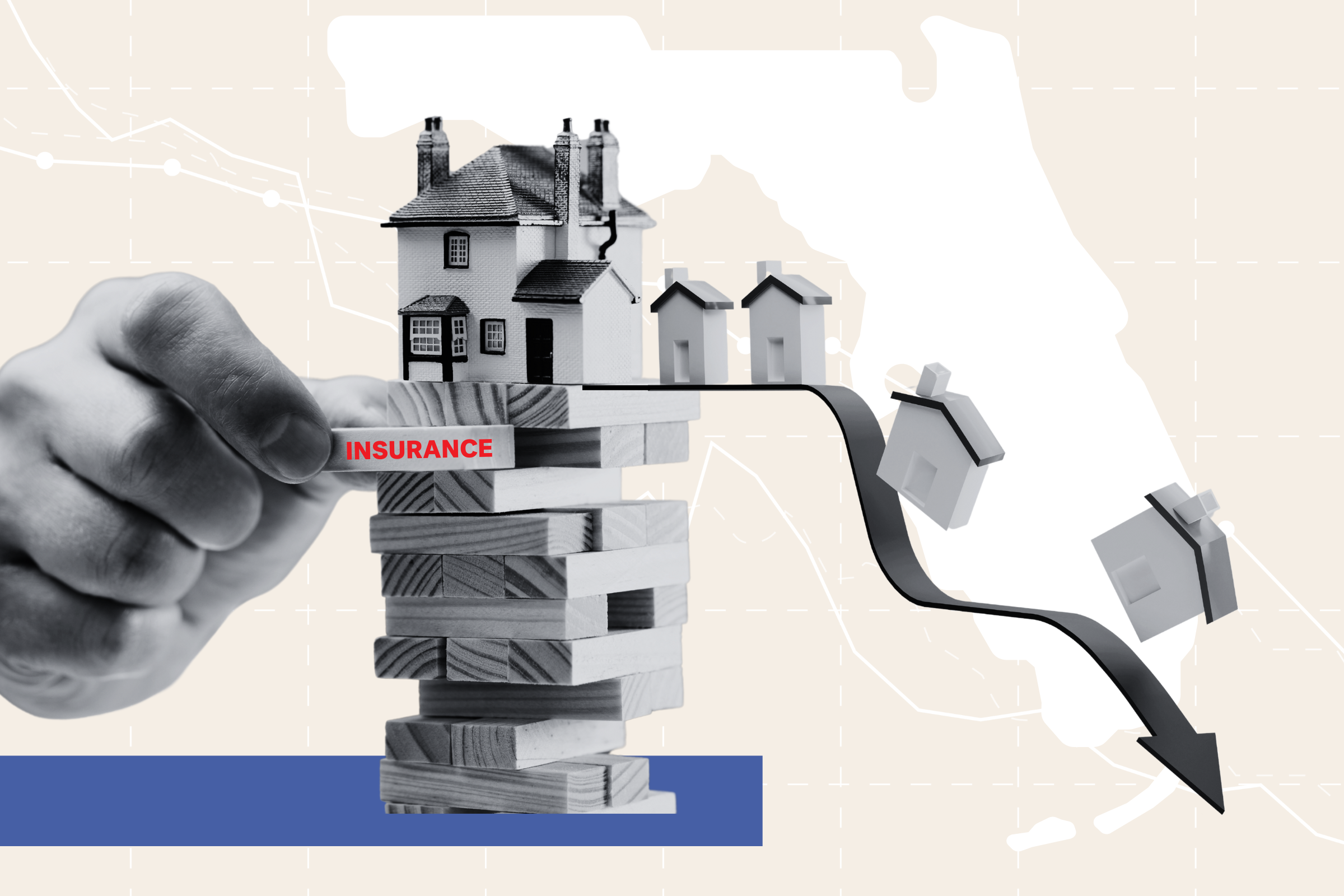

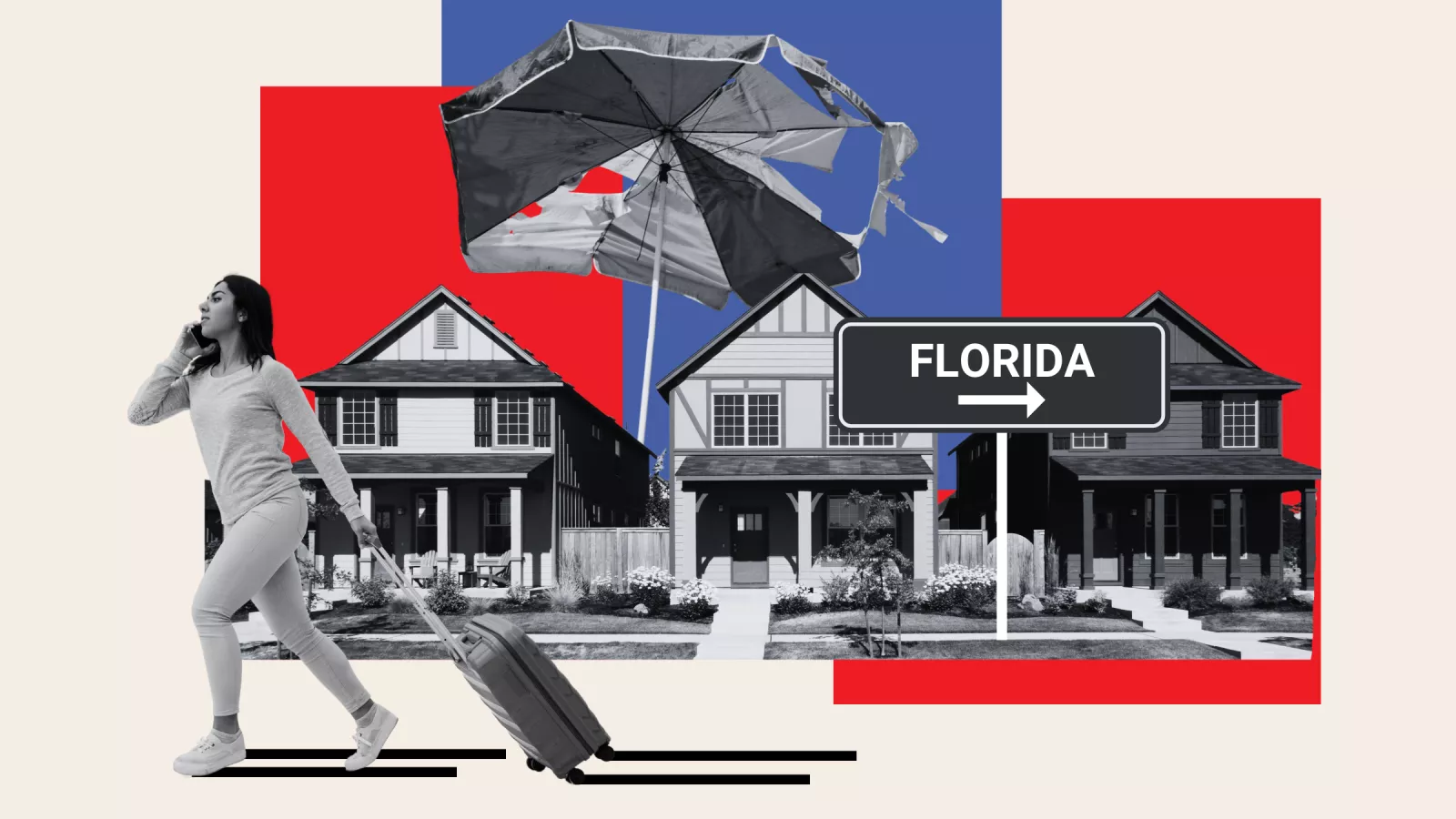

In recent years, the home insurance landscape in Florida has turned from challenging to nearly untenable, pushing an increasing number of residents to consider selling their properties. A recent survey conducted by Redfin, in collaboration with Qualtrics in February 2024, reveals a stark reality: 11.9 percent of Floridian homeowners are contemplating relocation within the next year due to the spiraling insurance costs— a figure that significantly outpaces the national average of 6.2 percent.

The survey’s findings underscore a broader trend mirrored in real estate market data, where Florida not only leads in the number of homeowners planning to move but also tops the charts with the highest number of motivated sellers. According to Zillow, out of the 218,050 properties listed in Florida, 5,790 are by motivated sellers willing to accept offers below the listing price for a quicker sale.

Crisis Deepens in the Sunshine State

The root of this exodus is multifaceted, primarily driven by the heightened risk of extreme weather events due to climate change. This has led to increased insurance claims, higher premiums, and a growing sense of uncertainty among homeowners. Additionally, Florida’s insurance market is plagued by excessive litigation and widespread fraud, significantly skewing the balance of claims and litigation nationally.

Rick Scott should be ashamed. No one should be forced out of the homes they’ve worked so hard for — but Florida homeowners are fleeing because of the insurance crisis that Rick Scott created. https://t.co/J8c33hlNGO

— Debbie Mucarsel-Powell (@DebbieforFL) April 25, 2024

The consequence of these challenges is a strained insurance market where private insurers are increasingly withdrawing their services. Since 2017, eleven insurance companies that previously served Florida homeowners have ceased operations, with five liquidations occurring in just 2022. This retreat by insurers leaves homeowners grappling with fewer options and higher costs, creating a precarious financial situation for many.

