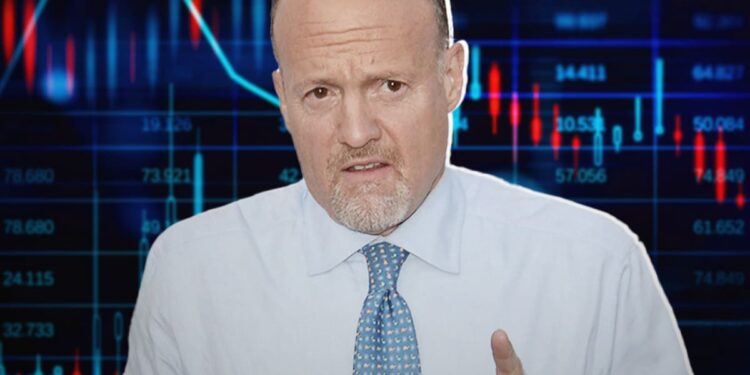

In the ever-tumultuous sea of stock market advice, CNBC’s Jim Cramer stands out on Monday, casting a sceptical eye on the flurry of sell-side downgrades that impacted major players like Amazon and Apple. His message to investors is clear: in the long game of stocks, it’s wise to keep a steady course rather than succumbing to the knee-jerk reactions market shifts might prompt.

Navigating Through Wall Street’s Choppy Waters

On a day marked by significant downturns in major indices—with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite falling 0.94%, 0.96%, and 1.18% respectively—Cramer highlighted the perils of overreacting to market noise. “When I look at the history of this incredible bull market—and it has been an incredible bull market—it’s littered with ‘buy-to-hold, hold-to-sell, buy-to-hold, hold-to-sell,’ these downgrades that scare you out of amazing stocks at levels that may temporarily be too high, but will recover later,” he explained. This pattern, according to Cramer, is a trap that can prevent investors from participating in a stock’s eventual recovery.

The Case Against Downgrading Amazon and Apple

Despite acknowledging some current challenges for Amazon, Cramer disagreed with Wells Fargo’s recent downgrade. He argued that the tech giant has demonstrated resilience in the face of past hurdles and is poised for a rebound. Reflecting on the company’s quick recovery following a revenue miss in early August, he reassured that “it’s only a matter of time before that happens.”

Similarly, Cramer contested the rationale behind Jeffries’ downgrade of Apple, especially with the upcoming release of the iPhone 16. He emphasized that betting against Apple’s long-standing “culture of excellence” is misguided, noting the company’s consistent track record of high-quality product releases.

Wall Street’s Addiction to Trading

“Wall Street is addicted to trading,” Cramer pointed out, urging individual investors to tune out the noise. In his view, following the flurry of trading tips and rapid stock shifts is a full-time job and not one suited to those managing their finances with a long-term perspective. This approach, he argues, might lead to missed opportunities and potential financial missteps in an attempt to keep up with professional traders.

In a climate where stock advice is as volatile as the market itself, Jim Cramer’s insights serve as a reminder of the virtues of patience and due diligence in investment strategies. For those looking to build lasting wealth, his advice underscores the importance of focusing on solid, reputable companies capable of weathering market uncertainties.