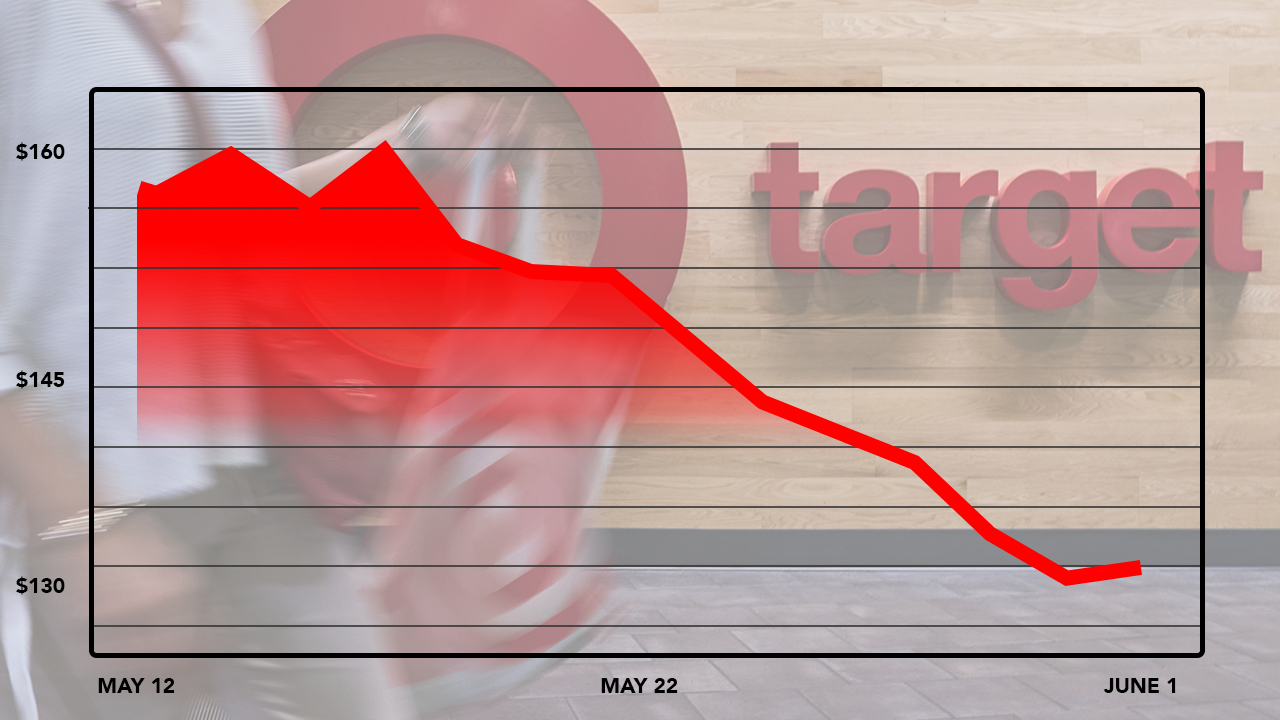

In a revealing glimpse into the retail world’s current tribulations, Target Corporation’s latest earnings snapshot has set off alarm bells. Despite ambitious efforts to entice customers with slashed prices and revamped loyalty programs, the retail giant’s financial results fell short of expectations, sparking a significant drop in its stock value.

This downturn signals a broader trend of consumer caution, particularly in the realms of discretionary spending and groceries, hinting at deeper economic undercurrents affecting retailers nationwide.

Financial Figures: A Closer Look

Target reported a slight miss in its expected earnings per share, coming in at $2.03 against the anticipated $2.06, as surveyed by analysts from LSEG. Although the company’s revenue hovered around the expected $24.53 billion, it marked a 3% decline from the previous year’s $25.32 billion. This quarter marks the first earnings miss since November 2022, illustrating a challenging fiscal landscape for the retailer.

The company’s net income also saw a slight dip, falling to $942 million from $950 million in the same quarter last year, highlighting the slender margins within which major retailers are currently operating. Despite these challenges, Target remains optimistic, maintaining its full-year forecast with expectations of a modest sales increase of up to 2% and adjusted earnings per share ranging from $8.60 to $9.60.

Strategic Responses to Economic Pressures

Brian Cornell, CEO of Target, emphasized the company’s focus on delivering value to its customers amidst these trying times. “We are seeing continued soft trends in discretionary categories,” Cornell noted, underlining the shift in consumer spending habits away from non-essential goods. In response, Target has aggressively cut prices on daily essentials such as milk, bread, and diapers in an attempt to draw in more customers and clear its shelves of slower-moving stock.

Moreover, Target’s leadership believes that the retailer is set for a rebound in the coming quarters. Christina Hennington, Chief Growth Officer, pointed out some positive trends, particularly in apparel, which saw a near 4% uptick from the previous quarter. “Our collaboration with Diane von Furstenberg and other unique items have driven significant traffic online and in stores, showing promising signs for our strategy moving forward,” Hennington added.

Navigating a Competitive Landscape

Target’s strategic price reductions and marketing initiatives are part of a broader battle among discount retailers to capture the attention of increasingly frugal shoppers. The retailer’s efforts to enhance its digital sales, which saw a 1.4% increase, the first in over a year, indicate a focused push to adapt to changing consumer behaviors, which now favor a mix of online and in-store shopping experiences.

Competitors like Walmart have also made significant inroads in appealing to budget-conscious consumers, particularly through their expansions in grocery offerings—a category that continues to draw steady traffic as customers prioritize essential spending over discretionary purchases.

Target’s Adaptive Strategy in Turbulent Times

As Target navigates these turbulent waters, the company’s ability to adapt to an evolving retail landscape will be crucial. With strategic price cuts, enhanced loyalty programs, and an eye on digital expansion, Target is positioning itself to not only weather the current economic uncertainty but to emerge stronger. As the fiscal year progresses, all eyes will be on Target to see if these strategies will translate into improved financial performance and a regained footing in the competitive retail market.

For retailers like Target, the message is clear: adapt swiftly and strategically, or risk being left behind in a rapidly shifting economic tide.