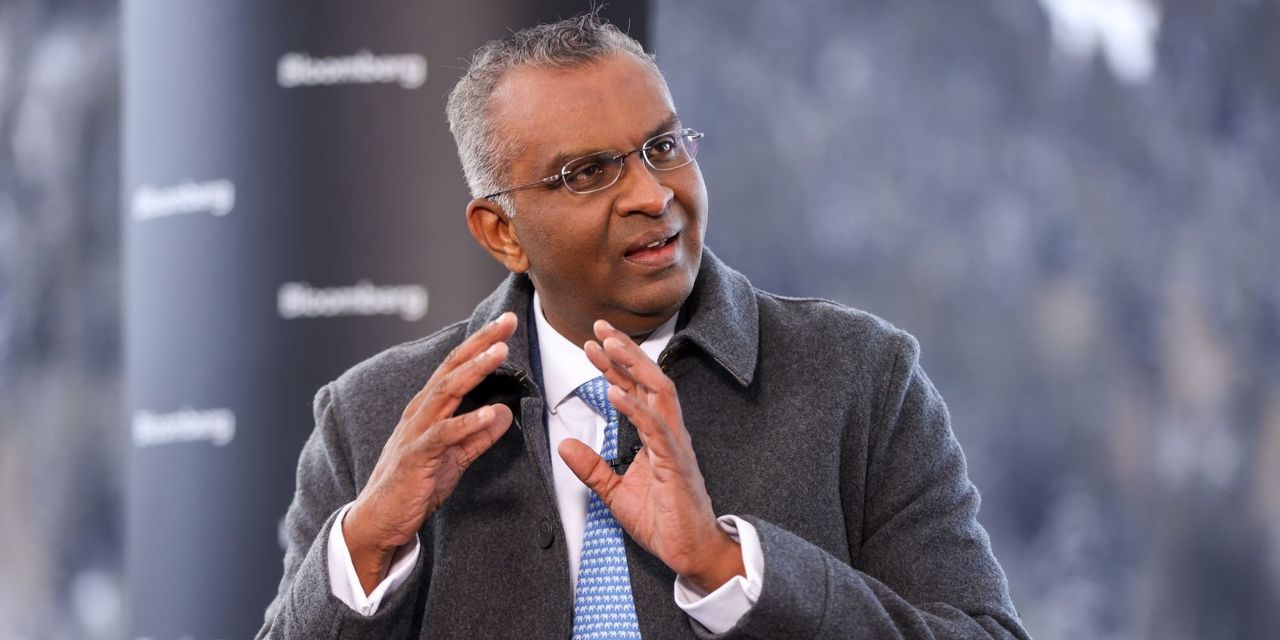

In an industry where leadership transitions signify strategic shifts and potential innovation leaps, Citi’s latest executive announcement heralds an era ripe with anticipation. The banking giant has officially welcomed Viswas “Vis” Raghavan, a seasoned strategist from JPMorgan Chase, as its new head of banking. This move is not just a routine shuffle in the upper echelons of financial services; it represents a deliberate step towards redefining banking operations and customer engagement in an ever-evolving digital landscape.

A Strategic Appointment at a Crucial Time

Raghavan’s journey from JPMorgan to Citi is a narrative of experience, leadership, and strategic foresight. With a rich history spanning over two decades at JPMorgan Chase, his tenure saw him ascend through various significant roles, culminating as the sole head of global investment banking—a testament to his expertise and vision in the financial sector.

His transition to the banking conglomerate comes at a pivotal moment, as underscored by CEO Jane Fraser. “Vis is the right person to take over at this pivotal moment for our banking franchise,” Fraser remarked, highlighting the strategic timing of this appointment amidst the bank’s ongoing structural and operational enhancements.

Raghavan’s role is set to encompass a broad spectrum of responsibilities, from steering Citi’s investment, corporate, and commercial banking divisions to shaping the firm-wide strategy alongside Fraser.

Navigating Citi Through Transformation

Citi’s embrace of Raghavan is more than an executive reshuffle; it’s a signal of the bank’s commitment to innovation and efficiency. The bank’s restructuring efforts, aimed at streamlining operations and enhancing client engagement, find a complementary leader in Raghavan.

His proven track record at JPMorgan, especially in leading through change and fostering growth in investment and corporate banking, aligns with its ambitions.

Moreover, venture into the digital frontier, including partnerships aimed at tokenizing private markets and launching consumer-centric digital tools like the Citi Shop browser extension, underscores a strategic pivot towards leveraging technology for operational efficiency and customer satisfaction.

Raghavan’s leadership is expected to further this agenda, driving Citi’s banking operations into new territories of innovation and market leadership.

🚨 BREAKING 🚨

$759 BILLION CITI BANK IS NOW

TESTING THE TOKENIZATION OF

ASSETS ON CHAIN.GIGA BULLISH 🔥 pic.twitter.com/BBhwJFvjrX

— Ash Crypto (@Ashcryptoreal) February 18, 2024

Towards a Future of Digital Excellence

Raghavan’s appointment is a beacon for Citi’s journey towards digital transformation and market excellence. The challenges of modern banking—ranging from the need for operational efficiency to the demand for innovative customer solutions—are well documented.

Its recent endeavors, including the exploration of blockchain technology for tokenizing private markets and enhancing consumer banking experiences through digital tools, reflect a forward-thinking approach to banking.

With Raghavan at the helm, the banking giant is poised to navigate these challenges, leveraging his extensive experience and strategic insight.

As the banking industry continues to evolve, driven by technological advancements and changing consumer expectations, Raghavan’s leadership will be instrumental in shaping Citi’s response to these trends, ensuring the bank remains at the forefront of innovation and service excellence.

In essence, Viswas Raghavan’s arrival at Citi is more than a change of guard; it’s a harbinger of transformative leadership and strategic innovation in banking. As the banking giant continues to adapt and evolve, the industry will be watching closely, anticipating the next wave of banking innovations that Raghavan’s leadership will undoubtedly inspire.