As self-checkout becomes increasingly common across retail environments, it also brings with it a host of challenges, including heightened theft rates. In response, Dollar General is implementing significant changes in its self-checkout process to mitigate theft and enhance customer interaction.

The Self-Checkout Conundrum

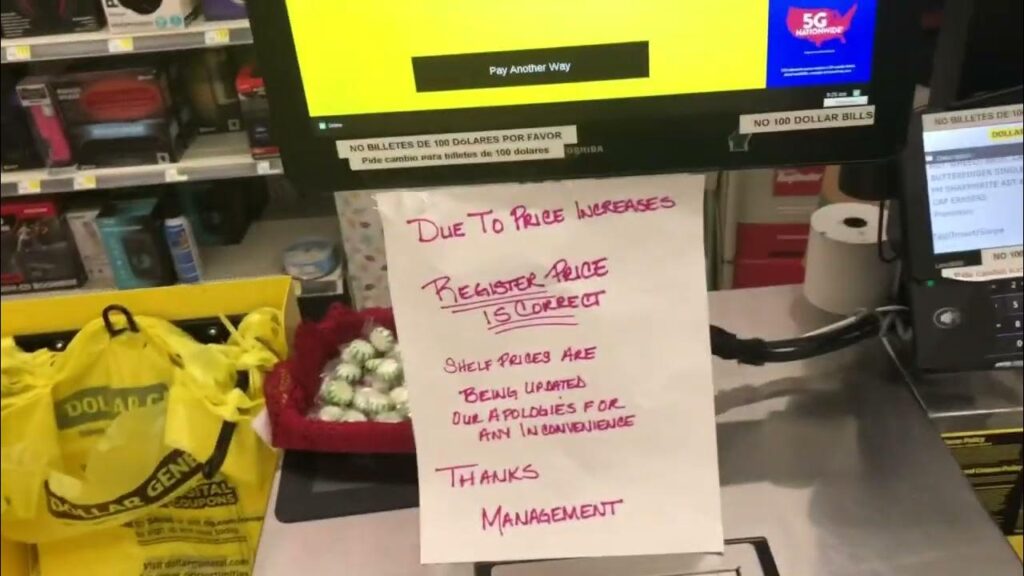

While self-checkout systems offer the dual benefits of reducing labor costs and speeding up transactions, they have also been associated with increased instances of retail shrinkage, which includes losses due to theft. This has led some retailers, like Target, to restrict or modify their self-checkout options. Against this backdrop, Dollar General, a leading chain in the retail sector, is taking decisive action to address these issues at its stores.

Dollar General’s Strategic Overhaul

During the company’s fourth-quarter earnings call, CEO Todd Vasos unveiled a three-pronged strategy aimed at revamping the self-checkout experience across its over 14,000 stores. Vasos emphasized, “Although adoption rates for self-checkout have been high, we believe there is truly no substitute for an employee presence at the front end of the store to greet customers and provide excellent customer service, including at checkout.” Reflecting this belief, the company has started converting self-checkout registers to assisted-checkout systems in approximately 9,000 stores.

Limits and Reductions

Further detailing the changes, Vasos stated that the company will limit self-checkout to transactions of five items or less at all remaining stores equipped with this technology. Additionally, over the first half of the year, more than 300 of its highest shrink stores will see self-checkout options removed entirely. These measures are intended to foster greater personal interaction with customers, which Dollar General believes aligns with consumer preferences.

Comprehensive Measures to Combat Shrink

Beyond modifying self-checkout, Dollar General is implementing several other strategies to reduce shrink, such as inventory adjustments and SKU rationalization. “We are also executing on a variety of other actions to reduce shrink this year, including additional shrink incentive programs for our store managers to encourage and foster a greater sense of ownership; and the utilization of high-shrink planograms,” Vasos explained.

Impact on Stock Performance

These strategic changes seem to be resonating positively with investors as well, as reflected in Dollar General’s recent stock performance. The stock closed at $136.91, marking a 7% increase on the day and trimming its loss for May to just 1.6%. Over the year, the stock has seen a modest increase of 0.7%, bouncing back from the lows experienced post-pandemic and inflation surges.

Dollar General’s Strategic Shift

The strategic shifts at Dollar General highlight a broader industry trend where retailers are reevaluating the role and function of self-checkout systems within their operations. By integrating more employee interactions and limiting self-checkout usage, Dollar General is aiming to enhance the shopping experience, improve security, and ultimately boost its financial performance. These changes, though gradual, are set to significantly impact the retailer’s approach to customer service and loss prevention as it moves forward into 2025.