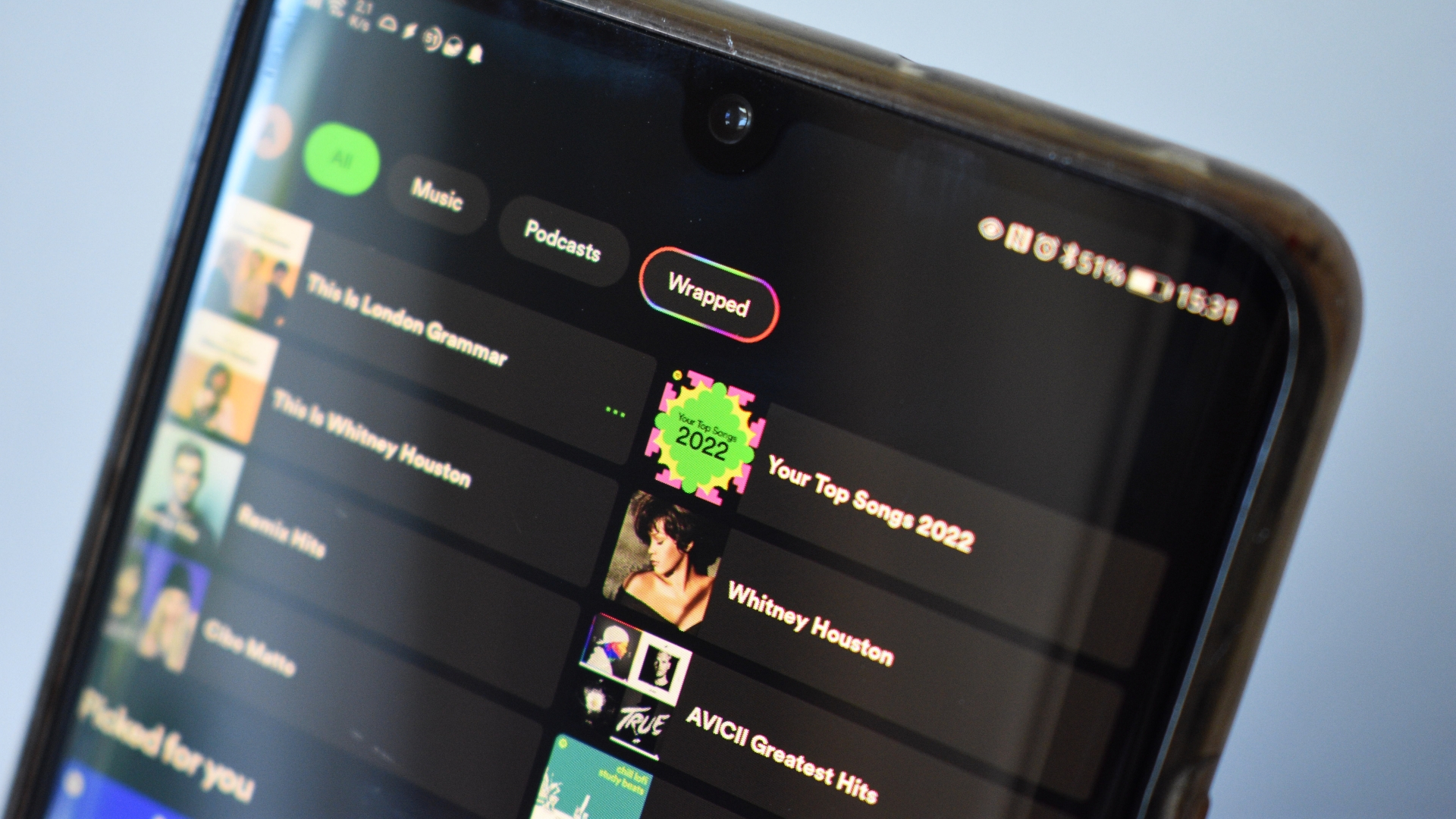

In a recent announcement that stirred significant attention, Spotify revealed plans to increase its subscription prices starting next month. This decision comes amidst a complex backdrop of financial challenges and strategic adjustments within the company. Daniel Ek, CEO, stated that the pricing adjustment aims to reflect the true value and sustainability of the company’s expansive audio streaming services. However, the move has sparked a variety of reactions among users and financial analysts, shaping a new narrative around Spotify’s future in the competitive streaming landscape.

A Closer Look at Spotify’s Financial Dynamics

Company’s journey through financial reformation has been marked by a series of bold steps, including significant layoffs and previous price increases. In December, the Stockholm-based streaming giant announced a reduction of approximately 1,500 positions as part of a cost-cutting initiative, which followed earlier job cuts throughout the year. These layoffs, while challenging, were deemed necessary by Ek to streamline operations and bolster the company’s financial health.

During the first-quarter earnings call, Ek highlighted the impact of these layoffs, acknowledging the operational disruptions they caused but also noting their necessity for strategic realignment. The company reported a robust free cash flow of €207 million ($221 million), although this was partially offset by severance costs. Despite these challenges, Spotify boasted a record-setting user growth in 2023, with 615 million Monthly Active Users (MAUs), surpassing even the most optimistic forecasts.

The Impact of Price Increases on Spotify’s Market Position

This is not the first time Spotify has adjusted its pricing strategy. The cost of a premium individual subscription will climb from $10.99 to $11.99 a month, with similar increases across other plan types. Such changes mirror earlier increments and reflect a broader strategy to enhance revenue streams. Notably, Wall Street has reacted positively to these developments. Benchmark, for instance, upgraded Spotify’s price target from $375 to $405, maintaining a buy rating on the stock.

Analysts from JPMorgan and Deutsche Bank echoed this optimism. JPMorgan revised its price target upward to $375 from $365, citing minimal anticipated impacts on subscriber churn and acquisition. Deutsche Bank’s Ben Black highlighted the potential for these price adjustments to significantly boost gross profits and margins, suggesting a solid upside for Spotify’s financial health moving forward.

Community Reactions and Future Outlook

Despite the strategic confidence expressed by Wall Street, some of its users expressed discontent on social platforms, criticizing the notion of costless content creation and questioning the long-term value of Spotify’s service. Ek responded to these concerns by clarifying his earlier statements, emphasizing his respect for the creativity and effort involved in producing lasting and meaningful works.

As Spotify navigates these turbulent waters, its ability to balance user satisfaction with financial necessities will be crucial. The company’s efforts to expand its service offerings, particularly in audiobooks, indicate a strategy aimed at diversifying content and enhancing user engagement. This approach, combined with a nuanced understanding of market dynamics and user expectations, will likely shape Spotify’s path forward in a highly competitive industry.

Overall, while the price increase might seem contentious to some, it is a reflection of broader industry trends and company’s strategic positioning. The coming months will be telling, as the company strives to maintain its growth trajectory and prove the sustainability of its business model amidst evolving market conditions.