentially leading to shifts in where people choose to live and invest their money.

Economic Implications: Investment and Inflation Concerns

Michael Ryan, a finance expert who runs michaelryanmoney.com, expressed concerns about the broader economic implications of such tax increases. He pointed out that higher taxes on capital gains could disincentivize investment, which is a key driver of economic growth.

Additionally, Ryan highlighted the potential for policymakers to allow inflation to increase, which could inadvertently boost tax revenues from gains calculated on inflated values.

The potential disappearance of a tax subsidy for crypto investors, which allowed them to claim losses on their investments against their tax liabilities, is another significant aspect of Biden’s proposal. This change could reshape the landscape of crypto investing, adding another layer of complexity for investors navigating the new tax regime.

“The Biden administration's proposed capital gains tax rate increase to 44% and the 25% tax on unrealized gains, if passed, will not only destroy the economy but punish the hardest working people in America and guarantee Trump the 2024 election.”

“I voted democrat most my life… pic.twitter.com/XP8w44MIwe

— Grant Cardone (@GrantCardone) April 27, 2024

The Response from States and Investors

The prospect of increased capital gains taxes has already triggered discussions about potential migration from high-tax states to more tax-friendly regions. This is particularly relevant in the era of remote work, where physical location is becoming less tied to employment.

States that might see an exodus of both people and businesses include California and New York, where the combination of high living costs and tax rates make other states more financially appealing.

Kevin Thompson, founder and CEO of 9i Capital Group, predicts that such changes could lead to a significant market selloff as investors rush to secure more favorable tax rates before the new policies take effect. Thompson’s view underscores the immediate impact of tax policy on investment behavior and market dynamics.

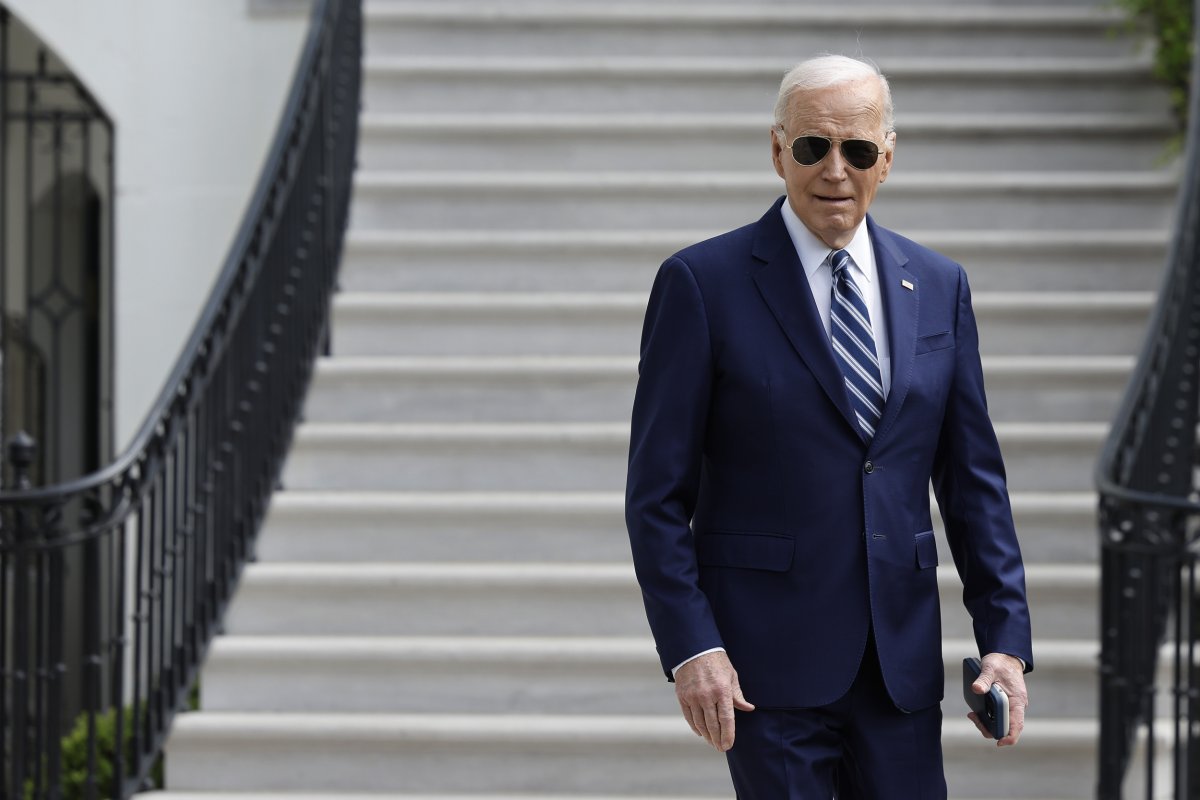

Joe Biden: A Delicate Balance

As the Biden administration’s budget proposal moves through the legislative process, the reactions from various sectors of the economy suggest that its final form and impact are still to be determined.

Financial experts and policymakers alike will need to tread carefully, balancing the need for increased revenue with the potential risks to economic stability and growth.

This unfolding scenario presents a complex puzzle for investors and policymakers, highlighting the delicate interplay between tax policy and economic behavior. As we move closer to 2025, the decisions made now will undoubtedly have long-term consequences for the financial landscape of the United States.