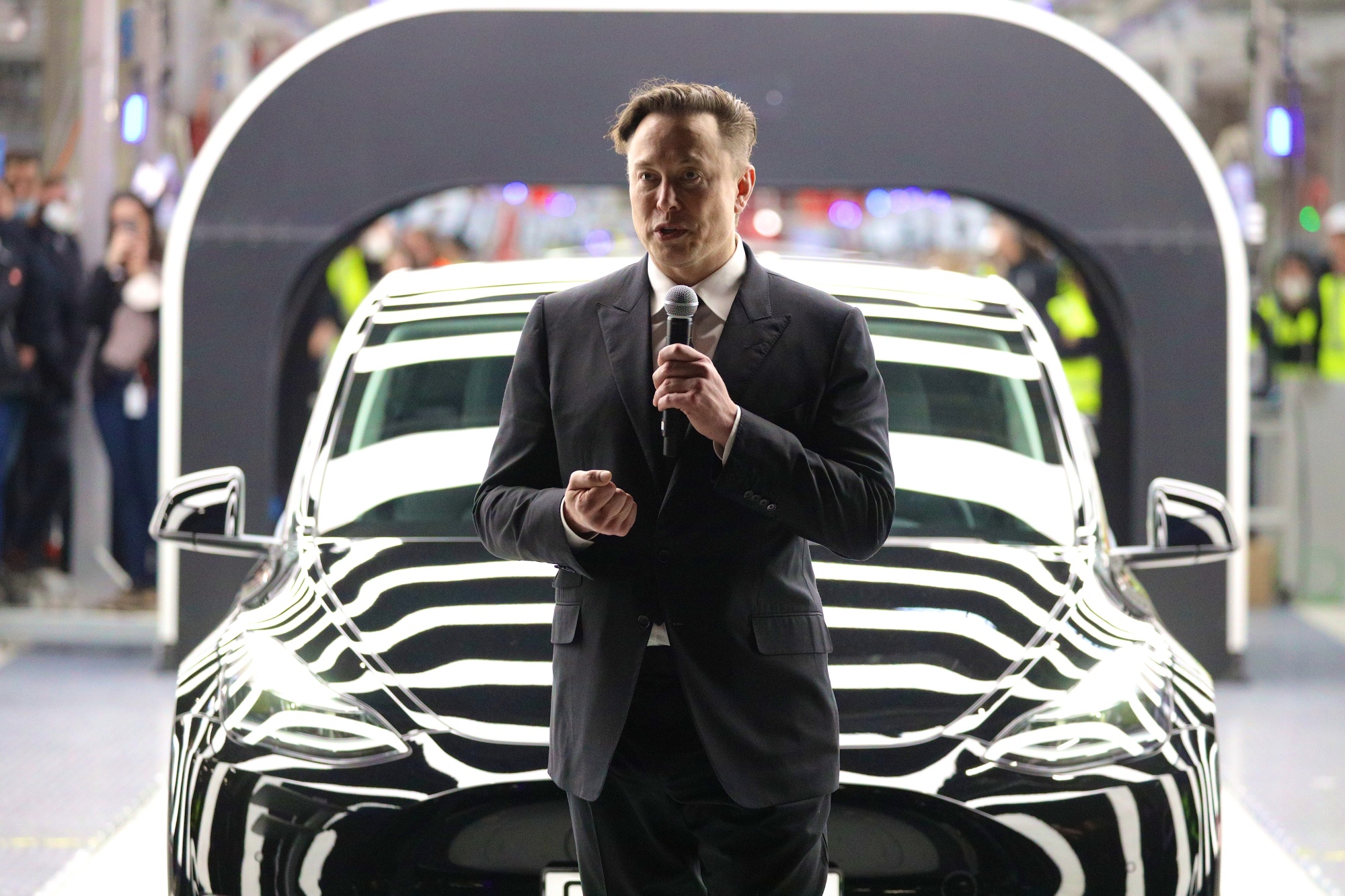

Tesla, the trailblazer in electric vehicles, has recently disclosed a significant strategic shift, opting to spend on advertising to influence shareholder approval of a colossal $55 billion compensation package for CEO Elon Musk. This move marks a stark departure from Tesla’s usual reliance on word-of-mouth and organic growth, spotlighting the intricate dance between corporate governance and executive compensation.

The Backdrop of a Groundbreaking Compensation Plan

In 2018, Tesla shareholders green-lit what was one of the most staggering compensation plans ever conceived for a CEO—$55 billion in fully stock-based remuneration for Elon Musk. This unprecedented plan was designed not just to compensate Musk but to align his financial incentives closely with the company’s long-term success.

However, the road to this monumental agreement has been anything but smooth. Earlier this year, a judge sided with lawyers representing a Tesla shareholder who alleged that the company’s board had not fully disclosed the details of the package when it was initially presented to shareholders. The crux of the matter, according to the judge, was that Tesla’s board and Musk had sidestepped some of the traditional rules that govern public companies.

Governance Concerns and Legal Repercussions

The ruling unearthed significant governance concerns, notably that the compensation plan was supposedly negotiated by “independent board members,” despite revelations that some of these directors had personal financial relationships with Musk outside of their Tesla roles. This discovery led a Delaware court to invalidate the initial shareholder vote, forcing Tesla to rescind the original compensation plan.

Tesla’s Renewed Effort to Win Shareholder Support

In response to the court’s findings, Company has taken a proactive approach. Last month, the company not only proposed to relocate its state of incorporation to Texas but also announced plans to re-present Musk’s compensation package for a revote—this time without any changes.

The campaign to garner support for these proposals has been vigorous, with company launching a dedicated website, engaging in extensive communications with shareholders, and taking a further step by purchasing ad spaces.

Tesla's Board Chair Pleads For Reapproval Of Elon Musk's Controversial $47 Billion Compensation: 'Incredi https://t.co/i0so20oQRe

— marylynnjuszczak (@marylynnjuszcza) May 7, 2024

A Strategic, Yet Controversial Advertising Spend

Company’s latest filings with the SEC reveal that the company has now turned to buying advertisements to encourage shareholder votes. These communications are listed as “sponsored” on Google, indicating that Tesla has invested in Google ads for the initiative. More controversially, The company has also bought ads on X (formerly Twitter), an Elon-owned platform, which has raised eyebrows given that it could be seen as funneling company money into Musk’s own ventures.

Electrek’s Insightful Take on Tesla’s Tactics

Commentary from Electrek, a leading electric vehicle news site, suggests that company’s board is exhibiting signs of anxiety about the upcoming vote. The irony of Tesla’s board, having had a previous compensation package invalidated due to governance issues, now using company funds to potentially enrich Musk further on a platform owned by him, is not lost on observers.

Conclusion: A Crucial Vote Ahead

As the deadline of June 13th looms for shareholders to cast their votes, the stakes are incredibly high. company’s aggressive push to secure approval for Musk’s hefty compensation package underscores the complexities of corporate governance and the lengths to which companies will go to secure their leadership structures. Whether this bold strategy will pay off remains to be seen, but it certainly sets the stage for a pivotal moment in company’s history.