In a recent discussion with Fox Business, housing expert Bill Pulte issued a striking forecast that could have potential homeowners and investors alike bracing for a significant market shift. As the CEO of Pulte Capital and a prominent figure in the real estate sector, Pulte suggested that the average US home price might exceed an unprecedented $500,000 barrier.

This prediction hinges on the Federal Reserve’s interest rate decisions in the face of persistent inflation.

The Influence of Federal Reserve Policies on Home Prices

Bill Pulte’s insights are deeply rooted in the dynamics between Federal Reserve policies and the real estate market. “I predict if rates go down, housing prices will go through the roof,” Pulte stated. He elaborated that a premature reduction in interest rates, before effectively managing inflation, could lead to a 20% surge in home prices.

This would push the median US home price from its current $418,000 to over $500,000, marking a historic high. The backdrop for this projection includes a robust increase in home values over the past five years.

According to data from the St. Louis Fed, the median US home price has already escalated from $313,000 in early 2019 to $418,000 in the last quarter. This trend underscores the potential for even sharper increases if the Federal Reserve opts to lower rates shortly.

Case-Shiller: Home Prices in 20 US Cities Increase More Than Forecast https://t.co/JE3qh1E2cl pic.twitter.com/V3o3Mq0L6b

— Gist Junction (@GistJunction) May 29, 2018

Rising Costs and Their Impacts on Housing Affordability

The interplay between rising costs and housing affordability is central to Pulte’s analysis. The real estate market has faced escalating prices due to increased costs in land, construction, building materials, and even furnishings.

These factors, combined with a historically high inflation rate that peaked at over 9% in the summer of 2022, compelled the Fed to increase its benchmark interest rate from nearly zero to over 5%.

Such rate hikes are intended to curb spending and slow price inflation by making borrowing more expensive. However, these measures have also led to a notable rise in the 30-year fixed mortgage rates, affecting both buyers and sellers.

Sellers are reluctant to list their homes, fearing the loss of low mortgage rates, while buyers are deterred by the prospect of high monthly payments. This has resulted in a constrained housing inventory, further driving up prices.

The Potential Effects of a Rate Decrease

Should the Federal Reserve decide to lower interest rates, Pulte predicts a significant spike in demand, as more buyers would find entering the market more feasible.

