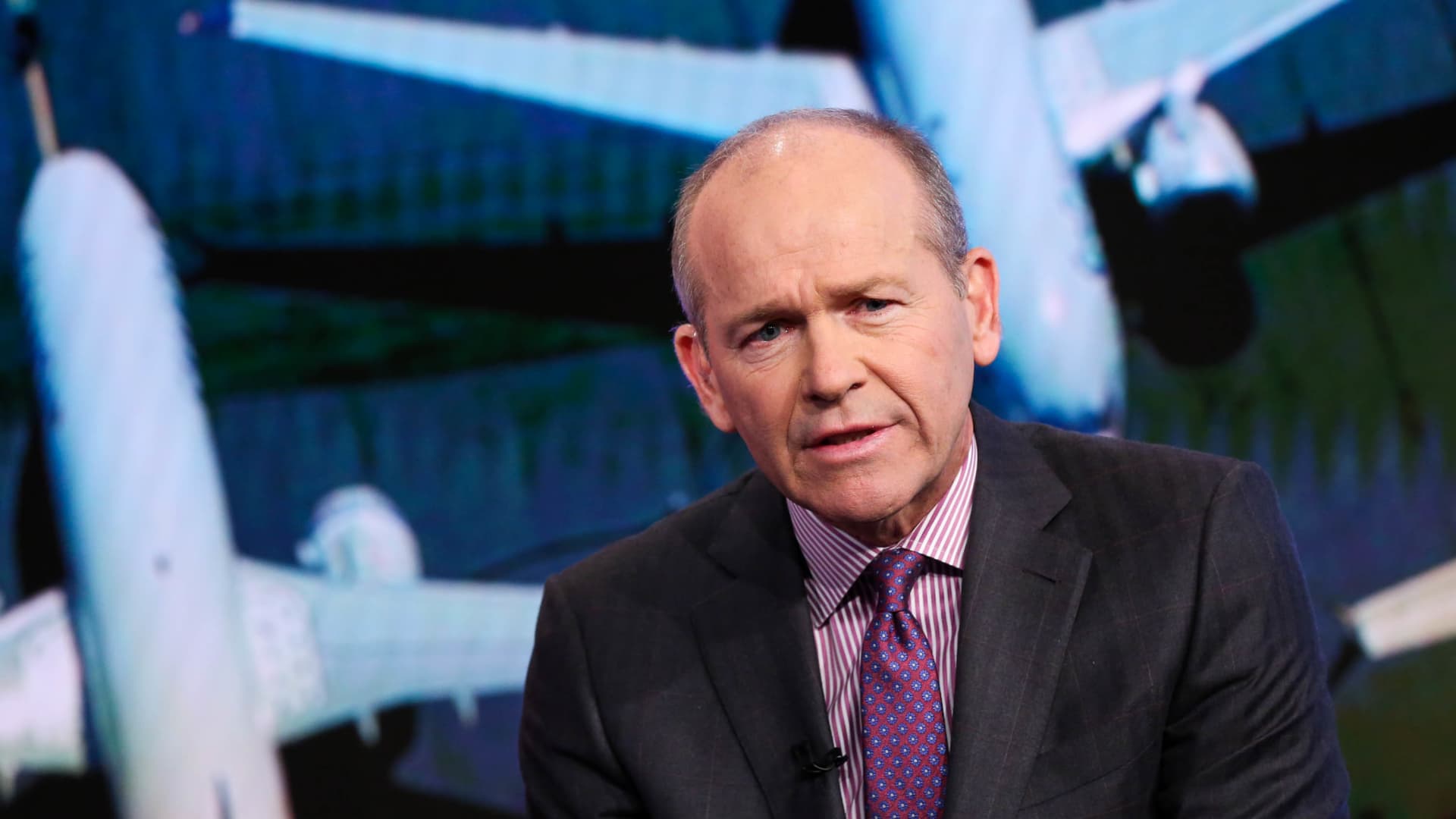

In a recent turn of events that could shape the future of aviation, Boeing shareholders cast a crucial vote last Friday. Despite the cloud of investigations and potential prosecutions hanging over the company, they approved a hefty $32.8 million compensation package for CEO David Calhoun. This decision came at a pivotal time as the aerospace giant grapples with significant challenges both internally and externally.

Turbulent Times for Boeing

David Calhoun outlined a strategic response to the ongoing crises, notably addressing a recent incident where a door plug detached from a Boeing 737 Max during flight. The CEO highlighted the completion of a 90-day plan aimed at rectifying the manufacturing glitches that have marred the company’s reputation. This plan was initiated following the door plug incident, under the strict scrutiny of the Federal Aviation Administration (FAA).

Boeing’s leadership is also focusing on finalizing the acquisition of Spirit AeroSystems, a crucial supplier known for its fuselages but also for its role in recent quality issues. Calhoun, however, did not commit to a firm deadline for this acquisition, indicating ongoing complexities in Boeing’s operations.

Shareholder’s Scrutiny

The virtual shareholder meeting, though meticulously scripted, revealed the depths of the concerns among stakeholders. The CEO faced pointed inquiries about his compensation, especially since his approval rating stood only at 78%, reflecting a somewhat shaky confidence among the board members. Steven Mollenkopf, Boeing’s new chairman, supported Calhoun, emphasizing the necessity of rebuilding trust and ensuring operational success in the coming years.

