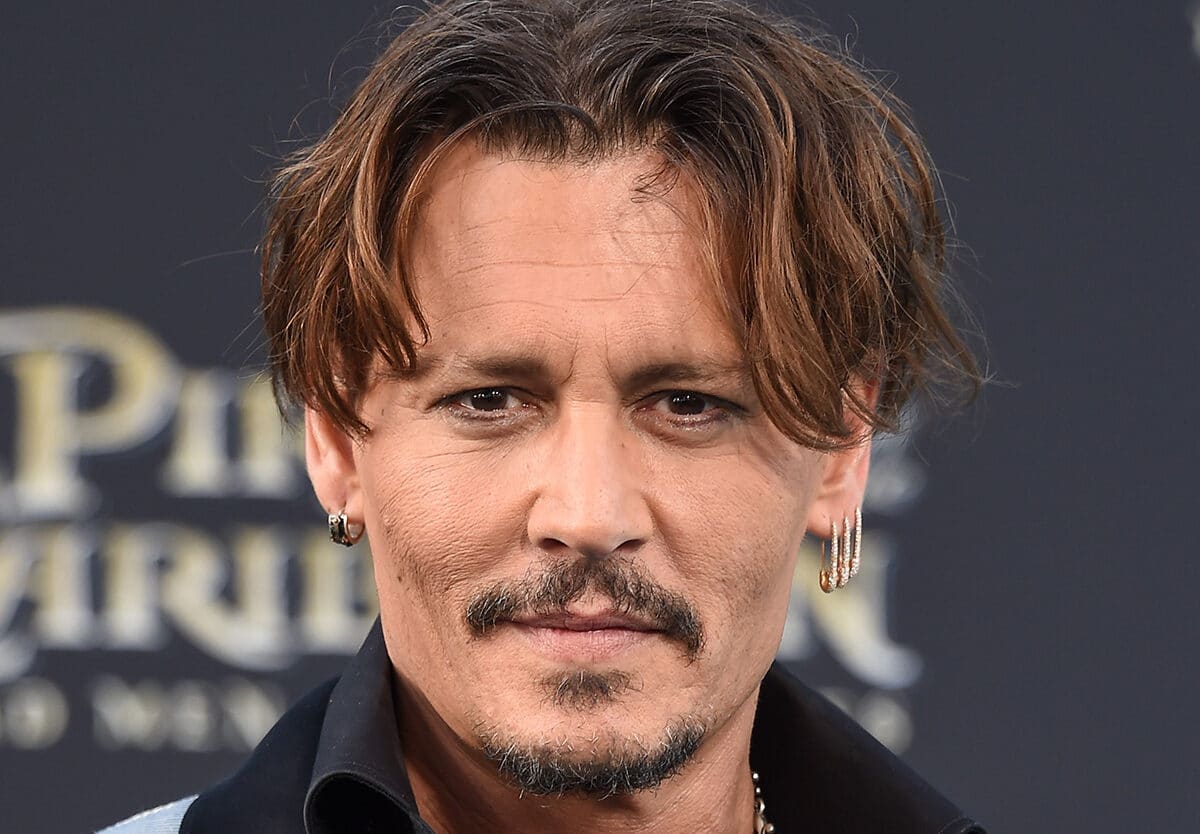

In a twist fit for the silver screen, Hollywood luminary Johnny Depp recently made headlines not for his on-screen antics but for a real-life financial rescue that highlights a broader American struggle. While Johnny Depp managed to safeguard his luxurious West Hollywood estates with a staggering $10 million lifeline, the narrative casts a stark contrast against a grim backdrop of widespread housing instability faced by millions.

Johnny Depp’s Decisive Action Amid Foreclosure Fears

Last year, the actor, renowned for his portrayal of Captain Jack Sparrow in the “Pirates of the Caribbean” series, found himself on the brink of losing his two iconic residences. To avert this disaster, Johnny Depp secured a substantial loan, effectively preventing the foreclosure of his properties.

This move, though not uncommon in celebrity circles, underscores a significant disparity between the economic capabilities of Hollywood’s elite and the average American homeowner.

The Wider Impact: Understanding Zombie Foreclosures

While Johnny Depp’s story ends in relief, the term “zombie foreclosure” paints a less fortunate picture for many. This term refers to homes that are effectively abandoned by owners who can no longer shoulder their mortgage burdens yet remain shackled to their property’s title.

According to ATTOM’s recent Vacant Property and Zombie Foreclosure Report, approximately 1.3 million residential properties in the U.S. were vacant in the second quarter of 2024, mirroring previous statistics.

Despite a 20.6% year-over-year decrease in such foreclosures, the persistence of this issue reveals a critical facet of the housing crisis. Zombie properties, once a more visible symptom of economic distress, now represent a dwindling yet poignant fraction of the national housing stock.

Insights from Industry Experts

Rob Barber, CEO of ATTOM, provides a nuanced perspective on the situation. “Predictions of a huge spike in foreclosures post-moratorium did not materialize. Instead, we’re seeing the reverse trend, with zombie properties becoming increasingly rare,” explains Barber.

However, he cautions that the U.S. housing market’s long-standing boom is showing signs of regression, which could precipitate a rise in foreclosures.

The Silver Lining: A Resilient Market

Despite recent downturns, the national median home value stands at $330,000, marking a slight decline yet still representing a 3% increase from the previous year. This ongoing appreciation in property values since 2012 has significantly elevated homeowner wealth. Notably, nearly 95% of homeowners with mortgages have amassed some equity, with almost half owning less than half the estimated value of their homes.

A Dual Narrative of Celebrity and Struggle

Johnny Depp’s successful navigation through potential financial ruin showcases both the advantages enjoyed by celebrities and the harsh realities that many others face. His story serves as a microcosm of the broader housing issues plaguing America, reflecting both the resilience and the ongoing challenges within the real estate market.

As the nation continues to grapple with these dual realities, the spotlight remains not only on those who escape hardship but also on the mechanisms that perpetuate it.