In a stunning display at London’s Harrods department store, a million-pound diamond necklace gracefully draped over an exquisitely designed Easter egg captures the eye but perhaps not the consumer heart as it once would have. Amidst a backdrop of declining interest and shifting values, the Gems industry, long symbolized by the notion that “a diamond is forever,” faces its most significant challenges yet.

De Beers, a titan in the diamond industry since its slogan captivated a post-war audience in 1948, is experiencing the erosion of its once unshakeable market position. This shift comes as Anglo American, its largest shareholder, plans to divest from De Beers following a failed takeover bid by BHP.

Duncan Wanblad, CEO of Anglo American, remarked to the Financial Times that this divestiture represents “the hardest part” of the company’s restructuring strategy, underscoring a fundamental shift away from gemstones that “don’t fit in anymore despite the strong legacy of De Beers.”

Economic and Cultural Shifts Dim the Sparkle of Diamonds

The Gems industry’s woes are exacerbated by a complex interplay of economic and cultural dynamics, particularly in China—a critical market. According to Daxue Consulting, the decline in marriage rates coupled with an increased enthusiasm for gold and lab-grown gems has dampened Chinese demand for diamonds.

Post-pandemic, consumers are redirecting their spending towards experiences like travel rather than luxury goods.

Compounding these cultural shifts are the economic realities. Paul Zimnisky’s rough diamond index indicates a 5.7% price drop in diamonds this year alone, with a staggering 30% decrease from the 2022 peak. Bloomberg reports that in response, De Beers slashed prices by 10% at the year’s start, signaling a rocky road ahead for the traditional Gems market.

💥3rd September, 2023 Fortune – Diamond demand is falling so fast—courtesy lab-grown stones—De Beers is cutting some prices by more than 40%https://t.co/etdq9KfmfY

11th February, 2023 #Prediction pic.twitter.com/degpKHVzV6

— Dr. Shah (@ankitatIIMA) September 4, 2023

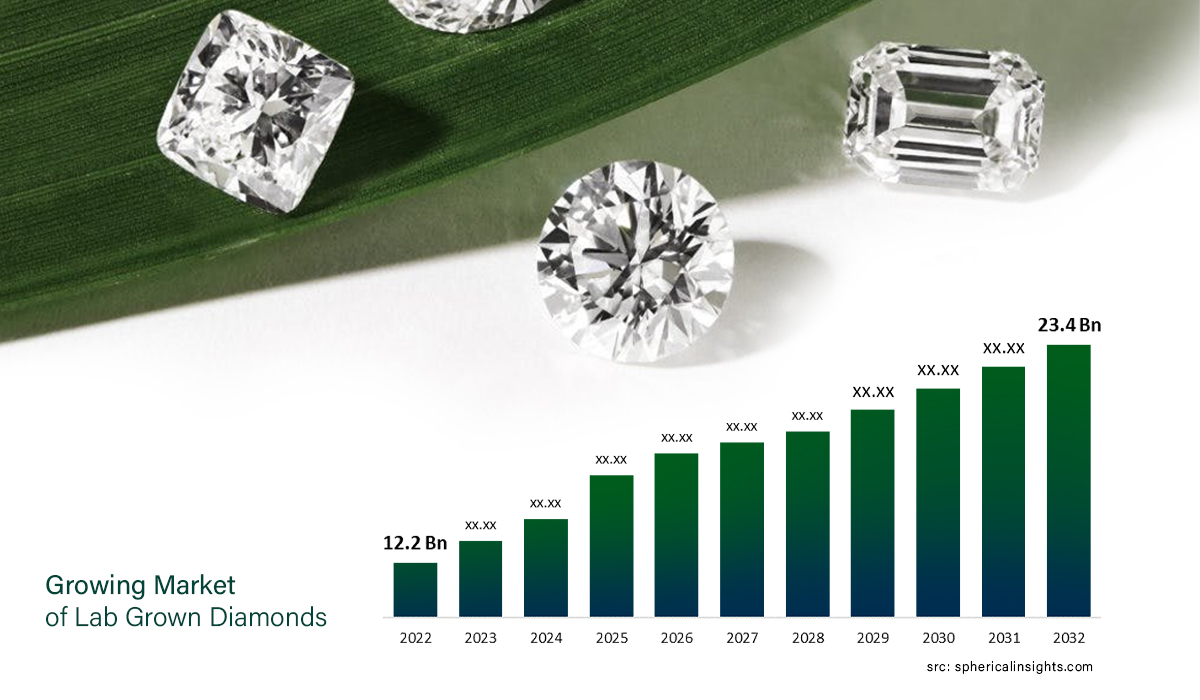

The Rising Popularity of Lab-Grown Diamonds

The burgeoning interest in lab-grown gems, which offer a more affordable and environmentally conscious alternative, is reshaping the industry. Ankur Daga, CEO of Angara, highlights that these man-made gems now constitute 50% of engagement ring stones in the U.S., a dramatic increase from just 2% in 2018. “The core issue is the rapid growth of lab-grown diamonds,” Daga told CNBC, noting their significant cost advantage and diminished investment allure. As natural gems prices continue to tumble, Daga predicts a further 15%-20% price decline over the next year.

Reviving the Diamond Industry: A Path Forward

Despite these challenges, there is cautious optimism among some industry insiders. Anish Aggarwal of Gemdax notes that while the Gems market faces significant hurdles, they are not insurmountable. “Creating the want” for diamonds through effective marketing strategies could reignite consumer interest, particularly in pivotal markets like China.

In a strategic move to bolster demand, Signet Jewelers recently teamed up with De Beers in a marketing collaboration aimed at boosting natural diamond sales, with an anticipated 25% increase in engagements over the coming years. This partnership, as noted by Marcelo Esquivel of Anglo American, represents a significant effort to “move the needle for the larger industry.”

As the Gems industry navigates these tumultuous waters, the collaboration between the world’s leading diamond miners and retailers may indeed spark a resurgence in demand. However, the shifting consumer preferences and the rising appeal of lab-grown alternatives suggest that the industry’s path to recovery will require not just strategic partnerships but a reimagining of what it means to market luxury in an increasingly conscious consumer landscape.