Interestingly, the shareholders showed a clear stance on other sensitive issues, rejecting resolutions related to pay equity and the company’s engagements in China, and narrowly approving the advisory measure on executive compensation with a 64%-36% vote.

Financial Struggles and Accountability

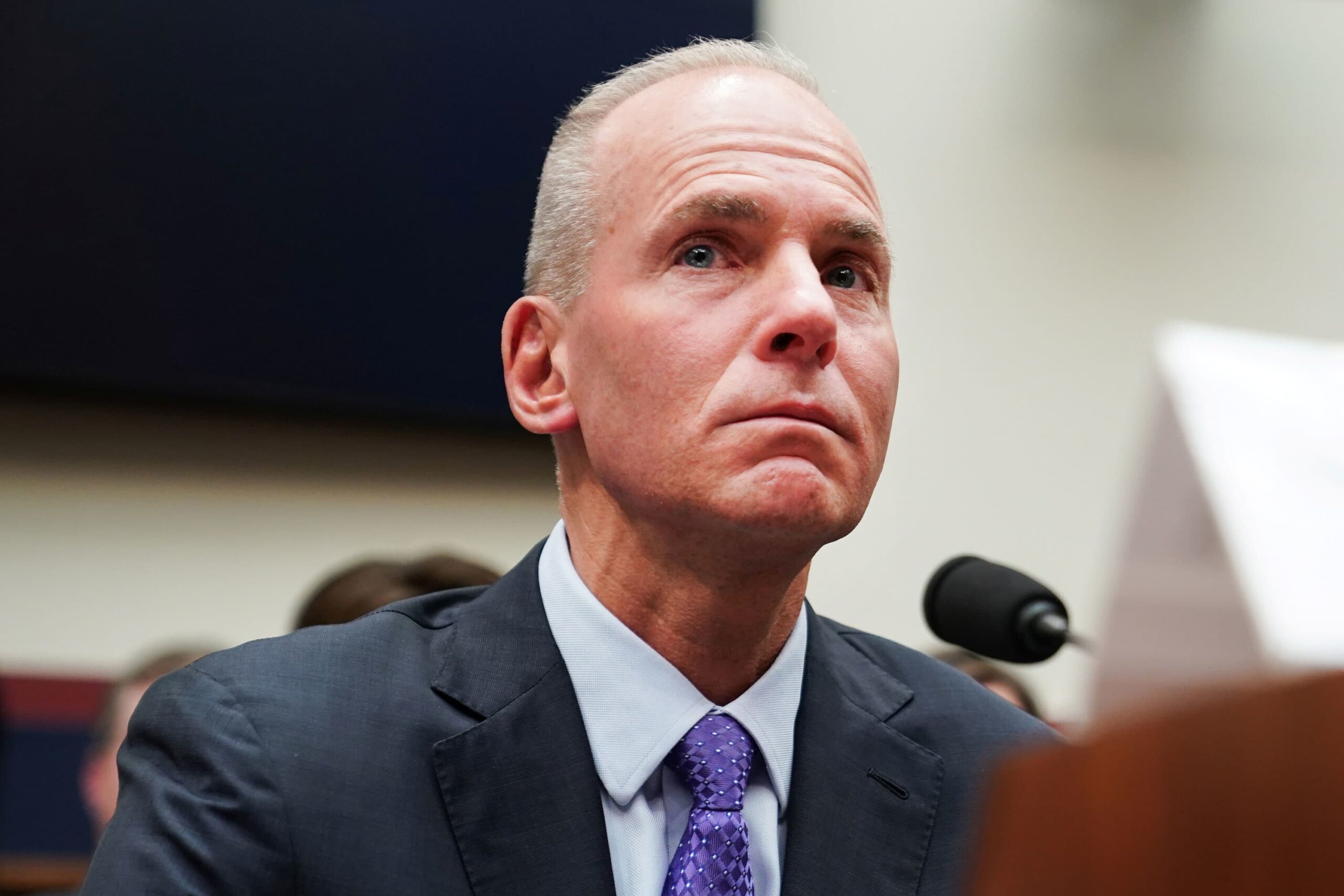

Under Calhoun’s leadership, which began in January 2020, Boeing has encountered severe financial downturns, reporting losses over $23 billion, attributed largely to the fallout from two catastrophic 737 Max crashes. These incidents not only diminished consumer trust but also positioned Boeing behind its European counterpart, Airbus, in both sales and deliveries.

Amidst the financial turbulence, activist shareholder James McRitchie criticized the board’s decision to compensate the CEO so generously despite the company’s failures, highlighting the contrast between leadership compensation and company performance.

Looking Ahead

As Aerospace giant confronts these formidable challenges, the path forward is fraught with the need for transparency and rigorous improvements in safety and quality. The aerospace behemoth remains at a critical juncture, and as Mollenkopf aptly noted, the focus is now on reclaiming the trust that has been eroded over turbulent years. The industry and the world await to see if Boeing can align its leadership and operational strategies to navigate through these storms and emerge stronger.