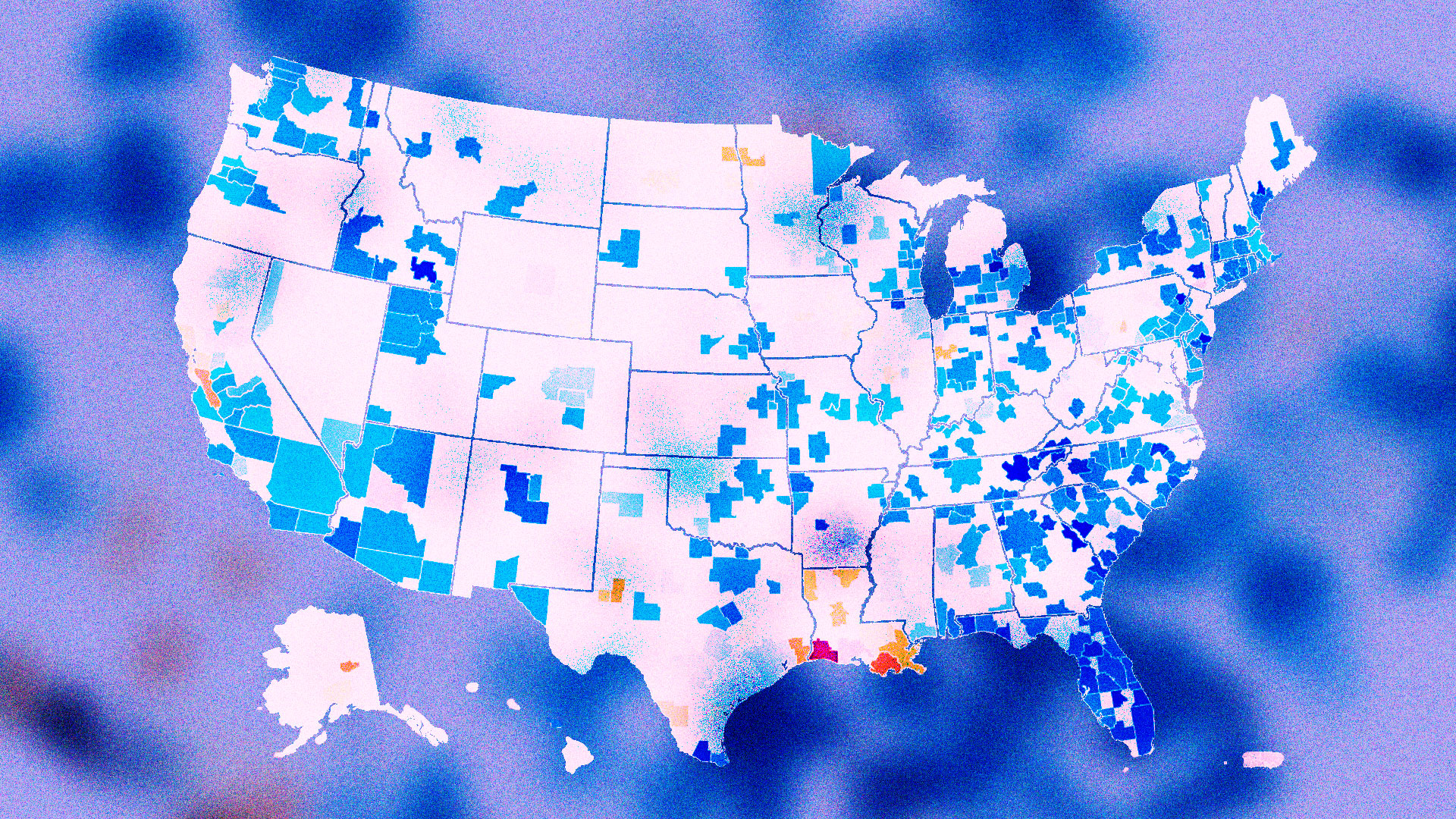

“You’re going to have a flood of people trying to get into this stuff, and it’s going to be a big problem, and you’re going to see it everywhere,” he emphasized. This could lead to a “buying frenzy” reminiscent of the market during the COVID-19 pandemic.

US Home: A Market at a Crossroads

The potential for a 20% increase in home prices to a record $501,000 carries significant implications for the US housing market.

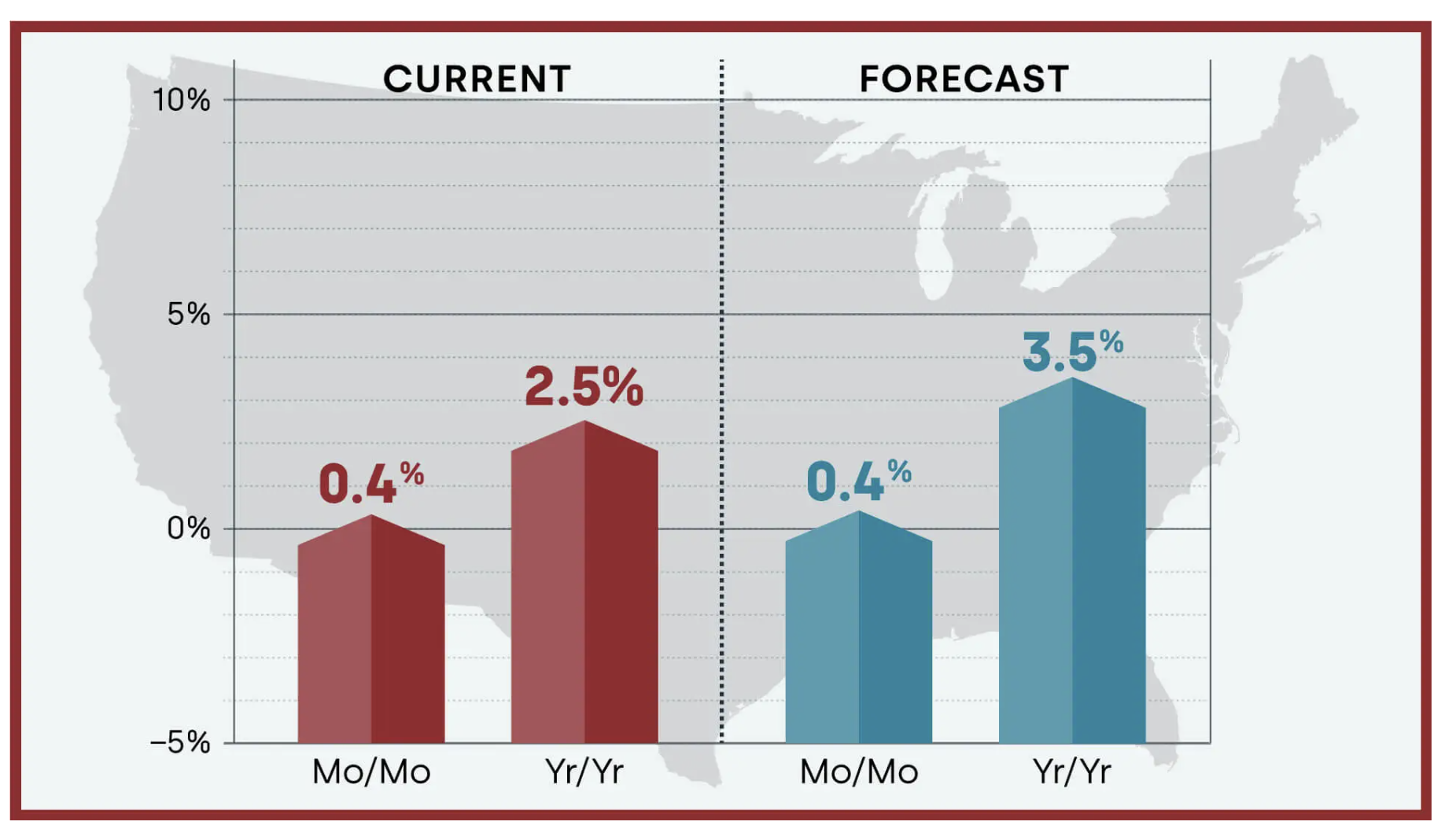

As inflation remains a concern, with a recent uptick to 3.5% in March—well above the Fed’s 2% target—the decisions made by the Federal Reserve in the coming months could either exacerbate the current affordability crisis or help stabilize the market in the United States of America.

Bill Pulte’s forecast serves as a crucial indicator for prospective buyers, investors, and policymakers alike, as they navigate the volatile terrain of the US real estate market.