In an era where digital transactions are the norm, a billing error can quickly spiral into a significant financial debacle. For one couple, a startling charge on their T-Mobile account turned what should have been a simple bill payment into a distressing financial predicament, leaving them without funds for essential groceries.

The Shocking Discovery

The issue came to light when Reddit user VenusMagna and her husband noticed an unexpected charge of over $357 from T-Mobile—a stark contrast to their typical monthly bill. This unexpected financial strain was not only surprising but also alarming, as the couple had not made any recent purchases or changes to their contract that would justify such a hefty charge.

VenusMagna’s situation becomes even more sympathetic considering their recent switch from a grandfathered military plan to a more costly alternative, a change they felt compelled to make despite financial reservations. The timing of the overcharge could not have been worse, as they had just decided to switch carriers in search of better service and lower rates.

The Response from T-Mobile

Upon contacting T-Mobile to inquire about the mysterious charge, VenusMagna and her husband received little in the way of explanations. The carrier’s advice was straightforward yet frustrating: dispute the charge. While this is a standard procedure for unexpected fees, it doesn’t alleviate the immediate financial pressure faced by the couple, especially since their bank indicated a resolution could take up to 90 days.

A Lesson in Financial Safety

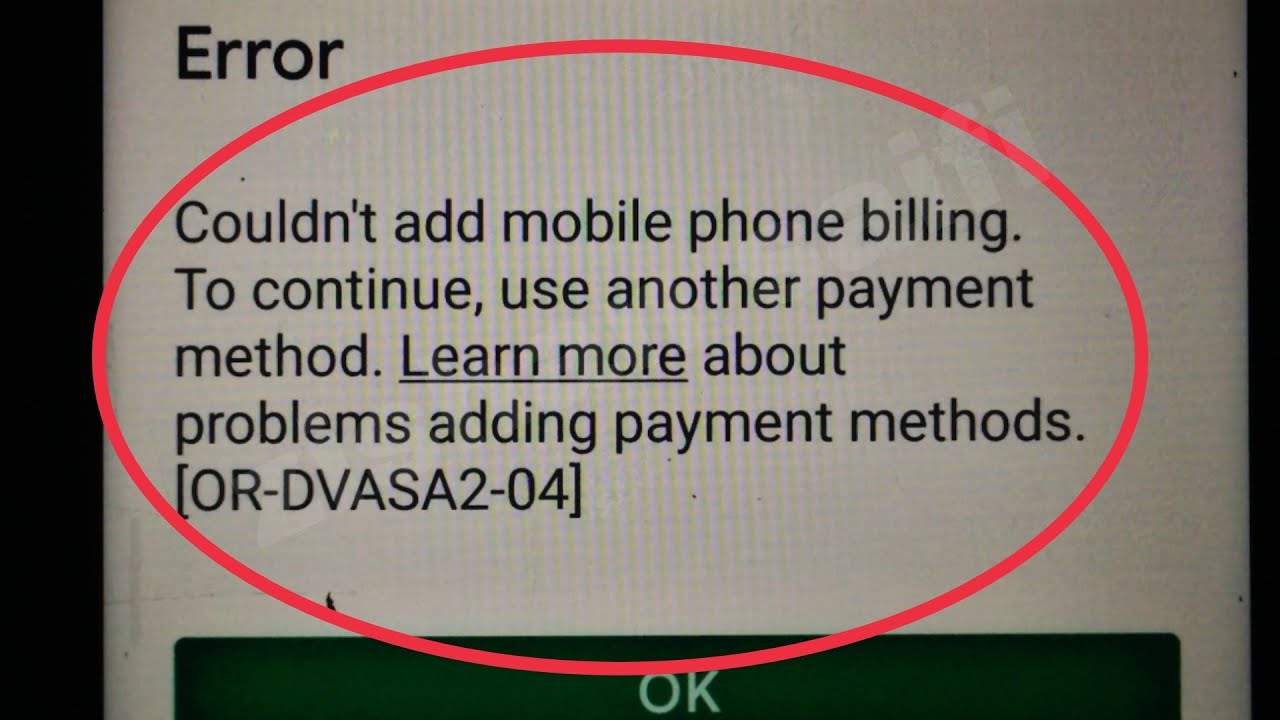

This incident serves as a potent reminder of the vulnerabilities associated with automated payments and digital transactions. Customers often find themselves at the mercy of system errors or unforeseen charges that can temporarily cripple their financial stability. Financial experts often recommend keeping a low balance on debit cards used for automated payments or opting for cards with lower limits to mitigate potential risks.

The Broader Implications

While T-Mobile suggested the charge could be an error, or possibly linked to inadvertent premium rate texts, the lack of a clear immediate resolution highlights a critical area of customer service that could be improved. For customers, the ordeal underscores the importance of vigilance with account management and the potential pitfalls of automated billing systems.

T-Mobile Billing Error: A Lesson in Digital Caution

The financial hiccup experienced by VenusMagna and her husband is more than just a cautionary tale—it’s a stark example of how easily a digital error can lead to real-world consequences. As we navigate the conveniences of modern technology, this story reminds us of the importance of maintaining oversight of our digital footprints and the need to prepare for the unexpected when it comes to financial transactions. This narrative not only sheds light on the potential for service improvement for T-Mobile but also serves as an educational cornerstone for consumers everywhere, advocating for a more informed and cautious approach to digital spending.