The introduction of the Visa Flexible Credential allows users to streamline their wallets by using just one card for various accounts. This innovation not only simplifies the physical aspect of carrying multiple cards but also enhances the ease of managing financial resources. “This represents a shift towards more integrated financial services, where convenience meets technology,” explained Jack Forestell, Visa’s Chief Product and Strategy Officer.

During the forum, the card payment company highlighted the potential of this new technology to provide a seamless shopping experience. Whether making online purchases or at physical stores, customers can now enjoy the flexibility of choosing from multiple payment options with just a single piece of plastic.

Expanding Mobile and Biometric Payment Options

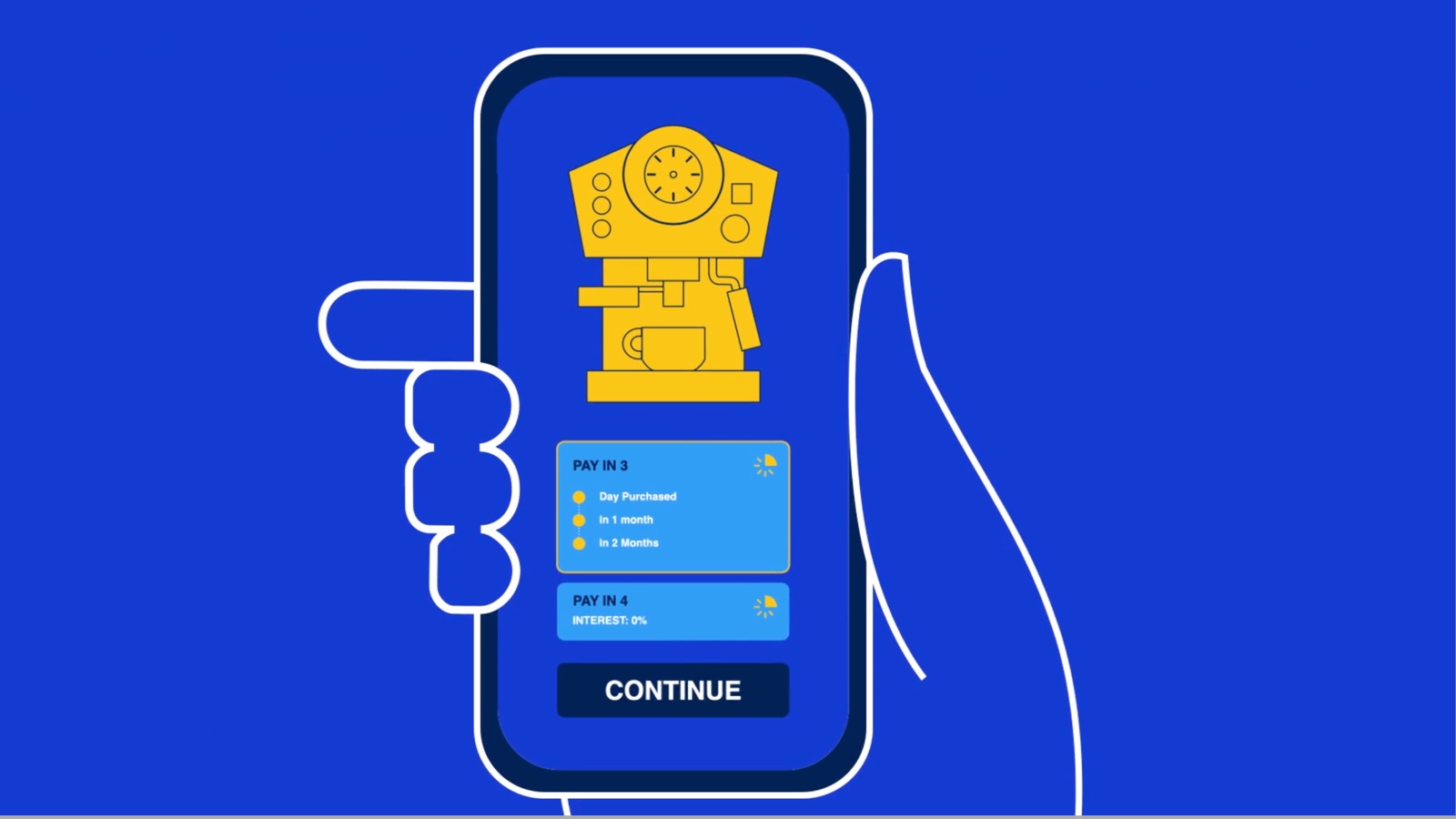

Visa’s commitment to innovation doesn’t stop at card consolidation. The company also announced significant advancements in mobile payment technology. Soon, any mobile device could be transformed into a point-of-sale (POS) system, allowing customers to “tap” their device not only to make payments but also to confirm identities or add a card to a digital wallet.

Furthermore, the company is pioneering a new Payment Passkey Service that will allow online payments through biometric verification, such as facial scans or fingerprints. This feature aims to replace traditional passwords and one-time codes, offering a higher level of security and convenience to users.

“The era of cumbersome password entries is coming to an end, making way for a quicker, more secure way to verify user identity and process payments,” Forestell added.

Visa’s Market Position and Future Outlook

As Visa rolls out these features, starting in Asia and soon in the U.S., the company is set to solidify its position as a leader in payment technology. The timing is critical as the industry faces an increase in credit card delinquencies and record-high debt levels among consumers.

The company’s stock, currently at $279.84, reflects the market’s response to these innovative strides and the challenges ahead. “The industry is at a pivotal point — new technologies like Gen AI are rapidly shifting how we shop and manage our finances,” Forestell remarked.

The company’s strategic innovations are designed not only to adapt to these changes but to lead the charge in creating a digital-native payment environment.

A Forward-Thinking Shift in Payment Processing

Visa’s announcement is more than just a product launch; it is a vision of the future of financial transactions. The Visa Flexible Credential and the Payment Passkey Service are set to revolutionize the way we think about money, from how we carry it to how we spend it.

As these technologies take hold, they promise to bring about a more connected, efficient, and secure financial landscape for consumers across the globe.