Impact on Home Values and Future Coverage Concerns

The insurance woes in Florida have broader implications on property values and long-term homeowner stability. Redfin chief economist Daryl Fairweather highlighted the risks, stating, “Homeowners living in areas where insurance premiums are surging are at risk of seeing their properties gain less value than homeowners in areas with stable premiums—and in some cases, they may even lose money.” The increasing desirability of homes in low-risk areas is expected to drive up their value as the threats of climate change become more pronounced.

Moreover, the survey revealed that a significant 70.3 percent of Floridian homeowners have felt the impact of rising insurance costs or changes in coverage over the past year, a rate much higher than the national average. Concerns are mounting, with 27.7 percent of respondents worried about future availability of coverage for their homes.

Florida’s Property Insurance Crisis: Urgent Calls for Reform

The ongoing crisis in Florida’s property insurance market is more than a financial issue; it’s a critical socio-economic challenge that requires urgent attention from lawmakers and industry stakeholders. As the state grapples with finding viable solutions, the exodus of homeowners serves as a stark indicator of the urgent need for reform and stabilization in the insurance sector.

As Florida continues to battle these unprecedented challenges, the real estate market remains a vital pulse to watch, reflecting broader economic health and homeowner confidence in the Sunshine State. Homeowners and potential buyers must stay informed and consider all variables in this rapidly evolving market landscape, where the right decision today could safeguard against tomorrow’s uncertainties.